OCC Warns Of Auto Lending Risk

The Office of the Comptroller of the Currency, a government entity that regulates and supervises banks, is sounding the alarm regarding risks related to auto loans.

In its semi-annual report released earlier this week, the OCC warned about the usual factors that TTAC has been discussing for some time: rising loan terms, an increased focus on monthly payments and deteriorating underwriting standards

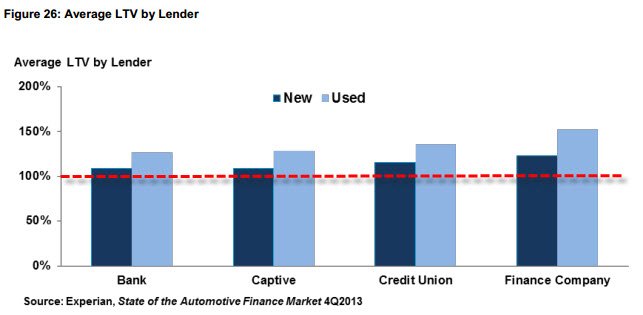

Across the industry, auto lenders are pursuing growth by lengthening terms, increasing advance rates,

The average loss per vehicle has risen substantially in the past two years, an indication of how longer

The OCC report did not single out subprime loans specifically, but instead focused on the entire auto loan sector. The full report is available here.

More by Derek Kreindler

Comments

Join the conversation

There is no point in an auto credit risk warning. If subprime lenders will make a deal with credit risks, that is their problem. But, no bailout by Government.

The cost of cars is rising much much faster than the median wage. C4C took a lot of good running, paid-off cars off the road and exchanged them for a new debt cycle. The used car market has been artifically inflated ever since. I'm starting to feel like this isn't predatory lending... it's an industry doing what it takes to survive, and a populace doing what it takes to get "new and shiny."

To some extent, longer terms are probably justifiable, as cars are almost certainly lasting longer and have higher resale values down the road. The resale value trend may change, of course, and then the lenders are screwed.

This is curious to me because of the hard depreciation cars usually take in the first year, not to mention the several years during the loan. If you are financing a fast depreciating item, it stands to reason that lenders will almost always be lending more than the asset is worth except in cases with heafty down payments. Is book value a measure of the average value of the asset during the loan, value at inception, value at end of loan term? As others have mentioned, it seems to me that this is a relatively good business to be in due to the low default rate. What is more troubling is people agreeing to terms they will struggle to afford and make no sense such as a 10 year loan. Financing on new cars is at such incredibly great rates, if i didnt have good credit, I think I would just buy a cheap ride with cash. Its hard to believe that people are paying a bunch of interest when 0% financing is available on plenty of cars.