Carlos Ghosn: The Yen Is Abnormal, And We Won't Live Much Longer With That Deviant

When we went on the plane this morning for the some 600 mile trip to see a Nissan plant in Kyushu, the southernmost of the four main Japanese islands, we asked ourselves: Why?

After all, the plant had been there since 1975. What’s new? We soon should find out: Nissan CEO Carlos Ghosn went on a full frontal attack against the high yen, threatened several times that Nissan and most of the Japanese industry would pack up and leave, and delivered an ultimatum: “If six months down the road we are still in this situation, then this will provoke a rethinking of our industrial strategy.”

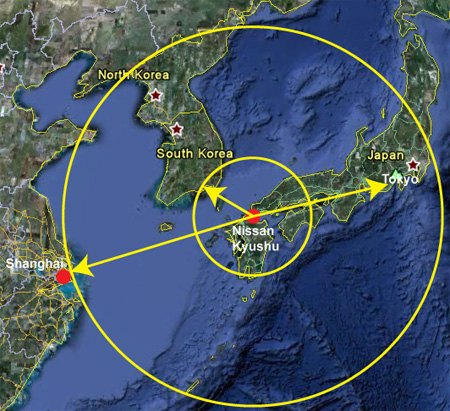

The Kyushu plant was the perfect venue: It sits halfway between Yokohama and Shanghai. South Korea, the land of the cheap Won, is some 150 miles across the water.

The Nissan plant struts into the water like a huge ship that is ready to sail. Nearly half of Nissan’s Japanese production rolls off the lines in the Kyushu plant, and the lion’s share rolls right into huge car carriers, docked at Nissan’s private deep-water port. 57.4 percent sailed across the Pacific last year , and on to North America.

Soon, this port will see incoming traffic: As a first step to ward off high yen denominated costs, Nissan will increasingly import parts and components from South Korea and China.

Carlos Ghosn tried his best to make this choice palatable for local dignitaries and a sometimes fiercely nationalistic press:

“Importing from China does not automatically mean that we stop buying from our Japanese suppliers. Many Japanese companies have plants in China. What is better than Japanese supplier? It is Japanese suppliers with the benefit of competitive production.”

A few sentences later, it was no longer that clear-cut:

“We will also use our Japanese suppliers in China – or Chinese suppliers, and we will use Japanese or Korean suppliers from South Korea.”

In this case, the high yen makes the imported parts cheaper. But cheaper parts are not enough to withstand the “strong headwinds” that Ghosn mentions again and again as he winds up to the real topic of the day: the obscenely high yen.

“This exchange rate is abnormal.”

Ghosn says this again and again, as if we aren’t talking about foreign exchange, but something that belongs on a list of sex offenders.

“Two months ago, we were fighting the yen at 90, and we were asking for a more reasonable rate. Instead of the rate becoming more reasonable, then yen went to 85 against the dollar, and then 80, and now 77. Common sense tells us what we are seeing today is abnormal.”

After saying several times that the rate is deviant, Ghosn signals what will happen if the currency won’t go where it belongs: In the past, he had committed that a million cars will be built in Japan. That is less than a quarter of what Nissan makes worldwide. But even that will change if the Yen won’t get cheaper:

“This exchange rate is abnormal. If I thought that the exchange rate would remain the way it is today, there would be a lot of decisions made at Nissan today that would be unfavorable to locating car production in Japan. I don’t think this is sustainable for the economy, I don’t think it is sustainable for Japan, I don’t think it is sustainable for the industry. I know how much we are struggling, and how much our competition is struggling, and I don’t think it is going to last. The only question is how long the pain is going to be endured. We are still in the mood of saying that it is going to correct. We are making investment decisions based on faith. But if the exchange rate will remain at this level for a very long time, a lot of decisions will be reversed. We stick with one million cars in Japan because we believe in common sense and we believe that at the end of the day nothing abnormal will remain abnormal, and long-term trends will prevail.”

Ghosn wants to see this change fast:

“Given the choice, we stay in Japan, This is our home, this is our base. If we go, then because we are forced out. If in six months down the road we are still in this situation, then this will provoke a rethinking of our industrial strategy. Personally, I don’t think this will be the case – but I may be wrong.”

Toyota finds itself in a much more precarious situation. Toyota makes nearly half of its global production in Japan, and committed to 3 million units made at home. Spokespeople at Toyota had no fresh comments and referred to past statements by their executives.

At the August 2 financial results press conference in Tokyo, TMC’s Senior Managing Officer Takahiko Ijichi said that 76 yen is extremely difficult and might exceed the limit for domestic production. He had mentioned the importation of parts, but was wary of the quality of the product Toyota gets from suppliers. At the May 11 full year financial results conference, TMC’s CFO Ozawa said that Toyota could break even with 6.6 million units at 85 yen to the dollar.

Today, a dollar bought 76.5 yen, far away from what Toyota needs to make a profit, and far away from what Ghosn thinks is normal. Let’s pray it will change soon.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lorenzo People don't want EVs, they want inexpensive vehicles. EVs are not that. To paraphrase the philosopher Yogi Berra: If people don't wanna buy 'em, how you gonna stop 'em?

- Ras815 Ok, you weren't kidding. That rear pillar window trick is freakin' awesome. Even in 2024.

- Probert Captions, pleeeeeeze.

- ToolGuy Companies that don't have plans in place for significant EV capacity by this timeframe (2028) are going to be left behind.

- Tassos Isn't this just a Golf Wagon with better styling and interior?I still cannot get used to the fact how worthless the $ has become compared to even 8 years ago, when I was able to buy far superior and more powerful cars than this little POS for.... 1/3rd less, both from a dealer, as good as new, and with free warranties. Oh, and they were not 15 year olds like this geezer, but 8 and 9 year olds instead.

Comments

Join the conversation

You are right. Toyota's problem with the strong yen are four fold compared to Nissan. Toyota produces four times as many cars in Japan. In 2010, Toyota made 4.04 Million cars in Japan, nearly 50% of the global total, 8.55 Million Units. Lets not forget that the Yen has appreciated a lot against the Euro and GB pound as well. So exports to NA are not the only ones losing money. For every one yen rise against the dollar, Toyota loses 30 Billion Yen($400 Million) a year in operating income. The yen has gone up from 83 in Jan to 76.35 now. That's more than $2.5 Billion wiped off their books. At today's rates, I doubt if Toyota can export anything profitably to the United States, except for a few Lexus models. The losses should be catastrophic especially for low margin cars like the Yaris, Corolla, Prius, Camry, ES and IS. The Japanese Govt. efforts to devalue the Yen have fallen short. The last round of devaluing was effective only for a couple of days. With the Swiss, the only other safe haven currency after Japan, deciding to peg their Franc to the Euro, we can all expect the yen to rise further - some are predicting 70 Yen to the Dollar before the end of this year. Toyota can neither raise prices nor cut content to make up for the losses, in this market where the competition has never been this good. Toyota no longer competes only with Honda in the US market.

I lived there at 76 y back in the 90s. I know what it feels like to visit America from a country with weak currency.