#MarketShare

Hyundai, Kia See Weakest Annual Sales Growth in a Decade

2014 may only be a day old, but it’s already shaping up to be a rough year for Hyundai and Kia as they prepare to increase global sales by just 4 percent this year, the lowest and bleakest forecast for the Korean duo since 2003.

Hyundai Battles Skoda For Czech Republic

While Skoda has long been the Cinderella story of the Czech Republic, Skoda could soon find itself deposed as sovereign of their domestic auto market.

Hyundai Casts Aside Conquest For Quality in Europe

Though Hyundai has set its sights on some sales gains in 2014 in the European market, the automaker has no plans to defend market share to the death, opting for repeat business rather than taking the Germanic approach of volume at all costs.

Ford Expects SUVs, Crossovers to Drive Global Success

Is the future of motoring in the global marketplace in the good hands of the Golf, Forte and Fiesta? Not if you’re Ford’s vice president of Global Marketing, Jim Farley. In his mind, it’ll be a page from the 1991 Explorer’s successful playbook that will help his employer gain market and mind share the world over.

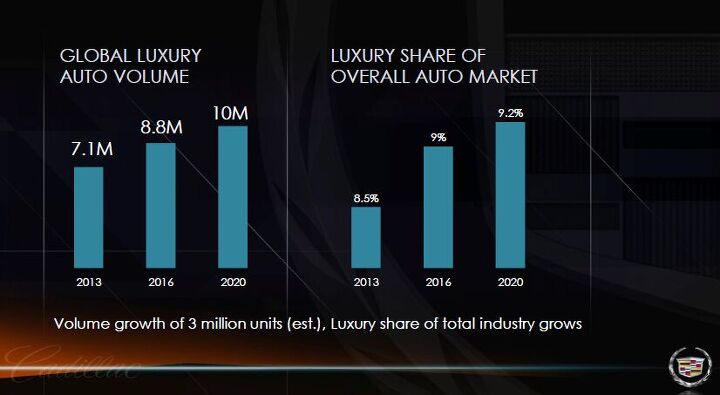

Hail Mary: Cadillac Bets Big On China

When GM announced last week t hat it wants to increase Cadillac’s share of the global luxury market from 8.5 percent now to 9 percent by 2016, we opined that from “looking at the plan, GM appears to be betting big on the success of its new Chinese assembly plant.” It turns out that Cadillac is betting big on China. Cadillac “aims to quadruple its share of China’s luxury auto market to 10 percent by 2020,” Reuters reports today.

By 2020, GM is “targeting about 250,000 luxury car sales in China,” says Reuters. It will be rough.

Global Growth Of Cadillac: GM Cautious

GM appears to be less convinced of the second coming of Cadillac than many of its fans. In the Global Business Conference Call, Bob Ferguson, VP of Global Cadillac, did set very cautious goals for Cadillac.

Why Is Nissan Cutting Prices?

One of the bigger stories of 2013 has so far managed to escape the news cycle. I’m not exactly sure why Nissan’s announcement of significant reductions on the MSRP of new cars hasn’t gotten more coverage, but I’m also not 100 percent sure of Nissan’s motives either.

GM Prepares A Barrage Of New Cars, Hopes To Right Sinking Market Share

GM’s pickup truck changeover has received all the attention of TTAC’s commentariat, but GM knows it needs more than new trucks to make up for decades of deteriorating market share. All hopes are on a wave of new showroom offerings. “Seventy percent of the automaker’s U.S. portfolio will be refreshed between the start of 2012 and the end of 2013, and 89 percent will be refreshed by 2016,” writes the Detroit News.

GM Reports $1b Q1 Profit, Still Seeking "Competitive Levels Of Profitability"

Once upon a time, GM’s North American operations spewed red ink across the firm’s balance sheet, with the whole mess kept afloat by relatively strong overseas operations. Now GM makes most of its money at home while its international divisions limp along. No, really: in its just-released Q1 financial report, GM reveals that some $1.7b of its $2.2b global EBIT came from its once-troubled home markets. What a difference a bailout makes!

QOTD: How Many Times Has GM Made This Claim Before?

Automotive News reports, with their usual straight face, that “GM sees new models spurring rebound from lower U.S. market share.” The question isn’t whether GM has made this claim before, but how many times it has made it.

Still Generous With Incentives, GM Sheds Market Share Nonetheless

GM’s turn-around hinges on a market share above 19 percent, board member Stephen Girsky said at an industry meeting in October 2009. “The public plan is 19 percent and change. That is what everything is being based on,” Girsky said during a panel discussion at a conference at Columbia Business School. Reuters was taking notes.

In the 3rd quarter of 2009, GM had a market share of 19.5 percent. The share climbed to 21.8 percent in January 2011, and eroded ever since.

Win Some, Lose Some: Detroit Predicted To Give Up Most Gains This Year

Gains in market share, that is. It’s market share that counts. That perplexing axiom had been drummed into me in the many decades I spent on the other side. You need to be faster than the overall market, or you fall behind. Of course, you can gain share by giving away cars, but you won’t do that for long.

Detroit had a big comeback last year. Let’s look how big. And let’s discuss whether Bloomberg is right when it predicts that “U.S. automakers led by General Motors Co. may lose share in their home market this year.”

After Massive Losses Of Chinese Market Share: A Big Wave Of Toyota Buyers

At the times of the Beijing Olympics in 2008, Toyota proudly stood on the podium of the Chinese sales winners, along with Volkswagen and GM. Ever since, Toyota received the wrong fortune cookies in China: Its market share deteriorated steadily, down to half of its 2008 high. Toyota now is on an all-out offensive to re-gain lost ground, with promising success.

Edmunds Sees Nissan Charging Ahead, Detroit Falling Behind In August

Nissan’s “we have cars” ad may not meet with the approval of TTAC’s commenters, but it appears to be having some kind of effect. According to mid-month analysis by the A+ rated experts at Edmunds Autoobserver, Nissan’s looking at the strongest retail sales growth in the industry this month, building on last month’s already-strong performance.

One Country's Misfortune Is Another Country's Market Share. Don't Bank On It

“If you have no cars, you will lose market share,” said double-CEO Carlos Ghosn at last week’s annual results conference of Nissan. He said openly what other carmakers on the other side of the Pacific only dare to whisper into the ears of sympathetic reporters, or via analysts at banks and brokerages: The March 11 tsunami will cost Japanese makers big chunks of market share. The questions is: For how long?

Recent Comments