2 Views

Beijing Hearts Benz: China Might Buy A Chunk Of Daimler

by

Bertel Schmitt

(IC: employee)

Published: April 20th, 2009

Share

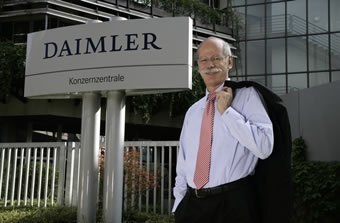

Daimler’s Zetsche won’t have to worry explaining the T&E for his trip to the Shanghai Motor Show. He might come back with a big chunk of Chinese money. According to the German Handelsblatt, “Daimler is negotiating with the Chinese sovereign wealth fund about selling shares and doesn’t rule out a Chinese engagement in Stuttgart.” Zetsche put on his best poker face: “We have had talks in the past with possible investors in China, and the talks are still on-going.” Looks like there is more to it: On Tuesday, Zetsche will travel to Beijing to meet with representatives of the Chinese government. Asked whether he would also meet representatives of the Chinese government fund CIC, Zetsche gave a definitive “no comment.” If they buy, China will be in good company:

Bertel Schmitt

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Published April 20th, 2009 2:31 PM

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Depends on the record of the company developing them. If it’s got a record of prioritizing safety over years of development, I’ll be fine with it, and I’ll expect it to be less risky than typical idiot human drivers. If it’s a “move fast and break sh!t” outfit like Tesla or Uber, no way.

- Kwik_Shift_Pro4X No thanks. You'll never convince me that anybody needs this.

- Kwik_Shift_Pro4X I'd rather do the driving.

- SCE to AUX EVs are a financial gamble for any mfr, but half-hearted commitment will guarantee losses.BTW, if there were actual, imminent government EV mandates, no mfr could make a statement about "listening to their customers".

- Zachary How much is the 1984 oldmobile (281)8613817

Comments

Join the conversation

Somehow I don't find this any more peculiar than the pop-up banner ads on TTAC for "Asian Girls for Love & Marriage."

"Perhaps they will take another run at acquiring another company or else diversify away from automotive." Oh great. Now Daimler can rape and pillage another company. I hope the Chinese just buy them.