#subprime

Subprime Car Buyers Haven't Defaulted This Much Since '96

Grunge was on its way out the door, Pepsi aficionado Bob Dole was challenging William Jefferson Clinton for the keys to the White House, and the Ford Contour was still a relatively new sight on American roads.

That was the last time this many U.S. car owners fell way, way behind on their subprime auto loans.

Vanishing Act? Fewer Subprime Customers Shopping for Cars

It’ll be another 24 hours before the nation’s automakers release March sales figures, all thanks to the Easter long weekend. Shaking off the effects of a chocolate bunny induced sugar high takes a day or two, after all.

This means, at most dealers, last month’s subvented rates still apply — so, if you’re looking at snagging a 2017 model, it might not be a bad idea to lock the deal down today. Shoppers of MY2018 machines can relax, as the deals on those rides will likely be better tomorrow morning … especially if it’s a vehicle that was majorly reworked for 2019.

Until then, we have time to peruse a story from Bloomberg, one which pontificates on the sudden evaporation of subprime new car buyers from showrooms in the month of March.

Evaporation? I thought there was a glut of them! Let’s dig into the report.

Bark's Bites: Subprime Lending Is Even More Bizarre Than You Imagined

“We’re dirty, yeah, but so are the dealers. We’re all dirty in this business.”

The petite, honest-faced young lady sitting across from me at my lunch table doesn’t look like a predator. To be fair, she isn’t. She just works for a company that’s one of the biggest subprime lenders in the country, with offices in several states. By the time a dealer calls them for a loan, they’ve already tried every traditional bank and credit union in their Rolodex.

And in exchange for a delicious burrito, she agreed to meet with me and pull back the kimono on the subprime auto lending business in the United States, a business which many in the financial sector believe to be the next big bubble.

I have a lot of questions, and she’s more than willing to answer them. I ask what sorts of credit scores they’ll approve.

“We can pretty much approve any credit score. I just approved a 413 beacon score the other day. Of course, it was a 25 percent loan. Credit is really just one piece of the puzzle,” Elizabeth* (not her real name) explains to me. “Sure, we pull TransUnion and Equifax, but we’re also looking at their obligations versus their verifiable income. Medical bills don’t count. It’s just rent plus whatever else is on their credit report.”

“Sure,” I say. “That makes sense.”

“Of course,” she continues between small bites of burrito, “if they’ve just stopped paying a bill, something other than another car loan, we don’t count that bill as part of their monthly obligations. Nobody pays student loans. They’ll have like five or six loans and won’t have paid a damn dime in months. So we don’t worry about those.”

Hang on. It gets weirder. And better.

Wells Fargo Places Cap On Subprime Loans

Wells Fargo will rein in its subprime lending business, limiting subprime car loans to 10 percent of auto loans it originates. According to the New York Times, the move comes amid concerns that the market for subprime car loans is expanding too quickly.

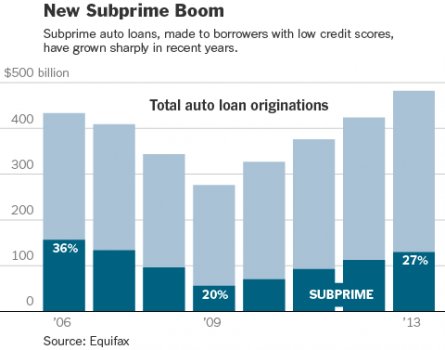

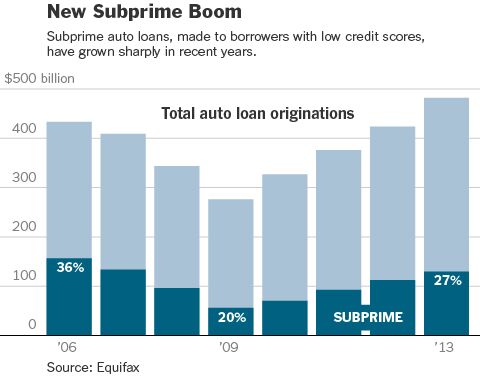

Subprime Auto Loans Climb to Highest Level Since Financial Crisis

Alan Zibel and Annamaria Andriotis of the Wall Street Journal (subscription required) report that consumer loans to borrowers with bad credit, including those for cars and light trucks, are now approaching 40% of loans issued, the highest percentage since the start of the financial crisis in 2007-08.

