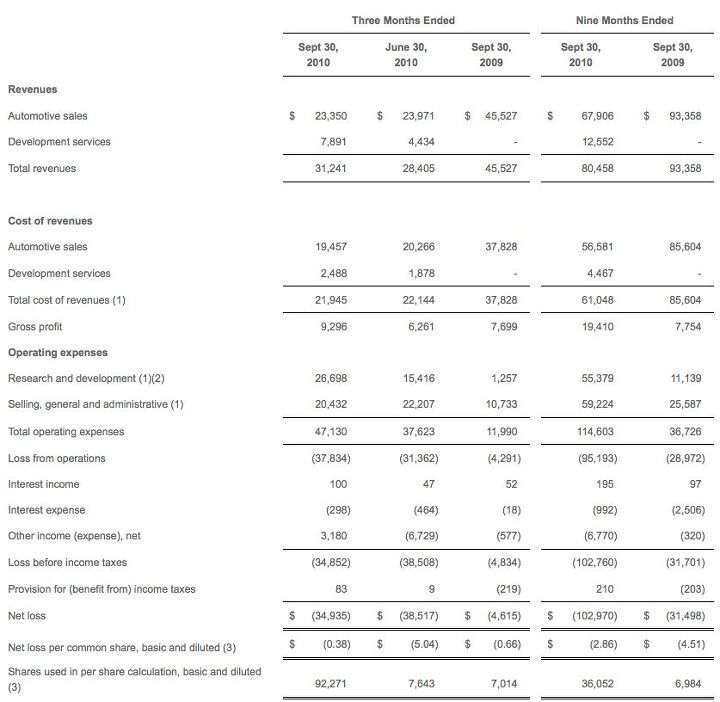

Tesla Lost $34.9m In Q3, Dropped $103m Year-To-Date

California EV maker Tesla has reported its Q3 results, and they’re a sizable helping of not great. But before we dive into the messy reality, let’s check in with CEO Elon Musk for an unreasonably rosy take on the loss:

We are very pleased to report steady top-line growth and significant growth in gross margin, driven by the continued improvement in Roadster orders and our growing powertrain business. Roadster orders in this quarter hit a new high since the third quarter of 2008, having increased over 15% from last quarter. While some of this is due to seasonal effects associated with selling a convertible during the summer months, we are pleased with the global expansion of the Roadster business and the continued validation of Tesla’s technology leadership position evidenced by our new and expanding strategic relationships

Translation: Toyota is investing in us… now get out of here with your awkward questions. Unfortunately for Mr Musk, it isn’t quite that simple…

What Musk leaves out is, well, there’s a lot he leaves out. For one thing, Tesla managed to lose only $4.6m in Q3 of 2009, so these latest results are a disaster when compared year-over-year. And the picture is even worse for year-to-date results: Tesla has lost $103m so far this year, over three times the $31.5m loss accrued in the first three quarters of last year. And even using Musk’s generous comparison to Q2 2010, Tesla’s operating loss actually widened (on massively increasing operating expenses), and was offset only by an increase in “other income.” And no surprise: automotive sales revenue was nearly half its Q3 2009 level.

UPDATE: Elon Musk tells the San Jose Mercury News that

attaining quarterly profitability isn’t a goal… We’re very focused on long-term profitability.

So… mission accomplished. Except that making profit on a blue-sky luxury electric sedan is typically a long-term (to say nothing of expensive) proposition. And the Model S won’t be the only green luxury game in town come 2012. But then, that kind of negative thinking has a history of not bothering Musk. If and when it starts affecting Tesla’s stockholders, things could get ugly.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 3SpeedAutomatic I'd like to see a sedan:[list][*]boxy in shape, avoid the windshield at a 65º angle BS[/*][*]tall greenhouse, plenty of headroom to sit straight up in the back seat[/*][*]V8, true dual exhaust, sans turbo, gobs of torque[/*][*]rear wheel drive, fully independent suspension, accommodate a stretched wheel base (livery service would go nuts)[/*][*]distinctive, tasteful colors (black, navy blue, claret, etc.)[/*][*]more substance, less flash on dashboard[/*][*]limited 5 yr run, get it while you can before the EPA shuts you down[/*][/list]

- Bd2 Mark my words : Lexus Deathwatch Part 1, the T24 From Hell!

- Michael S6 Cadillac is beyond fixing because of lack of investment and uncompetitive products. The division and GM are essentially held afloat by mega size SUV (and pick up truck GM) that only domestic brainwashed population buys. Cadillac only hope was to leapfrog the competition in the luxury EV market but that turned out disastrously with the botches role out of the Lyriq which is now dead on arrival.

- BlackEldo I'm not sure the entire brand can be fixed, but maybe they should start with the C pillar on the CT5...

- Bd2 To sum up my comments and follow-up comments here backed by some data, perhaps Cadillac should look to the Genesis formula in order to secure a more competitive position in the market. Indeed, by using bespoke Rwd chassis, powertrains and interiors Genesis is selling neck and neck with Lexus while ATPs are 15 to 35% higher depending on the segment you are looking at. While Lexus can't sell Rwd sedans, Genesis is outpacing them 2.2 to 1. Genesis is an industry world changing success story, frankly Cadillac would be insane to not replicate it for themselves.

Comments

Join the conversation

Their operating profits increased, which is a good thing. Their financial situation improved compared to 2009. They had a 34M loss because their Research and Development costs increased by 20 folds. Please compare apples with apples. Maybe they could make a profit from this research.