Quote Of The Day: A Sucker Born Every Minute Edition

Does Tesla’s S-1 SEC filing leave you worried about the state of EV startups? The great thing about the seamy underbelly of the EV industry is that there’s always a shadier prospect out there to make even marginal cases like Tesla look good. Our perennial favorite in the EV vapor game is ZAP, the erstwhile maker of the Xebra EV (interestingly, the Xebra still shows up on ZAP’s webpage). Zap’s latest play in its never-ending quest for press-release fodder: a tie-up with (get this) a South Korean optics company, best known for its camera lenses and closed circuit TV security systems. Because sometimes you have to cross an ocean to find a sucker big enough to say things like:

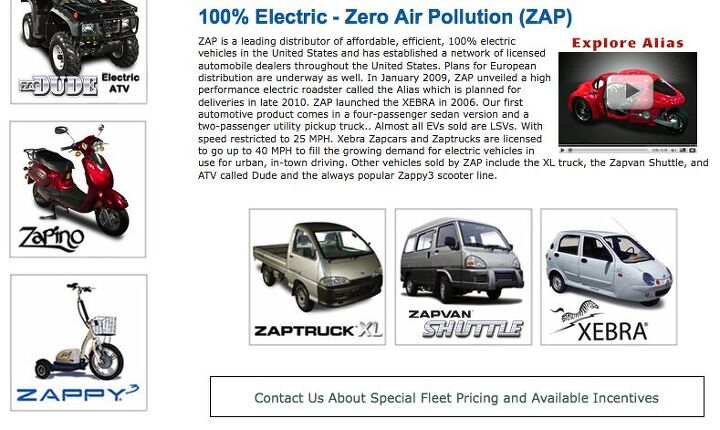

Samyang decided to partner with ZAP because of its extensive industry knowledge in electric vehicle production and the breadth and maturity of its current line of electric vehicles

Oh dear.

According to ZAP’s latest 8-K filing:

ZAP and Samyang entered into an Investment Agreement pursuant to which Samyang agreed to invest $3 million in convertible notes of ZAP (the “Samyang Investment”) and ZAP agreed to invest $2 million in convertible bonds of Samyang (the “ZAP Investment”).

A previous filing reveals that ZAP:

entered into a distribution agreement with Samyang Optics Co. Ltd of South Korea for the exclusive rights to manufacture, assemble and market ZAP’s complete line of electric trucks, vans, motorcycles, scooters and ATVs in Korea.

This partnership is part of Samyang’s broader strategic plan to enhance its core business with a new thrust into cleantech, focusing on Korea’s increasing market opportunities in electric vehicles. The agreement establishes Samyang as ZAP’s exclusive distributor and assembly partner, leading to potentially manufacturing its electric vehicles in Korea. The distribution agreement commits Samyang to set up manufacturing facilities and distribution hubs in Korea with annual procurement quotas. The electric vehicle bodies will be produced by ZAP’s recently announced manufacturing partner, Zhejiang Jonway Automobile Co. Ltd, and uses the electric power train technology and engineering designed by ZAP and produced by ZAP Hangzhou, the joint venture between ZAP, Holley Group and Better World International.Other recent SEC disclosures include the departure of ZAP’s auditors, a Chinese joint venture, and a damning 10-Q that shows a $2.9m operating loss in the first three quarters of 2009, $6m+ in new stock issuance cash flow and cash on hand of just $5.3m. All of a sudden, Tesla looks like a solid investment by comparison.More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- UnoGeeks Great information. Unogeeks is the top SAP ABAP Training Institute, which provides the best SAP ABAP Training

- ToolGuy This thing here is interesting.For example, I can select "Historical" and "EV stock" and "Cars" and "USA" and see how many BEVs and PHEVs were on U.S. roads from 2010 to 2023."EV stock share" is also interesting. Or perhaps you prefer "EV sales share".If you are in the U.S., whatever you do, do not select "World" in the 'Region' dropdown. It might blow your small insular mind. 😉

- ToolGuy This podcast was pretty interesting. I listened to it this morning, and now I am commenting. Listened to the podcast, now commenting on the podcast. See how this works? LOL.

- VoGhost If you want this to succeed, enlarge the battery and make the vehicle in Spartanburg so you buyers get the $7,500 discount.

- Jeff Look at the the 65 and 66 Pontiacs some of the most beautiful and well made Pontiacs. 66 Olds Toronado and 67 Cadillac Eldorado were beautiful as well. Mercury had some really nice looking cars during the 60s as well. The 69 thru 72 Grand Prix were nice along with the first generation of Monte Carlo 70 thru 72. Midsize GM cars were nice as well.The 69s were still good but the cheapening started in 68. Even the 70s GMs were good but fit and finish took a dive especially the interiors with more plastics and more shared interiors.

Comments

Join the conversation

I'm not down on Tesla; they've sold 1000 real cars so far, an accomplishment no automotive startup has done in decades. I'm not convinced their future is any shakier than GM's. As for ZAP and other pretenders - forget it. Lesson 1 is that you can't sell 3-wheeled cars to US consumers, or cars with outrigger wheels like Aptera's.

I love this photo. http://www.flickr.com/photos/8492055@N08/4305669761/