#Incentives

GM Kills The Competition… In July Incentive Spending

Postcards From "The New Normal"

Sales numbers for the US market in July should drop today, and based on an early analyst survey, the market’s only recovered to a 12m SAAR at best. Estimates aside though, it’s beginning to look more and more like the US market for new cars is approaching a “new normal.” How so? Automotive News [sub]’s Jesse Snyder figures it’s

Because discipline is breaking out all over– at manufacturers, suppliers and dealerships.

Even Snyder’s headline captures the mood of cautious realism that’s suddenly taken hold of the auto industry: though the market appears to have moved towards 12m annual units in July, Snyder’s analysis is headlined Life at 11 million U.S. sales.

California Denies Volt AT-PZEV Status, Tax Rebate, HOV Access

With Chevy’s Volt priced at an eye-popping $41k before tax breaks, those tax breaks are now more important than ever. The first 200k Volts will qualify for up to $7,500 in federal credits, but Chevrolet had to be hoping for state incentives on top of the federal credit, especially in the key launch state of California. For a number of reasons though, the Volt doesn’t meet California’s requirements for Advanced Technology-Partial Zero Emissions Vehicles, and will lose out on a $5,000 tax credit that’s available to its cheaper competitor, the Nissan Leaf. As a result, the Leaf will cost Californians who qualify for both full credits about $20k, while the Volt will cost about $33,500. Moreover, the Leaf will have full access to California’s High Occupancy Vehicle lanes while the Volt will not, unless a pending bill before California’s state Senate passes. Together, these developments represent a serious advantage for the Leaf over the Volt in what is almost certain to be the world’s largest market for electric cars in the short-to-medium term. So how did GM let this happen?

TTAC Moves Fast On A 0% ZR1

We don’t know for sure, but Dr. Sanjay Mehta (TTAC commentator doctorv8, awesome brother) did the deal on a 2010 Corvette ZR1 for 0% while the autoblogosphere still had it in editing. Not that the Internet is slow, he’s just that damn fast.The dude’s been keeping tabs on the inventory nightmare, calling out for GMAC’s corrective action on the Corvette Forum…almost a month ago. It’s so nice to see the two brothers speak The Truth About Cars, via different media.

Auto Dealer Tricks That The Financial Reform Bill Didn't Fix

With President Obama set to sign a new financial oversight bill into law on Wednesday, the New York Times has dug into the bill looking for key oversights. Because auto dealers were exempted from the bill (thanks at least in part to their mobilization by the GM/Chrysler dealer cull), auto dealer finance tactics ended up square in the NYT’s crosshairs, and paper’s Your Money blog has a rundown of three of the most heinous of these tactics: the Yo-Yo, the Markup and the Add-On.

