#saab

Our Daily Saab: With Plans Expired And Dealers Waiting On Cash, GM Takes The Wheel

Saab’s Memorandum of Understanding with PangDa and Youngman expired today, returning Saab to what must by now be a rather comforting, familiar state of limbo. Of course, the MoU in question was already dead, as GM had publicly nixed it, saying it wouldn’t supply parts or license technology to a 100% Chinese-owned Saab. But now, without an official agreement to rally around, Swedish Automobile, PangDa and Youngman are desperately pitching new ownership structures to GM in hopes of approval. Swedish Auto’s Victor Muller tells the WSJ [sub]

We are submitting an information package to GM and we will have to await the feedback that GM has on that package and then we’ll know.

Muller says the lesson of the failed MoU is that GM won’t accept Chinese control, and as a result the new proposed ownership structure is “very carefully crafted” so that none of the three partners has complete control. But since the previous deal, in which PangDa and Youngman would split a 54% stake in Saab, is also off the table, it’s tough to say what Muller’s “carefully crafted structure” entails. And while Saab and its Chinese suitors wait for GM approval that may never come (but don’t tell Keith Crain [sub] that!), it seems both time and money are getting tight. Again. Still.

Our Daily Saab: SWAN Examines The Endgame Options

With Saab’s latest MOU with PangDa and Youngman expiring on Tuesday, the heat is on for parent company Swedish Automobile (SWAN) to hash out the many problems and disagreements between GM and the proposed Chinese buyers. And now that it’s fairly obvious that a deal won’t happen, as GM and the Chinese Government seem fairly well set against it, the question is “what next?” How do you plan an endgame that should have been initiated months, if not years ago? That’s the challenge being considered by the few remaining shareholders in SWAN, who are meeting in Holland to pick through the none-too appealing options.

Our Daily Saab: TTAC On Swedish Radio

Lyssna: Kinesiskt ja kan tvinga fram ett godkännande

“We will try to get clarity about what the decision from GM means and if there is any way ahead,” court-appointed administrator Guy Lofalk told Reuters. “I hope that I will know more before the end of the week.”

For the time being, Lofalk will not recommend to the court to end the bankruptcy protection process. He said it could happen though.

On Monday, GM said they would yank all licenses and oppose the deal if Saab would be sold 100 percent to China’s Pangda and Youngman.

Both Victor Muller and his mouthpiece Saabsunited now say they knew that all along.

We are in rare agreement on that. Last Friday, Sweden’s national publicly funded radio broadcaster Sverigesradio reached me and asked what I think of the deal.

Or Daily Saab: A Wale Of A Botched Sale

GM’s China chief Kevin Wale poured a huge bucket of ice-cold water over hopes that China’s Pangda and Youngman will rescue Saab. The deal needs to be approved by the Chinese government, the European Investment Bank, the Swedish government and – GM.

Wale told Reuters today:

GM Issues Death Sentence To Saab Deal With China

While the flagwavers at Saabsunited wallow in the good news that the Swedish king announced at an annual moose hunt near Trollhättan that Victor Muller is a great guy, far away in Detroit, GM spokesman Jim Cain issued to Reuters what sounds like the death sentence to the sale of Saab to China’s Youngman and Pangda:

“GM would not be able to support a change in the ownership of Saab which could negatively impact GM’s existing relationships in China or otherwise adversely affect GM’s interests worldwide.”

The exactly same statement was sent to the Wall Street Journal, and GM will send it to anyone who asks what GM thinks of the deal. If Muller would have asked before announcing the sale, he most likely would have received the same answer.

Translation:

Our Daily Saab: Dark Clouds Gather Around Saab's White Knight

Pangda, one of Saab’s presumptive white knights, could itself be facing financial difficulties. Both the staid government-owned China Daily and the more outspoken Taiwan-based China Times report strange financial going-ons at PangDa. Says China Times:

“Shareholders and securities analysts are scratching their heads over how a top automobile marketing group in China managed to “burn” a huge fund of 6 billion yuan (US$944 million) in just six months. Many have speculated that Pang Da Automobile Trade Co has shifted to financial leasing services to cope with stalling car sales caused by the government’s credit-tightening regulations.”

