GM Kills The Competition… In July Incentive Spending

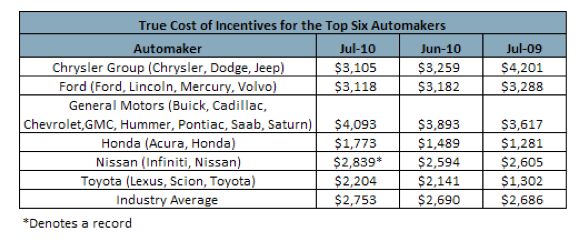

Nissan may have broken its own incentive record last month, but it was GM that blew the lid off the competition. According to Edmunds’ True Cost Of Incentives Index, The General loaded up nearly $1,000 more in incentive spending compared to its closest competitors, and killed the industry average by $1,340. Combined, Detroit spent $1.7 billion, or 57.3 percent of the total incentive expenditures last month. And according to Edmunds,

Analysis of incentives expenditures as a percentage of average sticker price for each segment shows large cars averaged the highest, 13.5 percent, followed by large trucks at 12.4 percent of sticker price. Premium luxury cars averaged the lowest with 3.5 percent and sport cars followed with 3.9 percent of sticker price.

More by Edward Niedermeyer

Comments

Join the conversation

Agreed - Let's see some ATP charts too.

It would be helpful to track something more meaningful, like real transaction prices. I imagine that would be tough to get and I expect the automakers are not motivated to be too helpful.

Incentives are not an aberration on the true price of a product. Incentives ARE the true market price of a product. MSRP- the attempt by the vendor to set the price in a market having a lot of choices- are the aberration of the true price. All the incentives do are reduce the artificial wish price sticker to a point where the product can actually sell. Wishing incentives will go away is neither here nor there. The automakers don't get to set the prices anymore, the customer does. The market hath spoken.

GM can sell their product at MSRP, however GM will sell much less of them. Add to the fact they have a high percentage of fleet sales and we are back to the same problem. GM still also has the UAW cancer that will want more for doing less.