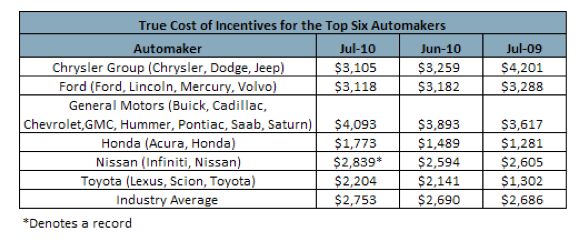

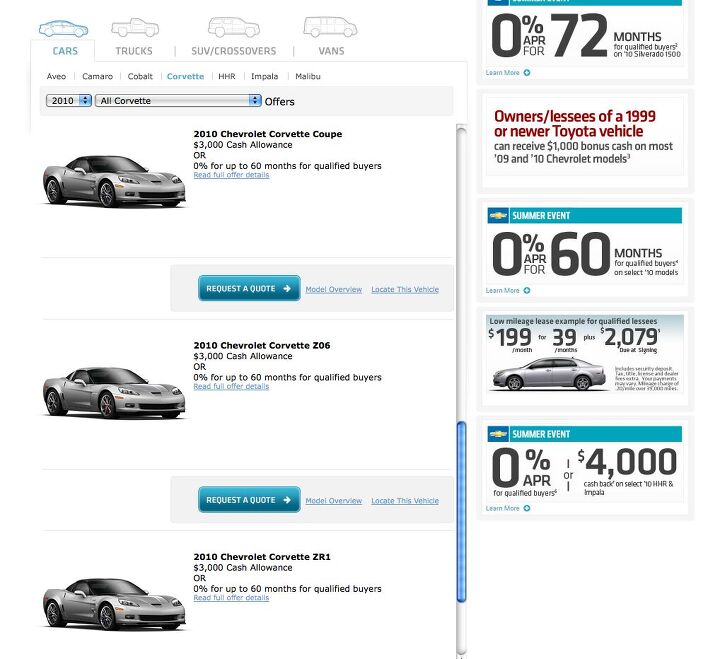

What's Wrong With This Picture: Incentivize This Edition

The good news? GM is so desperate to move Corvettes, it’s decided to give you $3k back or 0% financing on every single new ‘vette, including the world-beating ZR1. The bad news? You have to build the engine yourself. Also, this won’t exactly help GM climb off its throne as the reigning king of incentive spending. But hey, if $106k for a Corvette was sounding a little ridiculous, at least the price point has effectively fallen to $103k. If you’ve been on the fence over that three thousand dollars, it’s time to adjust your spreadsheet accordingly. [ZR1 incentives explained after the jump]

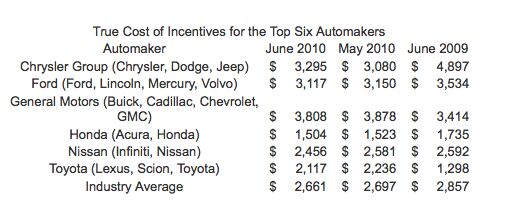

GM Tops June Incentive Spending

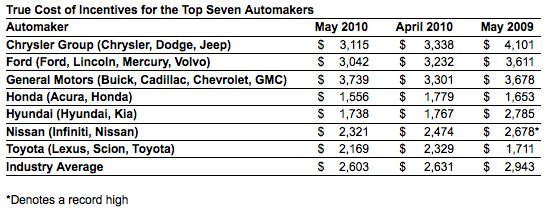

Detroit Tops May Incentives, Residuals Rise Regardless

Once again Detroit finds itself atop Edmunds’ True Cost of Incentive ranking of the top seven automakers [via earthtimes], as the domestic OEMs spent about $1.7b (or, about 60 percent) of the $2.8b paid out by the entire industry on incentives last month. Trucks were the most heavily discounted segment, with average incentives running around $4,650, or nearly 13 percent of the average segment sticker price. Saab spent the most by brand, slapping an average of $6,813 on its vehicles, with Lincoln coming in second at $4,987 per vehicle sold. Saab’s incentives equaled 17.1 percent of its average vehicle price, while Chrysler gave away about 12.2 percent of its average vehicle price last month.

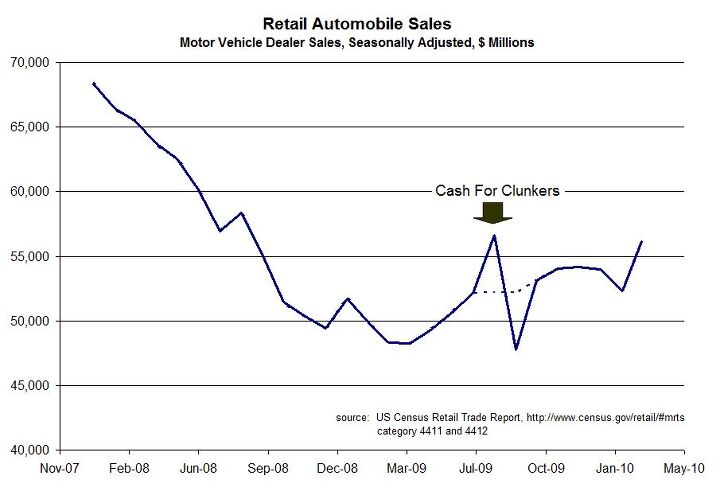

What's Wrong With This Picture: A Giant Clunking Sound Edition

Forbes: The "Most Overpriced Cars of 2010" Are Trucks And Utes

The only “real car” on Forbes’ most overpriced list is the Chrysler 300. Really. Despite being based on the compact Cobalt, Chevy breaks sales of its HHR out as a “truck,” in search of improved CAFE performance. And despite an MSRP of under $20k, the PT Cruiser-inspired wagon was still one of Forbes’ most overpriced vehicles of 2010. The rest of the list’s 11 models are unquestionably trucks, or truck-based utes, and save for Nissan’s Titan and Armada, they’re also all from Detroit automakers as well. If you’re looking for more reasons to build a cheap, utilitarian compact pickup truck ( ahem, General Motors) this list has got ’em. Hit the jump for Forbes’ list of most overpriced vehicles, and the magazine’s formula for deciding who makes the cut for this dubious distinction.

