#fleet

Current-Generation Chevrolet Impala Gets A New Lease On Life – Will The Bench Seat Get One Too?

Christmas has come early for our beloved commenters Zackman and Mikey – GM has confirmed that the current generation Chevrolet Impala will be produced until June, 2014, ostensibly for fleet duty and used car market fodder.

A Snapshot Of January Sales: Honda Civic Is America's Third Best-Selling Car

One month is far too premature to make any predictions about 2012’s sales race, but we still got our hands on the data, thanks to independent analyst Timothy Cain. As usual, the Ford F-Series and Toyota Camry were the top dogs.

Ford Hit With $2b Ruling In Commercial Truck Case

An Ohio judged has ruled [full ruling in PDF here] against Ford in a 2002 case alleging the automaker overcharged dealers by selling commercial trucks at unpublished prices between 1987 and 1998. According to the summary judgement, Ford’s “CPA” program violated its contract with dealers by publishing “unrealistically high” wholesale prices and using “secretive, unpublished discounts” on an uneven basis, thereby overcharging some 3,000 dealers by an average of $1,650 for each of the 474,289 medium- and heavy-duty trucks sold in the applicable time period (about $1.2b of the ruling is for unpaid interest). The story is intriguing in its illustration of the differences between consumer and dealer incentives: while consumer-end incentives can be applied on a market-by-market basis, dealer invoice prices must be evenly applied across all markets according to Ford’s contract with its dealers. The story is also of major significance considering Ford’s still-shaky financial position, with automotive gross cash exceeding total debt by a mere $1.4b. Ford will appeal the ruling, but because the damages awarded are material rather than punitive, an expert tells the Cleveland Plain Dealer, Ford’s appeal could be “interesting.” Which doesn’t sound like great news to us…

Is Ford… Underperforming?

Ask an industry-watcher to name an automaker that seems to be doing things right, and chances are one of the top choices would be Ford Motor Company. And though Ford is enjoying favorable perceptions in the media, according to the company’s own internal goals, it’s actually underperforming. And in a key metric, no less: retail market share. Bloomerg reports:

Chevy Captiva-ted By Fleet Sales

Weekend Head Scratcher: What Is The Future Of Limos and Livery Cars?

In his write-up on the new Town Car-replacing livery version of the Lincoln MKT, Jack Baruth takes on the practical issues at stake, writing

I’ve put plenty of miles on both the MKT and the outgoing Town Car. Make no mistake, the MKT is quieter, faster, more spacious, and possessed of a vastly superior level of interior technology. If you told me that I would need to run one up a curb at sixty miles per hour for the purpose of avoiding a wandering falafel vendor across 110th Street, however, I wouldn’t think twice before reaching for the old-style keys. Ford has their work cut out for them.

Well, livery fleet owners think Ford’s got its work cut out for it too… but not for the practical wear-and-tear reasons that Jack points out. No, the problem, according to the owner of one Chicago-area limo company [via AN [sub]] is that

What I heard from most people is that they’re dissatisfied. It’s mainly the appearance, which is a crossover vehicle. People are used to what they consider a luxury vehicle for their clients and this has got a bit of a van styling to it.

Yes, as is so often the case in the great automotive discussions of our day, aesthetics trump all. And in this case, the shallow critique might actually be fairly valid. Not only is the MKT seen by some as being “unrelentingly grotesque” (to borrow a phrase), but limos are typically the most traditional, conservative vehicles on the road. Though clearly the better vehicle, would a baleeen-grilled crossover impart the same sense of timeless gravitas as a black Town Car? Another limo fleet owner encapsulates the issue with a rhetorical question:

When you say limo, I know what that means now, but will it mean the same thing a year from now? Will I be thinking about the Lincoln or will I be thinking about all kinds of vehicles?

Well, is the MKT up to filling the Town Car’s shoes? Or will limo and livery buyers look to a more traditional replacement (hello, Chrysler 300)? Is the livery car’s conservative image about to be blown wide open, or is it more resilient than that?

Quote Of The Day: I Can Stop Any Time Edition

Bloomberg [via AN [sub]] reports that Chrysler’s fleet sales mix was at 25% in the month of January (according to Edmunds anyway, as Chrysler doesn’t release fleet numbers), the lowest level since a Cash For Clunkers-fueled August 2009. According to the same Edmunds data, however, the industry average fleet mix is just under 20%… and Chrysler’s 2010 average was 38%. But now that Chrysler’s been under 30% fleet for three months, sales boss Fred Diaz figures meeting the industry average is just a matter of time. Specifically:

By the end of the year, we will definitely be at industry average. That’s the goal; that’s our plan.

Considering Chrysler’s fleet sales fell from 56% to the 25%-range over the course of the last year, it sounds like the last few steps of this journey will be the most difficult. Especially when you remember that Chrysler’s also trying to increase volume some 45% this year. That means some 300,000-450,000 more Americans will have to decide to buy Chrysler Group products this year than did last year if the Pentastar wants to achieve both its volume and fleet goals. That’s going to take some serious selling…

What's Right With This Picture? Lincoln MKT Hearse

In the wild, panthers are endangered. In the automotive world, Panthers will go extinct sometime in the third quarter of 2011, when the last Lincoln Town Car Executive L rolls off the line. If you think Panthers get a lot of lovin’ around these here parts, you should attend a convention of folks for whom those LTCELs are tools of the trade. Chances are that if you’ve used a limousine or livery service in the past 20 years, you’ve sat in the back seat of a Lincoln Town Car Executive L. That’s why it was big news at Limousine Charter & Tour magazine’s LCT Leadership Summit a couple of months ago when Ford’s fleet marketing manager, Gerry Koss, announced that replacing the soon to be dearly departed Town Car in Ford’s livery fleet fleet will be livery and stretched limo versions of the Lincoln MKT.

