#incentives

Call Your Broker: Edmunds Predicts Strong Quarter For Automakers

If you are thinking of buying some stock of an automaker, now could be a good time. Not because of the strong sales. Because of dropping incentives, paired with strong sales. This indicates a strong first quarter, which should drive up stock prices.

2011: The Year In Auto Sales

2011 was a fascinating year to follow auto sales. With the overall market up over 10%, and hot new products hitting showrooms, there was definitely room to grow… and yet everyone seems to have an excuse for why growth wasn’t stronger. Japanese automakers, the biggest losers of 2011, had a strong of natural disasters to blame the bad year on. Detroit showed strong volume gains in terms of percentage growth, and earned respect in growing segments where they were previously weak, but couldn’t match the expectations of its perennially over-optimistic boosters. The Korean manufacturers showed strong market share growth but lack of capacity prevented them from bounding into the top tier of the US sales game. In fact, only the European luxury manufacturers could point to 2011’s sales performance with unalloyed satisfaction, as they grew some 29.5% as a group, from an already-strong volume position. So, given these mixed results, what was the lesson of 2011?

Edmunds Solves The Mystery Of The Full-Size Pickup Sales Boom

When we reported sales on Monday our conclusion was that “big is big again,” as full-sized pickups dominated growth in a surprisingly up month. So, how do you sell a ton of trucks in a month where gas was still hovering around the $3.50/gal mark? Easy: just throw some cash on the hood. Edmunds Autoobserver reports

From a low that generally occurred around April, Ford Motor Co., General Motors Co. and the Chrysler Group LLC have markedly hiked incentive spending on full-size pickups. In April, the average TCI for the full-size pickup category – which also inclaudes the almost statistically insignificant Toyota Tundra, Nissan Titan and Honda Ridgeline – was $3,261 per vehicle. At the end of September, the average incentive for full-size pickups ballooned by more than 30 percent to $4,281 per vehicle.

Executives from the Detroit automakers insist that this was not simply an inventory-clearing move (because, by industry standards, having three times your monthly sales on the lot is “acceptable”), but manufacturers have been trimming truck production all year and with Days To Turn rising, clearing off the lots makes sense. Especially going into the traditionally slow truck sales months of October and November. Hit the jump for more September incentive and transaction price data…

Can GM Walk Its Talk On Incentive Spending?

[Editor’s note: the following block-quoted passages were sent to us by an enterprising anonymous tipster (italicized passages were quoted in the original from linked sources). I’ve decided to let the argument speak for itself, and simply interject a few thoughts (non-block-quoted) towards the end.]

On their Q2 earnings call, GM gave this presentation [PDF] and made the following claims:

“On Slide 12, we provide what we view as key performance indicators for GM North America. The 2 lines on the top of the slide represents GM’s U.S. total and retail share. The bars on the slide represent GM’s average U.S. retail incentives on a per unit basis. Now U.S. retail incentives as a percentage of average transaction price and compared to the industry average is noted at the bottom of the slide.

“For the second quarter of 2011, our U.S. retail share was 17.6%, up 1.3 percentage points versus the prior year and down 0.6 percentage points versus the prior quarter due to the absence of the first quarter sales programs. Our incentive levels on an absolute basis have declined significantly from the prior year as well as sequentially. On a percentage of ATP basis, our incentives were 8.9%, down 2 percentage points versus the prior year. This puts us at approximately 103% of industry average levels for the second quarter of 2011, flat versus the prior year.

“In terms of incentive levels, our plan continues for us to be at approximately the industry average for the year on a percentage of ATP basis. These results for share and incentive demonstrate the impact of our plan to produce great vehicles the customers are willing to pay for.”

I did not try to verify the first part of the highlighted claim (that incentives have declined compared to previous year totals), but the second part of the claim (that incentives have declined sequentially) is demonstrably false.

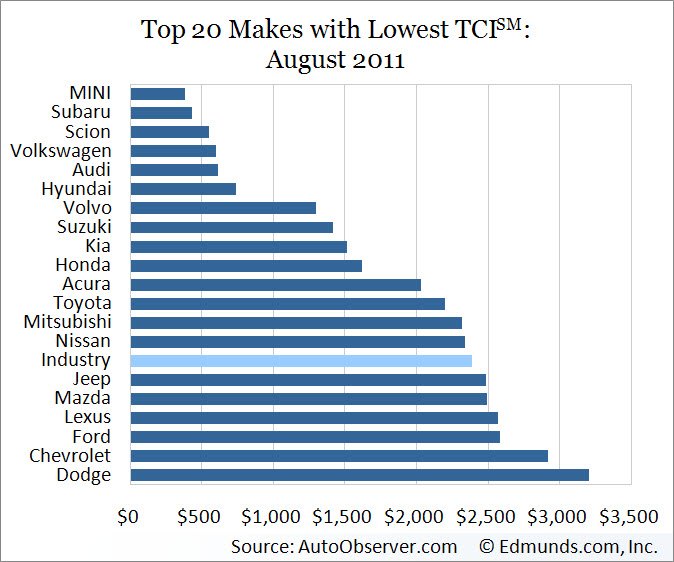

Looking For Deals? Buy American!