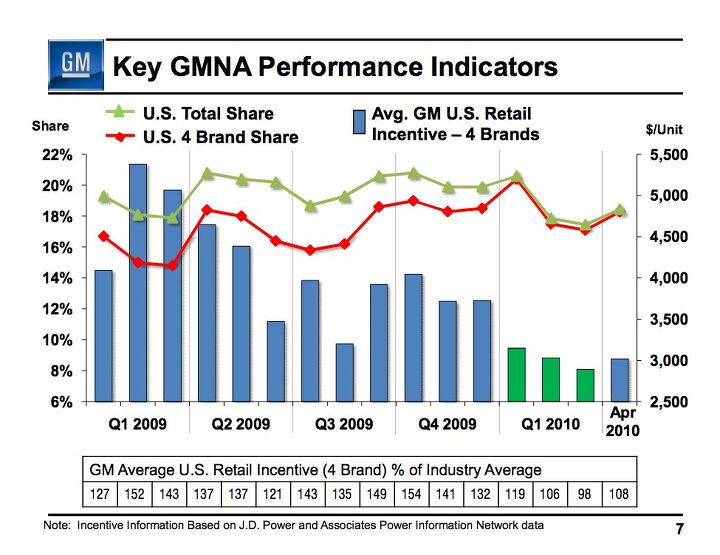

What's Wrong With This Picture: Follow The Incentives Edition

Sadly, my internet came crashing around my ears just as GM’s Q1 results conference call was getting interesting. Typical Monday. I’ll rock myself to sleep tonight with a recording of the call and report back tomorrow, but at this point the big news is plainly visible on this single slide. Yes, GM finally got control of its incentives and wrestled them below the industry average… for a month. That month (March) also just happened to be the worst month this year for GM market-share wise. The next month (April), the incentives went back over the industry average, and market share increased once again. The lesson seems obvious: GM won’t gain market share on promises of high-quality cars and taxpayer payback alone.

China To Electrify Their Car Market With Cash

If you listen to the commentators, you’ll believe that tax breaks and stimulus measures are the sole reason for China’s car boom. It turned the country into the #1 car market in the world. What’s more, the boom continued unabated in 2010. Wonks are worried that the market will crash when the stimuli are withdrawn. Don’t worry. There will be new ones. This time, for electric cars.

Inside Chrysler's Sales Increase: 40 Percent Fleet Mix And Industry-High Incentives (And Climbing)

To say that Chrysler’s 25 percent year-over-year sales increase last month came as a surprise would be pushing the boundaries of overstatement. Chrysler’s sales and market share have been in decline for a long time, but over the past several years, the tailspin seemed to have become terminal. So, how did the Pentastar (barely) make its 95k minimum volume level and increase sales by 25 percent over April 2009? Fleet sales, for one thing: according to The Freep, TrueCar.com estimates that a full 40 percent of Chrysler’s April sales went to fleet customers.No wonder made a big deal about publicly finding Jesus on the fleet sales issue… at the end of the month (to say nothing of the conspicuous absence of retail sales numbers in its April report and massive increase in Sebring sales). And the bad news doesn’t end there. Not only did Chrysler top all automakers in per-vehicle incentives last month according to Edmunds’ monthly True Cost Of Incentives index with $3,374 on the average Mopar’s hood, they’re actually increasing incentives even further.

GM Market Share In Reverse For Q1

Back in October, GM’s then-CEO Fritz Henderson announced that GM would make a stand on market share, refusing to allow its share of the US market to slip below 29 percent. Oh wait, that was Gary Cowger’s campaign of 2003, which saw GM execs wearing symbolic “29” lapel pins. Where Henderson actually drew GM’s market share line in the sand six months ago was

At this point about 19 percent… We’ll finalize that, but I’m not interested in going down from that

And according to the Detroit Free Press, GM actually achieved that goal in December, logging a 21 percent share based on Autodata findings. Unfortunately, things have been slip-sliding ever since. In February, GM’s share fell to 18.1 percent, and last month it fell even further, to 17.6 percent.

Edmunds: Record Percentage Of March Sales Were Financed At Zero Percent

Ever since a debt crisis toppled the already-precarious auto sector into undeniable crisis there’s been a running debate about when US car sales would “return to normal.” By now though, even the most ardent bulls seem to have accepted that 2007’s 16m number will be out of reach for at least several more years. So, how will we know when we’ve hit the new normal? According to Edmunds, at least one statistic roared back to 2006 levels last month: the percentage of sales financed at zero percent.

In March, more than 22 percent of financed new cars were purchased with zero-percent finance deals. Last March the total was just 13 percent. The prior high was 21 percent in July 2006.

Recent Comments