#MarketShare

Changing Tides: Can Ford And GM Control 40% Of The US Market By 2015?

The combined market share of GM and Ford will reach 40% of the US market by the end of 2015. Yes, you just read that correctly. That’s a full five percent more share than what they have today, or a gain of just one percent a year. Call me crazy… but recall that Farago and I called the GM bankruptcy way before most industry observers (and certainly before the BoD of Old GM) could see it coming. Long time TTAC readers will also remember my call to buy Ford’s stock in April 2009 when it was trading in the three buck range. So calm those gut-reactions for a few minutes and let’s walk through this.

Is Ford… Underperforming?

Ask an industry-watcher to name an automaker that seems to be doing things right, and chances are one of the top choices would be Ford Motor Company. And though Ford is enjoying favorable perceptions in the media, according to the company’s own internal goals, it’s actually underperforming. And in a key metric, no less: retail market share. Bloomerg reports:

Chart Of The Day: GM's Monthly Retail Market Share, 2008-2011

Retail market share is one of those metrics that tends to cut through the vagueness of pure sales-volume numbers, reflecting an automaker’s performance compared to the competition, without the distraction of fleet sales. It’s not a perfect measure of a business’s overall strength, as fleet sales can help with economies of scale and capacity utilization, but it’s one of the most accurate ways to measure the appeal of a firm’s products with real consumers. And, based on this chart of GM’s monthly retail market share (as calculated by TrueCar VP for Industry Analysis and all-round data ninja Jesse Toprak), GM’s much-vaunted Lutz-era products aren’t moving the needle with those real consumers. Emerging from bankruptcy didn’t seem to provide much of boost either. And unless drastic happens soon, GM’s battle for consumer acceptance will continue its slow but steady decline. Not good!

Hybrids Are A Speck On The Wall

Call me a cro-magnon cave dweller, but whenever I read these “car of the future” stories, I am reminded of a discussion I had with a Volkswagen engineer, some time in the late 70s. I was a wide-eyed copywriter and believed anything.

“I am working on the car for the year 2000,” the engineer announced.

“Wow! What will it be?” the wide-eyed copywriter asked in awe.

What's Wrong With This Picture: Spot The Turnaround Edition

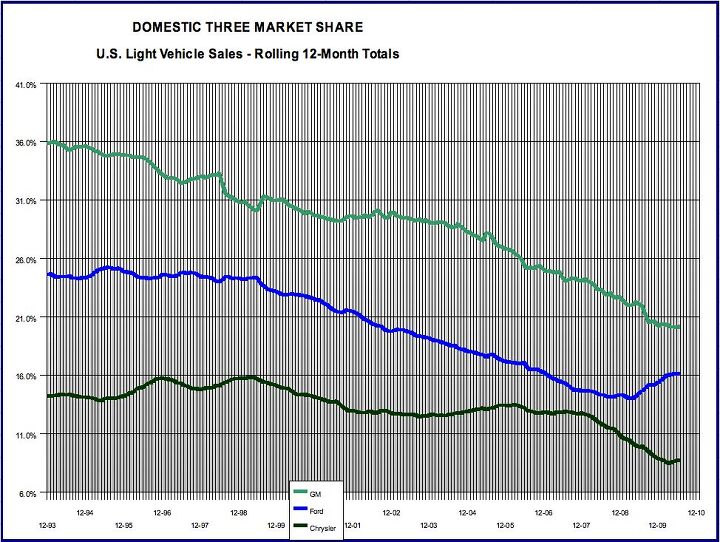

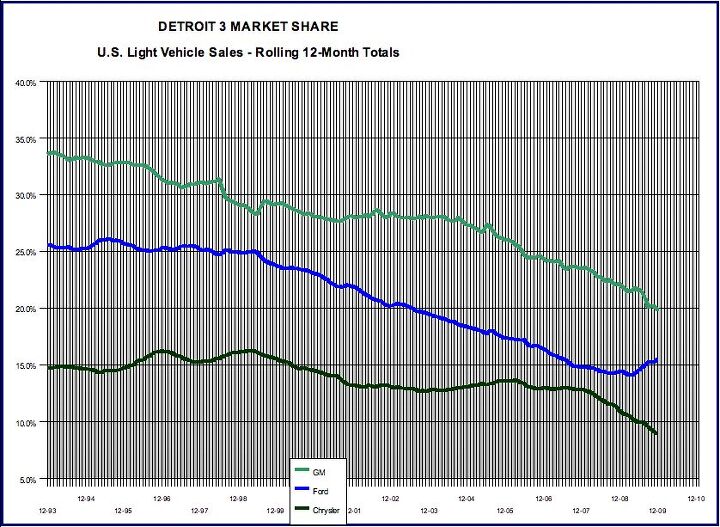

Collectively, the the Detroit Three have enjoyed precisely one market share turnaround in the last several years: Ford in 2009. This year, Detroit’s market share looks downright stagnant. Chrysler’s got a tiny bump going on, but Ford’s lost its fizz and GM is skidding bottom… at best. On the other hand, if this graph is just too gloomy for you, hit the jump for one of the first glimmers of (market share) hope for Detroit in years.

