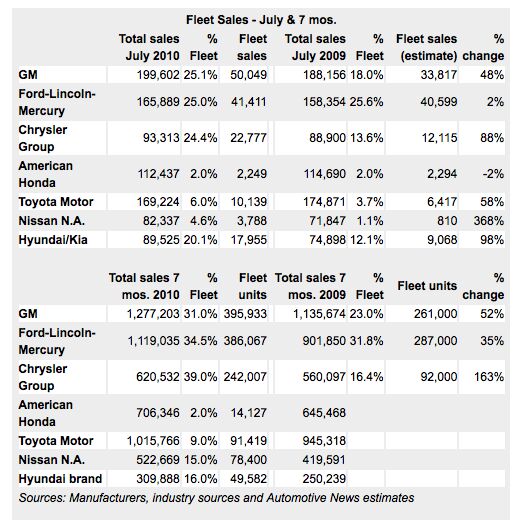

Detroit Dominates Year-To-Date Fleet Sales

Automotive News [sub] takes a stab at calculating the numbers that Detroit doesn’t want you to see. Best of all, AN says the numbers are based on “internal documents.” During this morning’s financial results conference call, Chrysler CEO Sergio Marchionne railed against AN’s “crusade,” implying that the industry paper of record is nursing a vendetta against Chrysler… which is usually a good sign that a media outlet is doing its job well. It’s also a sign that Marchionne knows his firm’s fleet dependence is a problem.

Why is AN going after fleet numbers? Because everyone knows Detroit is using them to help create the perception of a completed turnaround ahead of GM and CHrysler’s IPOs (to say nothing of midterm elections). Or, as AN diplomatically puts it:

Automakers traditionally have not broken out retail and fleet totals in monthly U.S. sales reports. But with growing interest from dealers and analysts, Ford and GM have started detailing basic fleet and retail information.

Count TTAC as part of that “growing interest.” Especially since the drive for greater transparency is clearly making certain executives very defensive. But, as AN points out, the response has not been so uniformly reflexive. After decades of fleet-free sales numbers ruling in Detroit, Ford and GM are breaking ranks to help prove that their addictions aren’t of the terminal variety.

George Pipas, Ford’s chief sales analyst, said the automaker cut its July fleet percentage to 25 percent by slashing daily rental fleet volume.

He said Ford is emphasizing commercial and government fleet sales — generally considered more profitable than sales to daily rental fleets. Sales to daily rental fleets are less than half of Ford’s fleet total this year.

By comparison, more than two-thirds of Chrysler and GM fleet volume goes to daily rental fleets.

And though not every manufacturer is getting on board with fleet-sales breakouts, nearly all of them agree that the second half of 2010 will see fewer fleet sales.

Manufacturers expect the pace of fleet sales to slow in the second half. Ford, Chrysler and GM say fleet will be a smaller part of their sales mix by year end. Pipas expects fleet volume to be about 30 percent of Ford’s sales for the full year. Henderson said GM’s full year fleet mix will be 25 to 26 percent, similar to 2009’s 25 percent.

Chrysler spokesman Ralph Kisiel said, “For the full year, fleet sales will be roughly 25 percent of our total sales.”

With Chrysler running at 40 percent fleet, it will have to cut back significantly to make a 25 percent fleet mix by year-end. If Chrysler’s sales start dropping off, we’ll know why. Meanwhile, the fact that consumers don’t seem to even be considering Chrysler paints a troubling picture ahead of its new product flood in the second half of the year.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Ivor Honda with Toyota engine and powertrain would be the perfect choice..we need to dump the turbos n cut. 😀

- Oberkanone Nissan Titan....RIP

- Jonathan It's sad to see all these automakers trying to make an unnecessary rush to go all out electric. EVs should be a niche vehicle. Each automaker can make one or two in limited numbers but that should be it. The technology and infrastructure simply aren't there yet, nor is the demand. I think many of the countries (including the U.S.) that are currently on the electric band wagon will eventually see the light and quietly drop their goal of making everyone go all electric. It's simply not necessary or feasible.

- TCowner No - won't change my opinion or purchase plans whatsoever. A Hybrid, yes, an EV, No. And for those saying sure as a 2nd car, what if your needs change and you need to use it for long distance (i.e. hand down to a kid as a car for college - where you definitely won't be able to charge it easily)?

- Ravenuer I see lots of Nissans where I live, Long Island, NY. Mostly suvs.

Comments

Join the conversation

Excellent post (and great research by Automotive News). I did the math this morning, and it's nearly mathematically impossible for Chrysler to get its fleet sales down to 25%, assuming that their overall 11% sales gain YTD holds true throughout 2010. Here's the link (in the beginning I linked back to TTAC, of course): http://www.autosavant.com/2010/08/10/chrysler-gm-and-ford-dominate-ytd-fleet-sales/

I’ve at least got a choice when I do business rentals, and it’s Toyota. Fleet business can still make a lot of money for a company. car insurance quote