Almost four of every 10 loans for autos, credit cards and personal borrowing in the U.S. went to subprime customers during the first 11 months of 2014, according to data compiled for The Wall Street Journal by credit-reporting firm Equifax.

That amounted to more than 50 million consumer loans and cards totaling more than $189 billion, the highest levels since 2007, when subprime loans represented 41% of consumer lending outside of home mortgages. Equifax defines subprime borrowers as those with a credit score below 640 on a scale that tops out at 850.

Repossessions, Delinquencies Up As Oustanding Auto Loan Balances Hit All-Time High

The latest Q2 2014 data from Experian was released this week, and key metrics like repossessions, loan delinquencies and outstanding balances have all seen increases.

Honda's Sales Chief Warns Of "Stupid Things" As Accord, CR-V Top Retail Sales Charts

In this year’s red hot new car market, the Honda Accord and CR-V have apparently captured the top spot in both new car and SUV retail sales through the first half of 2014, according to Polk registration data. But John Mendel, Honda’s head of sales, had some pointed words for the industry as a whole, and the state of the American auto market.

Santander Consumer Receives DOJ Subpoena

Following GM Financial’s subpoena from the Department of Justice, Santander Consumer said that it had received a subpoena as well related to

“production of documents and communications that, among other things relate to the underwriting and securitization of nonprime auto loans since 2007,”

A Contrarian View Of Subprime Auto Loans

The topic of subprime auto loans has been a hotly contested one at TTAC, with numerous commenters defending both the practice and the stability of recent run-up in subprime lending.

Outstanding Subprime Loan Balances Hit 8-Year Highs

Buried in a feel good story about auto loans comes the news that subprime auto loans are at levels that we haven’t seen in nearly a decade.

The New York Times Shines A Light On Subprime

The issue of subprime car loans, specifically loans with exorbitant interest rates for used cars, has filtered into the New York Times, with the paper’s Dealbook section running an investigation into the practice.

OCC Warns Of Auto Lending Risk

The Office of the Comptroller of the Currency, a government entity that regulates and supervises banks, is sounding the alarm regarding risks related to auto loans.

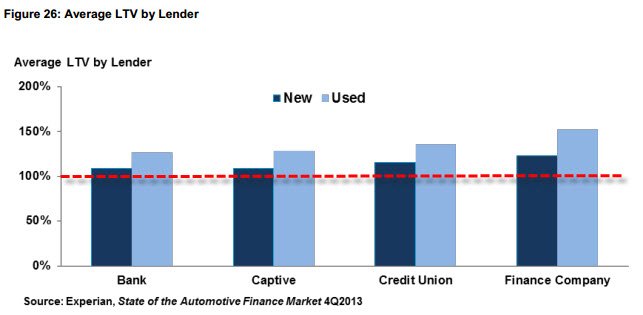

Captives Dominating Auto Financing As Banks Resort To Risky Loans

OEM captive financing arms are increasing their share of new car loans, with banks resorting to underwriting riskier loans in the used car market and to less credit-worthy buyers.

Moody's: Underwriting Standards, Borrower Credit Declining

The global outlook for Auto Back Securities (ABS) is steady – except in North America, where underwriting standards and borrower credit are slipping.

No Credit Score? Show Your Cable Bill, Get Approved

New technology is allowing buyers with no credit score – due to a lack of credit history or a personal bankruptcy – to get vehicle financing via examination of documents like the payment history of their cable or cell phone bill.

Recent Comments