According to China Daily, $659 million had been “used to repay bank loans and supplement working capital.” China Times reports a lot of the money as lost and says:

What's Wrong With This Picture: The 9-3 That May Never Be Edition

According to svd.se, this is an image of the next-generation Saab 9-3, as revealed in a presentation to Sweden’s National Debt Office. Based on a new Phoenix platform that is supposedly under development (although with what money is unclear… new platforms typically cost around a billion dollars to develop), the new 9-3 will be the first Saab developed by the brand since gaining independence from GM. If, in fact, the company survives long enough to bring it to market in the 2013-2014 projected timeframe. And, based on all the news we’ve seen, the chances of Saab surviving, let alone developing a new car on a new platform, are extremely slim. But if you’re still holding out hope for The Industry’s Most Troubled Brand ®, this might inspire some more wholly unjustified optimism… as might the leaked image of Saab’s future product “plans.” Just don’t come crying to us when this all falls apart again in mid-November…

Our Daily Saab: Saab Lives Another Day, Waits For Chinese Money

Today, Saab creditors met in a packed-beyond capacity courtroom on Vänersborg. After a short deliberation, the district court approved the reorganization plan, Göteborg’s Posten reports. It will cost 500 jobs in Trollhättan. On Friday, China’s Youngman and Pangda had agreed to take over Saab 100 percent – in a Memorandum of Understanding, which isn’t worth much, and which is littered with caveats.

The reorganization plan, ( full text here), was feted in a lengthy press release. It starts like this:

Our Daily Saab: Saab "Saved" As 100% Chinese Firm… Pending Those Pesky Approvals

On the last possible day to work out a deal before being forced into bankruptcy, the Victor Muller era has ended at Saab. The Swedish brand will now become a completely Chinese-owned company… if all goes to plan. A press release explains

Swedish Automobile N.V. (Swan) announces that it entered into a memorandum of understanding with Pang Da and Youngman for the sale and purchase of 100% of the shares of Saab Automobile AB (Saab Automobile) and Saab Great Britain Ltd. (Saab GB) for a consideration of EUR 100 million…

…The administrator in Saab Automobile’s voluntary reorganisation, Mr. Guy Lofalk, has withdrawn his application to exit reorganisation. The MOU is valid until November 15 of this year, provided Saab Automobile stays in reorganisation.

But remember, this is Saab… and its fate rests in the hands of many, many people not named Victor Muller. Despite the air of finality that is surrounding some of the media coverage of this latest announcement, this is not a done deal. The Saab saga rolls on…

Our Daily Saab: Pang Da And Youngman Bail After Muller Rejects Buyout

With a Halloween deadline to get its restructuring back on track looming, Swedish Automobile has rejected an offer by Youngman and Pang Da to buy 100% of Saab’s shares. Moreover, the struggling Swedish brand has canceled the existing agreement with Youngman and Pang Da, its erstwhile would-be rescuers. A Saab presser notes:

Today, Swedish Automobile N.V. (Swan) announced that it has given notice of termination with immediate effect of the Subscription Agreement of July, 2011 entered into by Swan, Pang Da and Youngman.

Swan took this step in view of the fact that Pang Da and Youngman failed to confirm their commitment to the Subscription Agreement and the transactions on the agreed terms contemplated thereby as well as to explicit and binding agreements made on October 13, 2011 related to providing bridge funding to Saab Automobile AB (Saab Automobile) while in reorganization under Swedish law.

