Tesla IPO Priced At $17/Share, Market Cap Estimated At $1.6b

A source tells Reuters [UPDATE: Tesla confirms in press release] that Tesla has

sold 13.3 million shares for $17 each, raising about $226 million. It raised the number of shares it hoped to sell by 20 percent. It had planned to sell 11.1 million shares for $14 to $16 each.

That’s more than the “as much as $213m” number floated earlier, but with a recent Toyota deal and an EV-infrastructure bill in congress, Tesla has as much wind at its back as it can ask for. But if investors do get to start trading Tesla stock starting tomorrow, they’ll have a gut check before long. Tesla lost $30m last quarter, and it the second quarter ends on Wednesday. If those numbers show another healthy loss, investors will look away knowing that they’re in a risky, long-term investment. But can a $1.6b market-cap firm really compete in development, design and manufacturing with the giants of the automotive world simply by taking in two times its 2009 revenue in one IPO?

On that point, Bloomberg BusinessWeek has an interesting insight:

At the midpoint price of $15, Tesla is valued at 5.5 times its net tangible assets, a measure of shareholder equity that excludes assets that can’t be sold in liquidation. That’s triple the median 1.82 times for automotive companies globally, data compiled by Bloomberg show.

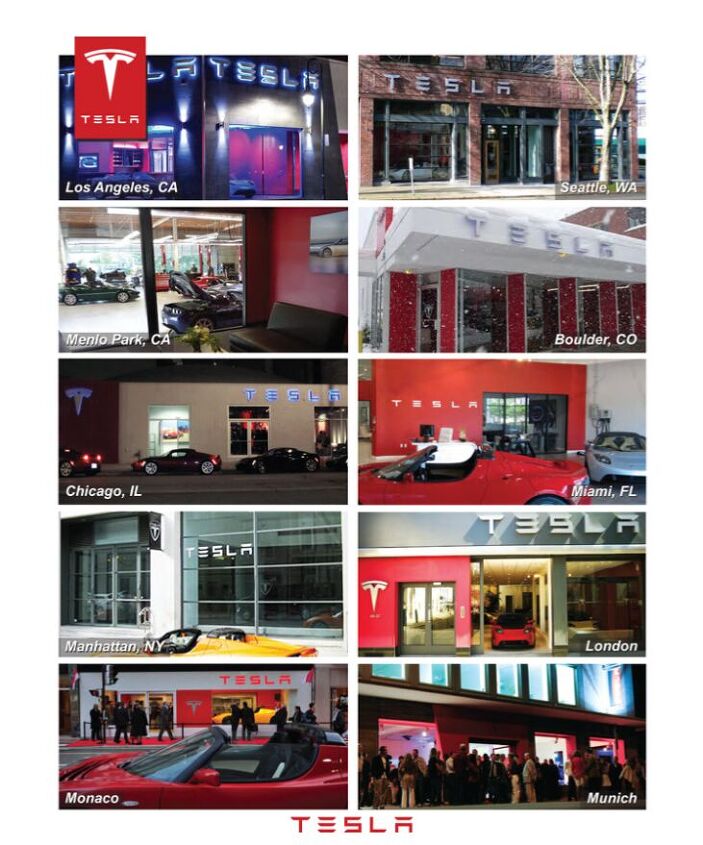

Which means Tesla is even more overleveraged at $17/share. And Tesla’s own prospectus mentions the challenges the firm faces at its projected volumes, especially on the retail front. Unless Tesla figures out how to get state-by-state franchise laws to allow internet car sales, much more money will need to be raised. Meanwhile, the Model S has yet to be spotted publicly road testing. And the Roadster is being canceled.

At the same time, Tesla’s sheer audacity deserves at least a little respect. It’s a wild moonshot of a company that resonates with lots of Americans for a number of reasons. The West coast of the United States doesn’t have many home-grown automotive protagonists. Tesla has probably benefited to some extent from anti-petroleum sentiment stirred up by the Gulf of Mexico oil spill. Still, Tesla needs to run on more than feel-good momentum and boutique service. They need to sell cars.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- EBFlex Ridiculous. “Insatiable demand for these golf carts yet the government needs to waste tax money to support them. What a boondoggle

- EBFlex Very effective headlights. Some tech is fine. Seatbelts, laminated glass, etc. But all this crap like traction control, back up cameras, etc are ridiculous. Tech that masks someone’s poor driving skills is tech that should NOT be mandated.

- Daniel There are several issues with autonomous cars. First, with the race the get there first, the coding isn't very complete. When the NTSB showed the coding and how that one car hit the lady crossing the road in the storm, the level of computation was very simple and too low. Basically, I do not trust the companies to develop a good set of programs. Secondly, the human mind is so very much more powerful and observant than what the computers are actually looking at, Lastly, the lawsuits will put the companies out of business. Once an autonomous car hits and kills someone, it will be the company's fault--they programmed it.

- FreedMike Can we mandate tech that makes Subarus move the f**k out of the fast lane?

- AZFelix Athenian style ostracism where every county allows people to post egregious driver behavior videos on a public forum and then allow registered citizens to vote to revoke the "winner's" license for one year. Counties with large populations can ostracize one driver per 100,000 residents.

Comments

Join the conversation

"overleveraged "? In what version of the English language? Capital raised via shares typically reduces leverage.

Tesla is a scam and a racket that deserves condemnation, beyond maybe riding whatever enthusiasm is out there and dumping before it all comes crashing down. car insurance quote