Sergio Marchionne Is Alarmed By FCA's Sudden Canadian Downturn, And Rightly So

With Jeep as the fastest-growing auto brand in the country and Ram pickup truck sales soaring to record levels, Fiat Chrysler Automobiles was Canada’s top-selling automobile manufacturer in calendar year 2015.

It was the first year in the company’s 90-year history that FCA (or DaimlerChrysler, or Chrysler Group, or whatever it was known as) outsold all other manufacturers.

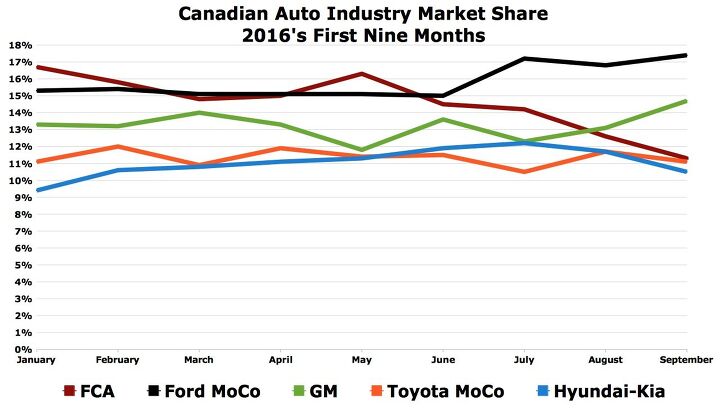

Yet in claiming the top-selling mantle, FCA’s Canadian market share decreased marginally, falling from 15.6 percent in 2014 to 15.4 percent in the automaker’s highest-volume year to date.

Fast forward nine months and FCA boss Sergio Marchionne finds the company’s Canadian situation, “alarming,” according to Automotive News Canada. How bad is it? And how did the tide turn so quickly?

MARKET SHARE

The Canadian market is most definitely slowing. But it’s not like the industry ran into a brick wall.

Across the industry, including FCA, sales fell 2 percent in Q3. Subtract FCA from the equation and Canadian auto sales actually increased 1 percent in Q3, adding nearly 5000 sales in large part thanks to all-time record Ford F-Series sales.

FCA produced one-quarter of its volume via fleet sales during the five-year period stretching from 2011 to 2015 and made a practice out of advertising $7,000 or more in Grand Caravan discounts.

But producing that volume — and earning a profit at the same time — is becoming more difficult for FCA because of a Canadian dollar that’s much weaker now than it was five years ago. Essentially at par with the U.S. dollar as recently as April 2013, one Canadian dollar now buys only USD $0.75.

Selling cars in Canada, however, is another matter.

In 2013, FCA was selling, for example, a CAD $40,000 pickup truck in 2013 that was worth roughly $40,000 U.S. dollars.

Today, that CAD $40,000 sale equals only USD $30,000.

FCA is obviously less willing to make that deal, resulting in lower incentives and higher prices that drive buyers to rival showrooms.

BLUE OVAL

Back at FCA, the automaker trailed Ford Canada by a 20,372-unit margin heading into the fourth quarter. General Motors Canada unexpectedly managed to outsell FCA’s Canadian division in August and September, as well.

Canada is disproportionately important to Fiat Chrysler’s North American operations. The Canadian auto industry generates 9.6 percent of North America’s total auto sales volume. FCA produces 11.0 percent of its North American volume in Canada.

[Images: FCA, TTAC]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

- Kwik_Shift_Pro4X Off-road fluff on vehicles that should not be off road needs to die.

- Kwik_Shift_Pro4X Saw this posted on social media; “Just bought a 2023 Tundra with the 14" screen. Let my son borrow it for the afternoon, he connected his phone to listen to his iTunes.The next day my insurance company raised my rates and added my son to my policy. The email said that a private company showed that my son drove the vehicle. He already had his own vehicle that he was insuring.My insurance company demanded he give all his insurance info and some private info for proof. He declined for privacy reasons and my insurance cancelled my policy.These new vehicles with their tech are on condition that we give up our privacy to enter their world. It's not worth it people.”

Comments

Join the conversation

Consumer Reports coming back to haunt FCA?

Much of this is due to truck allocation going to the U.S., and maxed out production not being able to fill Canadian demand. When it comes down to where to put the sale, it'll go to the more valuable dollar.