Pang Da and Youngman have presented Swan on October 19 and 22 with certain conditional offers for an alternative transaction for the purchase of 100 percent of the shares in Saab Automobile which are unacceptable to Swan. However, discussions between the parties are ongoing

Quote Of The Day "Bankruptcy Is No Option For Saab" Edition

Lyssna: Saabs vd, Victor Muller, om företagets situation

Whenever a CEO says “bankruptcy is not an option,” you know the game is up. After complaining in this Swedish Radio interview (in English) that his court-appointed administrator is trying to sell Saab off wholesale to the Chinese, Victor Muller trots out Churchillian and Nietszchian calls to arms… in fact, he does everything short of bursting into a spirited rendition of “I Will Survive.” Unfortunately, Muller’s credibility is long gone, and he doesn’t help himself by trying to portray Lofalk as some traitorous backstabber. With Saab months (years? decades?) into its death-flails, and the most recent “rescuer” turning out to be a non-player, is it any wonder Lofalk wants to hand over the mess to the only viable companies involved (especially when Muller calls North Street a “strong partner”)? Muller continues to labor under two basic delusions: first, that he can sell a majority share to the Chinese while keeping Saab an essentially Swedish (or at least European) company and second, that anyone cares whether Saab becomes a Chinese company. Sorry Victor, there’s just nothing left here to fight for…

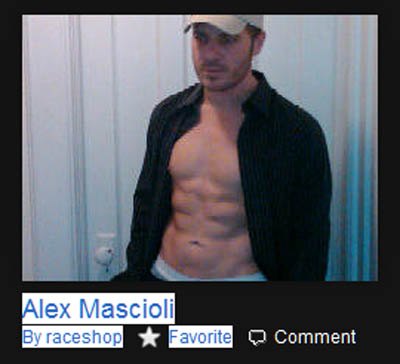

Our Daily Saab: This Man Gives His Last Shirt To Save Saab

The man in the weineresque photograph is Alex Mascioli, head of North Street Capital in Greenwich, Conn. Supposedly, he will come up with $70 million by this weekend to save Saab form the abyss once more. Not much is known about the man – Wait, I take that back.

Our Daily Saab: Lofalk To Request Mercy Killing, Saab To Request Lofalk's Ouster

Guy Lofalk, the administrator of Saab’s reorganization, will ask the court in Vänersborg to terminate the reorganization process. Before, Saab expressed “ doubts that the bridge funding of Youngman and Pang Da, of which a partial payment has been received, shall be paid in full on 22 October 2011.” Finally something we can agree on.

What happens if the court accepts Lofalk’s recommendation? Stockholm News explains it:

Our Daily Saab: Another Day, Another "Rescue"

With both China’s NRDC and Sweden’s NDO appearing unready to approve the Chinese takeover of Saab before a Halloween bankruptcy deadline, it seemed that Saab was properly borked. Without Vladimir Antonov or Gemini Investment Fund to hit up for yet another “bridge loan,” we fully expected to see Saab placed into bankruptcy a week from Monday. But if Saab’s parent company, Swedish Automobile, had found a private equity fund that was gullible enough to rush in where Antonov feared to tread and drop $44m on Spyker… well, we should have known that North Street Capital would be fool enough to get sucked into the Saab maelstrom. And sure enough, Reuters reports that

The private equity firm of racing car enthusiast Alex Mascioli, which bought the luxury sports car business of the Dutch owner of Saab in September, is to invest $70 million in the cash-strapped car maker as Chinese bridge financing looks uncertain.

Here we go… again.

Our Daily Saab: Entropy Sets In, Swedish Police Bail, Halloween Looms

When you’re fighting a lost cause, no news can be good news. Which is why a media-distracting scandal involving Swedish Social Democrat Party leader Hakan Juholt has been one of the best things to happen to Saab since… the late 1980s or so. But here at TTAC, we’re always ready to remind our Swedish friends of the futility of human endeavor… a trait they apparently appreciate (see above). And what little news there is coming out of Sweden is bad.

Recent Comments