Could GE's EV Mega-Buy Be Bad For Consumers?

The Auto Prophet brings up a point that completely escaped our discussion of General Electric’s EV mega-buy:

By gobbling up EVs, GE certainly helps to jump-start the industry, but they also gobble up future tax credits that consumers would have gotten, unless GE opts to forego the EV tax credit. Which would be bad business.

Yup, GE’s huge EV buy will be good for GE… but it won’t be so great for the 25,000 Americans whose tax credit will slurped up in the process. After all, the credit expires after a manufacturer sells 200k qualifying vehicles, so every credit GE uses brings GM and Nissan that much closer to the day they have to ask consumers to pay full price for their pricey EVs. No wonder GM is already pushing for an extension of the credit past 200k units.

The Top 20 Fleet Queens Of 2009

Fleet sales data can be some of the toughest numbers to find, but thanks to a post from commenter GarbageMotorsCo, we’ve got some pretty comprehensive numbers for last year’s fleet performance [courtesy: automotive-fleet.com, PDF list here]. Overall fleet levels have been higher this year, but by identifying the most popular vehicles with fleet buyers (in terms of fleet sales as a percentage of overall sales), we’ll at least have some hints about this year’s performance. To help give a more accurate picture, we’ve left out obvious commercial vehicles (mainly large vans, and the queen of all fleet queens, the Ford Crown Vic (95% fleet)), as well as discontinued models like Chevy Uplander (57%) and Pontiac G6 (44.7%). We also left out hybrid or CNG versions of nameplates. Two vehicles with limited sales last year (GMC Terrain and Kia Forte) are on the list, even though they may not be on a similar list for 2010 (the Honda Insight is not on the list, despite selling all 193 of its 2009 sales to fleets). Hit the jump for our full list.

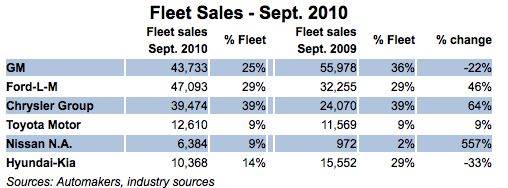

Chrysler Breaks Its Fleet Sales Promise, Tops Industry at 39%

Detroit Dominates Year-To-Date Fleet Sales

Automotive News [sub] takes a stab at calculating the numbers that Detroit doesn’t want you to see. Best of all, AN says the numbers are based on “internal documents.” During this morning’s financial results conference call, Chrysler CEO Sergio Marchionne railed against AN’s “crusade,” implying that the industry paper of record is nursing a vendetta against Chrysler… which is usually a good sign that a media outlet is doing its job well. It’s also a sign that Marchionne knows his firm’s fleet dependence is a problem.

Inside Chrysler's Sales Increase: 40 Percent Fleet Mix And Industry-High Incentives (And Climbing)

To say that Chrysler’s 25 percent year-over-year sales increase last month came as a surprise would be pushing the boundaries of overstatement. Chrysler’s sales and market share have been in decline for a long time, but over the past several years, the tailspin seemed to have become terminal. So, how did the Pentastar (barely) make its 95k minimum volume level and increase sales by 25 percent over April 2009? Fleet sales, for one thing: according to The Freep, TrueCar.com estimates that a full 40 percent of Chrysler’s April sales went to fleet customers.No wonder made a big deal about publicly finding Jesus on the fleet sales issue… at the end of the month (to say nothing of the conspicuous absence of retail sales numbers in its April report and massive increase in Sebring sales). And the bad news doesn’t end there. Not only did Chrysler top all automakers in per-vehicle incentives last month according to Edmunds’ monthly True Cost Of Incentives index with $3,374 on the average Mopar’s hood, they’re actually increasing incentives even further.

GM April Sales Up 6.5 Percent, Core Brands Up 20 Percent

For yet another month, GM’s sales [full April sales report in XLS format here, press release here] managed to be both promising and disappointing, depending on how you cut them. GM’s “core brands” were up 20 percent cumulatively, with Cadillac and Buick leading the way with 35.7 percent and 36.4 percent increases respectively (Chevy up 17.4 percent, GMC up 18.4 percent). And though GM is especially eager to boost sales numbers at its two premium brands, thanks to their low baseline sales, the solid percentage gains resulted in surprisingly small volume improvements. The General’s overall volume was up only 6.5 percent compared to April 2009, a month when the just-canceled Pontiac outsold both Buick and Caddy.

With Fleet Sales Booming,Chrysler Vows To Limit Sales To Rental Firms

Fleet sales were up 47 percent in the first quarter of this year, driving sales at a number of automakers. Ford, in particular, is targeting fleet sales unapologetically by touting a recovery in resale values for the Blue Oval Brand. Ford’s Mark Fields tells the Freep:

We love fleets at Ford…Ford remains focused on our disciplined approach to daily rental, making sure we help keep growing residual values

At Chrysler, which suffers from some of the lowest resale values in the business thanks in part to a longtime addiction to fleet sales, the response seems a bit more… conflicted.

Recent Comments