GM Goosing Stock By Overstocking Dealers With Trucks?

It has been around the net since yesterday that “trucks are piling up on auto lots” and that this could spell “trouble for GM.”

Bloomberg reports that GM did bet on a strong recovery and built more trucks to fill the imaginary demand. “The strategy is backfiring.”

The National Legal and Policy Center has more sinister suspicions. It states that “it looks like General Motors is up to its old tricks as it stuffs inventory channels with higher profit trucks.” The center is accusing GM and the Obama administration of “fudging earnings.”

All this was caused by a research note written by H. Peter Nesvold of Jefferies, a securities and investment group that just bought Prudential Bache.

Instead of regurgitating news pre-eaten by everybody from Bloomberg to Barrons, we wanted to wait until we get our hands on the original research note itself. The biass crowd is a rabid bunch, and we did not want to get caught copying mistakes.

You won’t be able to google the research note, but one of my high net worth friends is on Nesvold’s email list. My friend graciously forwarded the original report to me.

What worries Nesvold is this:

“GM’s pickup inventory continues to build (it now stands at 122 days vs Ford at about 80 days).”

Nesvold pretty much suggests that GM should stop making trucks for the year, as it has plenty standing around on dealer’s lots:

“We remain cautious about GM’s ability to continue producing GMT900 pickups given that inventory moved up marginally to 122 days. As described in more detail below, GM on the call unexpectedly announced that it would maintain pick-up truck inventories in the 100-110 day range through year end. While management offered reasons, we still struggle to understand the rationale. GM expects seasonality and a stronger second half to help bring inventories down, and reiterated its intent to clear the inventory by adjusting production if necessary.”

And why the huge inventories? They count as sold. Nesvold comes pretty close to calling stock manipulation:

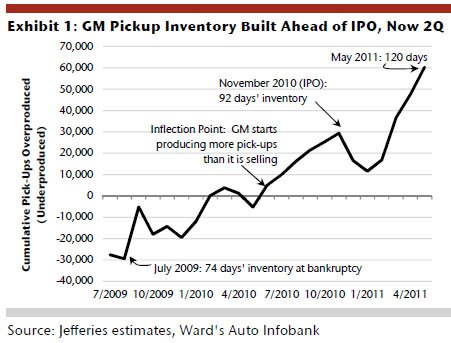

“Perhaps the most significant takeaway is the different pickup-truck inventory strategies being pursued by GM and F. Ford F-series inventories are around 79 days, while GM’s Silverado and Sierra inventories are about 122 days. Exhibit 1 shows the cumulative difference between GMT 900 pickup production and sales, which should over time roughly match. There was a clear build in front of the IPO, and now again in front of 2Q.”

What is so important about 2Q? The US Treasury is on record that they would not lighten-up on GM stock before second quarter earnings are reported. The earnings have to be high to drive the stock price up. Nesvold seems to indicate that the stock is being pumped before dumped by the Department of the Treasury.

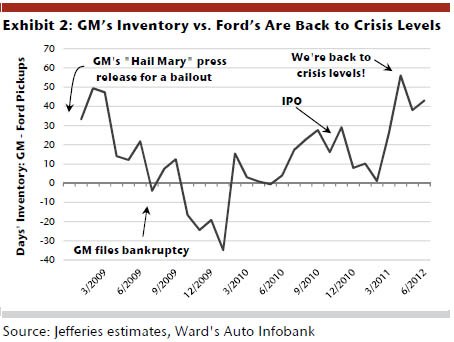

The exhibit 2 that accompanies the report has graphic content. Don’t view on an empty stomach if you hold GM stock.

“GM’s inventory is some 40 days higher than what Ford, which has a similar product mix, is carrying as shown in Exhibit 2. On the call GM said it was looking to exit the year at 100-110 days, which is 20-30 days more inventory than the 78 days it averaged at yearend between 2002 and 2010. Management said that it structurally needs to carry more inventories going forward because it had consolidated six plants to three. We can understand around the edges why that should result in higher inventories, plus the fact that the days’ inventory looks high due to cyclically low-end sales. But we respectfully aren’t convinced that triple-digit inventories should be the new normal. Just factoring in seasonally high sales and seasonally lower production in 2H vs. 1H, inventories should be down 15+ days. That GM intends to continue producing at elevated levels remains confusing. The net impact to the financials is that the company is pulling forward 2012 earnings into 2011. It respectfully begs the question, is GM falling into old bad habits?”

Nesvold has a BUY rating on Ford and a HOLD rating on GM. In the world of analysts, a HOLD is usually understood as “sell before everybody else does.” Such as the 900 lbs gorilla in Washington, DC.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts Poorly packaged, oddly proportioned small CUV with an unrefined hybrid powertrain and a luxury-market price? Who wouldn't want it?

- MaintenanceCosts Who knows whether it rides or handles acceptably or whether it chews up a set of tires in 5000 miles, but we definitely know it has a "mature stance."Sounds like JUST the kind of previous owner you'd want…

- 28-Cars-Later Nissan will be very fortunate to not be in the Japanese equivalent of Chapter 11 reorganization over the next 36 months, "getting rolling" is a luxury (also, I see what you did there).

- MaintenanceCosts RAM! RAM! RAM! ...... the child in the crosswalk that you can't see over the hood of this factory-lifted beast.

- 3-On-The-Tree Yes all the Older Land Cruiser’s and samurai’s have gone up here as well. I’ve taken both vehicle ps on some pretty rough roads exploring old mine shafts etc. I bought mine right before I deployed back in 08 and got it for $4000 and also bought another that is non running for parts, got a complete engine, drive train. The mice love it unfortunately.

Comments

Join the conversation

NO comment from the esteemed Aaron Bragman OR Rebecca Linland ( insert mooing bovine sound here) for IHS Global Insight? The horror, the horror!

Hopefully GM is goosing it's stock in Intermediate steering shafts to go with their trucks.