GM Q1 Global Sales: Improving, But Not Dominating

Whereas Chrysler’s surprise operating profit in the first quarter of this year was achieved mainly through cost-cutting, GM’s just-announced Q1 profit comes on the strength of sales increases in most of its global markets. Though The General’s sales numbers are still lower than they need to be, momentum is headed in the right direction… albeit somewhat more slowly than had been hoped.

GM Market Share In Reverse For Q1

Back in October, GM’s then-CEO Fritz Henderson announced that GM would make a stand on market share, refusing to allow its share of the US market to slip below 29 percent. Oh wait, that was Gary Cowger’s campaign of 2003, which saw GM execs wearing symbolic “29” lapel pins. Where Henderson actually drew GM’s market share line in the sand six months ago was

At this point about 19 percent… We’ll finalize that, but I’m not interested in going down from that

And according to the Detroit Free Press, GM actually achieved that goal in December, logging a 21 percent share based on Autodata findings. Unfortunately, things have been slip-sliding ever since. In February, GM’s share fell to 18.1 percent, and last month it fell even further, to 17.6 percent.

Japanese Mini Car Makers Fight Battle Of The Bulge

Subminiature, or „kei“ cars ( from kei-jidosha – subcompact cars) have been a Japanese phenomenon. At one time, their combined share was 1/3 of Japan’s market. Unlike anime and Pokemon, the 660 cc vehicles never much made it beyond Japan’s shores. And recently, the sales of the pocket monsters on wheels had been flagging. Last February, the little critters had recorded their first rise rise after 15 months of going down – by a hair of 0.7 percent.

According to today’s Nikkei [sub], “improvements in hybrid and electric technology are dulling the fuel-efficiency edge that minivehicles have long had over larger cars. To maintain their advantage, makers of minis are putting their autos on diets, shaving weight wherever they can to eke out better gas mileage.”

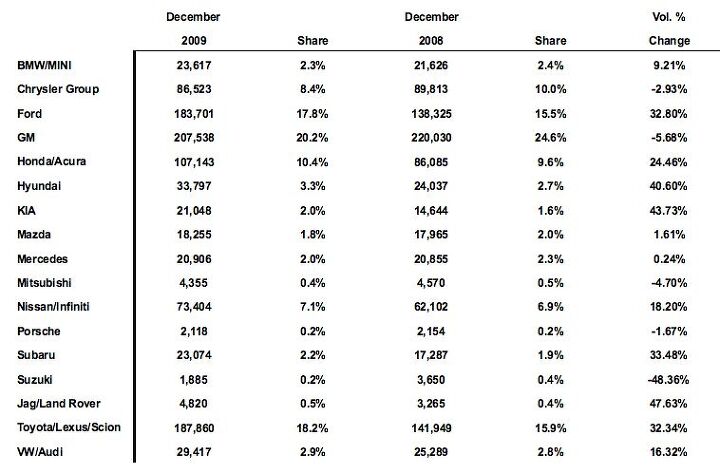

Reader Request: December 2009 Market Share

Sergio Marchionne Gives Media, Reality The Slip

Having been told by the Secretary of Transportation that the Chrysler Group’s motley assortment of new trim level names, rebadged Lancias, decal-sporting special editions represents “the cutting edge of developing the kind of products that I think people in this country, and also in other countries, are really going to feel very favorable toward,” CEO Sergio Marchionne apparently thought enough had been said about his struggling bailout baby. As CBS reports, Marchionne suddenly canceled a 45-minute scheduled press availability before he had the chance to confirm LaHood’s astonishing opinion.

Now Playing At TTAC: New Car Sales Since 1993

Will Chrysler Cut More Dealers?

Maruti Suzuki Gears Up For Indian Turf Battle

In my editorial on GM’s plant to take on the Indian market in partnership with SAIC, I wrote that Maruti Suzuki’s monstrous market share indicated the possibilities for GM. Well, the Indian market leader isn’t going to just sit on that lead. In 2007, Osamu Suzuki said that his firm’s Indian passenger car market share would never drop below 50 percent, an assertion that took two years to prove untrue. The WSJ reports that although the overall Indian market will probably grow 16 percent this year, Maruti’s share of that market has fallen over the last year from 45 percent to about 40 percent (with passenger car share down from 55 percent to 48 percent).

Recent Comments