After Massive Losses Of Chinese Market Share: A Big Wave Of Toyota Buyers

At the times of the Beijing Olympics in 2008, Toyota proudly stood on the podium of the Chinese sales winners, along with Volkswagen and GM. Ever since, Toyota received the wrong fortune cookies in China: Its market share deteriorated steadily, down to half of its 2008 high. Toyota now is on an all-out offensive to re-gain lost ground, with promising success.

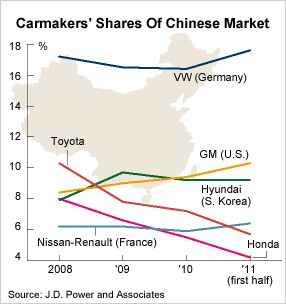

The chart, supplied by The Nikkei [sub] based on J.D.Power data, paints an ugly picture. In 2008, Toyota had China’s second-largest market share, after Volkswagen and a hair above GM. Ever since 2008, Toyota dropped steadily.

Shouts from the gallery: “Recalls! Crummy quality!”

Not so fast. Honda’s share deteriorated nearly in lockstep with Toyota, and Honda was not in LaHood’s crosshairs.

Enter racism-by-proxy: “The Chinese don’t like the Japanese!” Easy. Nissan is up a lot. And Hyundai, an easy victim of vehicular cultural bias (if it exists) is running strong. Hyundai could sell much more if they would have the capacity.

“Earthquake?” Just look at the chart.

All I can see is that both Toyota and Honda are worn down between the battling behemoths of Volkswagen and GM on one side and the local makers on the other (not on the chart.)

This list here (also provided by J.D. Power) paints an even nastier picture. Careful, it’s by brands.

Top 10 Selling Passenger Vehicles Brands in China

Whatever may have cut Toyota’s Chinese market share, the company is mad as hell and won’t take it anymore.

The Nikkei’s [sub] dispatch from the Chinese trenches says:

“To regain its lost ground, Toyota launched a high-octane sales drive in July as its production recovered. The payoff came quickly — the company’s flagship Corolla sedan topped the list of best-selling cars in China that month and Toyota is now back in the race for a leading position in the key market.”

Toyota’s China sales in July grew 28 percent on the year to 82,500 units, in a market that was up a meek 2.18 percent. Toyota uses a double-barrel shotgun. Lots of cars (they are plenty again) and big price cuts. The Nikkei found a dealership “located a 30-minute drive south of central Beijing” (that barely puts you past 4th Ring Road during normal Beijing traffic) that was willing to drop the red Mao equivalent of $2,800 on the hood of a Corolla of unspecified trim level. Beijing is not a market, it’s a wasteland as far as car sales go. A new subsidy program that offers drivers city government cash between $400 and $700 if they exchange their existing car for a new and cleaner vehicle won’t change much. China’s car growth comes from buyers who don’t own a car. As long as carless Beijingers must enter a lottery with worse odds than roulette to receive a license plate, there will be no growth in Beijing.

If foreign journalists would venture beyond 5th Ring Road, they would see that Beijing is not China, just as Washington, D.C. is not America. And discounts where you are still welcome to drive a car might be less generous.

All eyes are now on the low-priced Etios-based compact, developed specifically for China.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Danddd Or just get a CX5 or 50 instead.

- Groza George My next car will be a PHEV truck if I can find one I like. I travel a lot for work and the only way I would get a full EV is if hotels and corporate housing all have charging stations.I would really like a Toyota Tacoma or Nissan Frontier PHEV

- Slavuta Motor Trend"Although the interior appears more upscale, sit in it a while and you notice the grainy plastics and conventional design. The doors sound tinny, the small strip of buttons in the center stack flexes, and the rear seats are on the firm side (but we dig the ability to recline). Most frustrating were the repeated Apple CarPlay glitches that seemed to slow down the apps running through it."

- Brandon I would vote for my 23 Escape ST-Line with the 2.0L turbo and a normal 8 speed transmission instead of CVT. 250 HP, I average 28 MPG and get much higher on trips and get a nice 13" sync4 touchscreen. It leaves these 2 in my dust literally

- JLGOLDEN When this and Hornet were revealed, I expected BOTH to quickly become best-sellers for their brands. They look great, and seem like interesting and fun alternatives in a crowded market. Alas, ambitious pricing is a bridge too far...

Comments

Join the conversation

Well they are not the largest industrial company in the world for nothin'.

What is the reason for VW's overwhelming popularity?