America's Midsize Pickup Truck Sales Growth Is Suddenly Slowing - Oh, Ranger, Where Art Thou?

Nearly two and a half years since General Motors increased the number of offerings in the midsize pickup truck sector by two-thirds, and nine months since Honda revitalized its unique Ridgeline offering, we’re once again in need of new midsize pickup truck nameplates.

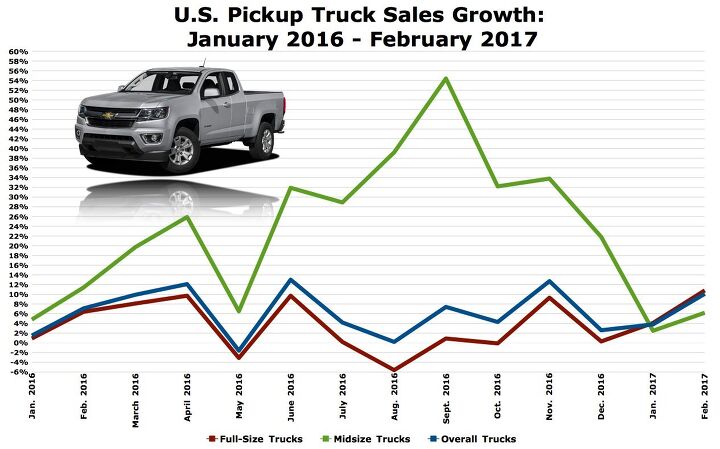

America’s pickup truck category began 2017 with a bang, growing by more than 7 percent and easily outpacing an industry that declined by more than 1 percent in the first one-sixth of 2017.

Yet virtually all of that growth — fully 90 percent — was fuelled not by midsize pickups but by the stalwarts: full-size trucks.

Fortunately, midsize pickup truck sales growth continues, albeit at a far slower rate than we’ve become accustomed to seeing, despite a modest slowdown in Toyota Tacoma volume (Toyota is increasing Tacoma production to help meet demand) and a sharp downturn in Nissan Frontier sales.

GM’s twins — the midsize category’s second-ranked Chevrolet Colorado and the truck market’s lowest-volume pickup, GMC’s Canyon — combined for an 8-percent uptick over the course of January and February.

But with the Honda Ridgeline excluded from the equation, as it wasn’t on sale at this stage of 2016 and is undeniably distinct in mission, America’s midsize pickup truck sales have fallen 6 percent so far this year.

That’s a stunning turnaround for a group of vehicles that produced 61 percent of the overall truck market’s growth in 2017.

Full-size pickups certainly have the strength of character, and the ability to be deeply incentivized, to keep midsize pickup trucks cowering in the corner.

A broader range of capability and competitive fuel economy are just two of numerous easily identified reasons that point to full-size trucks’ 85-percent market share. Moreover, full-size pickup trucks were less costly this February than last: KBB says the average full-size pickup truck transaction price last month was down 2 percent compared with February 2016. Average midsize pickup truck transaction prices continue to rise, however, climbing 2 percent in February 2017, year-over-year.

These factors have been and will continue to be in place. Full-size pickup trucks will, just as they always have, tow and haul more while also capably handle greater passenger loads. Full-size pickup trucks will continue to be priced in such a way as to pressure midsize pickup trucks.

Yet there’s another factor. Midsize pickup truck demand continues to be reigned in by a dearth of available midsize pickup trucks.

2009 this is not. There were still 11 small and midsize pickup trucks on sale in America eight years ago: the current quintet plus contenders from Suzuki, Mitsubishi, Mazda, Isuzu, Dodge, and Ford.

The Equator, Raider, B-Series, i-Series, Dakota, and Ranger disappeared; the Chevrolet Colorado and GMC Canyon eventually did, too. And in the lead-up to the launch of the current Colorado and Canyon, midsize pickup truck sales were falling even as the market surged and overall pickup truck demand increased. Through the first two-thirds of 2014, small/midsize pickup truck sales were down 4 percent.

But rather than diminishing the Toyota Tacoma’s success or limiting the Nissan Frontier’s appeal, the arrival of a new Chevrolet Colorado and GMC Canyon occurred in concert with record Toyota Tacoma volume in 2015 and 2016 and a 15-year high Nissan Frontier result in 2016.

There’s nothing that says the category can’t reclaim rapid growth in 2017. We’ve only seen two consecutive months of a severe slowdown in growth, and those two months form the weakest portion of the calendar for auto sales.

For the midsize truck category to once again be truly empowered as it was over the last 12-24 months, however, new product will once again be necessary. The next Ford Ranger is roughly two years away.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SilverCoupe Tim, you don't always watch F1 as you don't want to lose sleep? But these races are great for putting one to sleep!I kid (sort of). I DVR them, I watch them, I fast forward a lot. It was great to see Lando win one, I've been a fan of McLaren since their heyday in CanAm in the late '60's.

- Cprescott The problem with this fable by the FTC is:(1) shipping of all kinds was hindered at ports because of COVID related issues;(2) The President shafted the Saudis by insulting them with a fist bump that torqued them off to no end;(3) Saudis announced unilateral production cuts repeatedly during this President's tenure even as he begged to get them to produce more;(4) We were told that we had record domestic production so that would have lowered prices due to increased supply(5) The President emptied the strategic petroleum reserve to the lowest point since the 1980's due to number 3 and then sold much of that to China.We have repeatedly been told that documents and emails are Russian disinformation so why now are we to believe this?

- Ollicat Another Biden attempt to say, "Look over there!"

- Kjhkjlhkjhkljh kljhjkhjklhkjh Who cares. Price of gas is not the issue. spending an extra 100$ a month over 4 tanks of gas is not the issue.this a political scam to distract really dumb people from the real issue. if rent and house payments were not up by 50% to as high as 150% higher in a ton of locations, then paying an extra 100$ in gas would be annoying but not really an issue. But the real-estate market with hedge fund investors, power-relator groups bought a ton of houses and flipped them into rentals and jacked up the rates uplifting the costs on everything else. and ironically no-one seems to be in any hurry to build more houses to bring those costs down because supply and demand means keeping less houses available to charge as much as you want. It is also not the issue as a secondary issue is child care costs and medical... again 100$ extra per month in gas is *nothing* compared to 800$ a month in ''child care'' and 300$ per visit to the doctor office, 300$ for a procedure less dentist trip..

- Ajla Is there something proprietary or installed on the moon with these that I'm not aware of?

Comments

Join the conversation

I drive a four banger small truck. Primarily because they are fairly reliable and obscenely easy to work on. Not really sure where that puts me, but I could never really see me in a full size truck. I just prefer smaller-ish vehicles.

Mitsubishi has the most to gain by joining in and selling a pickup truck in USA and Canada. Triton/L200 is smaller than the Tacoma, Colorado, Frontier and Ridgeline. It is very rugged and dependable design. Keep it simple and sell it for less than all the competitors. Mitsu requires a minimal sales volume to deliver a return on investment and then profit. If they partnered with FCA perhaps assembly of complete knockdown kits could be completed at an FCA North American plant in return for a version to be sold as Ram or FIAT. FIAT already sells a Fullback branded version of Triton in some markets.