Seemingly Every Automotive Headline Includes Electric This or That, but What's the State of Electric Vehicle Market Share in America?

You can forget the GM EV1 and the Toyota RAV4 EV. The car that truly attempted to bring electric cars into the mainstream was the 2011 Nissan Leaf.

It didn’t. U.S. Leaf sales, never reaching any great heights, plunged after its fourth full model year, falling by more than half between 2014 and 2016.

There’s a thoroughly updated second-gen Nissan Leaf on its way, destined to hit U.S. dealers early in 2018. But during the first-gen Leaf’s tenure, the Nissan was joined by a broad array of electric cars, from a handful of Teslas to the Chevrolet Bolt, Volkswagen e-Golf, Kia Soul EV, BMW i3, and Hyundai Ioniq, and all of these cars together have combined to quintuple U.S. electric vehicle market share over the last half-decade.

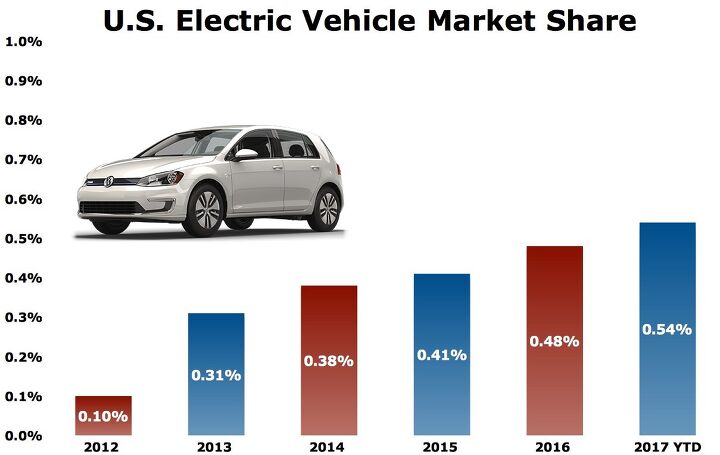

Only 0.1 percent of the new vehicles sold in America in 2012 were pure EVs. That figure has risen, very slowly, to 0.5 percent through the first eight months of 2017 while the number of available nameplates has more than doubled.

Perspective? Ford grew its F-Series’ share of the overall U.S. new vehicle market from 4.5 percent to 5.1 percent during the same period.

It’s not that EV sales aren’t rising. Clearly, to increase their share of the market — propelled along by government tax credits that will likely expire for many automakers in 2018 — from 0.1 percent in 2012 to 0.5 percent in 2017 requires a meaningful increase in actual sales. After all, the market at large has grown, as well.

According to HybridCars.com, a vital source for this post’s EV sales data, fewer than 14,000 pure battery-powered cars were sold in 2012: Nissan Leafs, Tesla Model Ss, Smart Fortwo EDs, Ford Focus Electrics, Honda Fit EVs, Mitsubishi i-MiEVs, and Toyota RAv4 EVs.

But after growing by leaps and bounds in 2013, growth powered largely by the Leaf and Model S, the rate of growth has markedly slowed. EV sales more than tripled in 2013, as did EV market share. But the year-over-year increase in 2014 was down to 33 percent despite four additional nameplates. In 2015, EV sales were only 5 percent stronger than in 2014. Then 2016’s EV sales rose 18 percent, even though the fleet didn’t add to its number of nameplates. The rate of growth in 2017, with 16 different nameplates collecting U.S. sales in the first two-thirds of the year, stands at a similar 21 percent.

Granted, that is growth in a market that’s experiencing decline. But the total numbers are so small, they can be compared with individual nameplates such as the Honda Odyssey, Lexus RX, Honda HR-V, Subaru Crosstrek, Chevrolet Tahoe, and Dodge Charger. Indeed, vehicles that wouldn’t be widely considered marketplace hits — the Dodge Journey and Kia Forte — generate significantly more volume than America’s entire EV sector.

The incoming EV tide is altering the shape of the shoreline, but the movement of the sand is so limited and so gradual that it’s difficult to spot with the naked eye.

Amidst news that Volvo will “electrify” its entire lineup by 2020, that BMW will offer a bevy of EVs by 2025, that Nissan will sell twice as many new Leafs as old Leafs, that the Chevrolet Bolt just outsold the Chevrolet Volt, reside these cold, hard facts. Even with EV sales doubling between 2013 and 2017, only 1 out of every 200 U.S. new vehicle acquisitions involves an electric vehicle. Plug-in hybrids are comparably popular, hybrids generate four times more volume, and diesel-powered vehicles — excluding full-size pickups — achieve EV-like volume despite their Volkswagen extermination, as well.

Buying habits will change. But they will change very slowly.

[Images: General Motors, Nissan, Tesla; Chart: © The Truth About Cars]

Timothy Cain is a contributing analyst at The Truth About Cars and Autofocus.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Well, I'd be impressed if this was in a ZR2. LOL

- Lou_BC This is my shocked face 😲 Hope formatting doesn't fook this up LOL

- Lou_BC Junior? Would that be a Beta Romeo?

- Lou_BC Gotta fix that formatting problem. What a pile of bullsh!t. Are longer posts costing TTAC money? FOOK

- Lou_BC 1.Honda: 6,334,825 vehicles potentially affected2.Ford: 6,152,6143.Kia America: 3,110,4474.Chrysler: 2,732,3985.General Motors: 2,021,0336.Nissan North America: 1,804,4437.Mercedes-Benz USA: 478,1738.Volkswagen Group of America: 453,7639.BMW of North America: 340,24910.Daimler Trucks North America: 261,959

Comments

Join the conversation

With the exception of the Bolt and Tesla, driving an EV is like driving a gasoline car with a 2-3 gallon tank that needs to be refilled with a drink straw. Most people start to get nervous when they have only 2-3 gallons left - my car gives me a warning chime at about 75 miles of range left, but I have the option for a quick splash and dash if I need a bit more range to get to my destination. With an EV, if you forget to plug-in overnight, or the recharger at work or on the way is busy or out-of-order, or if its cold and you lose 20% range or its hot and you lose 20% from heavy A/C use, there is no "splash and dash" equivalent to get you to your destination. Range anxiety is a real issue with regards to the mass adoption of battery-electric vehicles.

EV’s will be neither practical nor accepted for general-use vehicles in America for the foreseeable future, because of these factors: a) They would need a range of greater than 500 miles. b) They must charge fully in 10 minutes or less. c) They must cost LESS than a comparable ICE vehicle. d) They must be supported by charging stations all over the country (America). e) They must have a supporting electric grid capable of powering more than 25% of all customers who would drive all EV’s (which does not yet exist). f) They must not depend on exotic metals like indium and cobalt, which are rare and rapidly depleting. g) They must have adequate VERY cold-temperature performance (which they do not now). And right now, into the foreseeable future (10-20 years out), the market will still favor ICEs at about an 80% take rate, because of engine advances: http://www.caranddriver.com/flipbook/12-propulsion-technologies-that-will-increase-future-cars-efficiency ===========================