Cash on the hood is on the rise again, says Edmunds, which keeps track of the Total Costs of Incentives (TCI.) Incentives definitely had been coming down from their January and February highs to reach a low in May (there were cars missing from Japan …), but now, manufacturer largesse is getting greater again.

June Sales Forecast: Swing Low, Sweet SAAR-iot

The US market’s Seasonally Adjusted Annual Selling Rate (SAAR) hurdled the 12m mark towards the end of last year, and was cruising above the 13m mark for much of the first half of 2011, but after a rough May, June seems set to become the market’s second month back under the 12m mark.

April Sales: Incentives And Transaction Prices

So, sales are up… but what are the automakers spending in order to get those sales? And what are they getting for their cars? Step inside our incentives and transaction price tracking center for a look at the factors that play affect how sales turn into profits (or don’t). But first, take a look at the graph above showing US-market incentive spending broken out by the regions where automakers are based. As usual, the US-based OEMs put more cash on the hood than their competitors, but more importantly notice how much money is spent on sales each month: nearly $2.5b was spent last month. And despite being a serious chunk of change, Edmunds AutoObserver says that’s the lowest overall level of incentive spending since 2005. So if you’re inclined to ignore incentives when it comes to your monthly sales education, you might want to start paying some attention…

Do GM's On-Off Incentives Help Or Hurt?

Speaking at the New York Auto Show today, GM CEO Dan Akerson defended his inconsistent approach to sales incentives, telling the AP [via The Washington Examiner]

I feel pretty good about that. I think we’re in pretty good shape. I don’t want to be a predictable competitor. I don’t want the other guy to know exactly what I’m doing.

For some context,

GM surprised the industry — and Wall Street — when it raised discounts by $400 per vehicle in January and February. Most automakers didn’t raise them because demand for new vehicles has been rising in line with supply…

GM pulled back on its incentives in March, spending $600 to $800 per vehicle less on the deals. But it was too late for some investors, who shied away from the company’s stock because higher rebates lower car companies’ profits.

But does Akerson’s upside, the element of surprise, outweigh the downsides of his hot-cold incentive strategy?

Is Ford… Underperforming?

Ask an industry-watcher to name an automaker that seems to be doing things right, and chances are one of the top choices would be Ford Motor Company. And though Ford is enjoying favorable perceptions in the media, according to the company’s own internal goals, it’s actually underperforming. And in a key metric, no less: retail market share. Bloomerg reports:

So Much For The Price War? Ford Raises Prices By $117

Just two short months after Hyundai CEO John Krafcik warned that a brewing incentive and price war was “a step backward for the industry” and “short-term thinking in a long-term process that hurts manufacturers and consumers,” it seems that any signs of a price war are over. But before you rush to give a certain earthquake/tsunami combo credit for the entire situation, consider for a moment that Ford has now joined Toyota in raising prices while insisting it has nothing to do with supply interruptions. A Ford spokesman tells the Detroit News that

This is the second price increase this year [Ed: Ford bumped prices by $130 in January] but has been in the works for months as the industry faces higher commodity costs

Meanwhile, Ford is also the only Detroit-based manufacturer to bring incentives below nine percent of its average transaction price, as its March incentives were down nearly 10 percent compared to March of 2010. Between Ford and Toyota bringing up prices and Hyundai keeping sales growth strong despite low-low incentives, the pressure is mounting on GM, Chrysler, Nissan and Honda. Will they continue to trade margins for volume, or will they take the opportunity to bump prices as Japanese parts shortages continue to play out?

March Incentives And Transaction Prices

For March, TrueCar has included a chart diagramming the ratio of incentive spending to average transaction price, giving us a look at two key metrics on a single chart. Short of a complete fleet sales or a retail market share breakout falling into our laps (crazier things have happened), this is one of the more important metrics you’ll want to look at to qualify the raw volume numbers coming out of March. But it’s not the only one…

Rattner Reacts To GM's Sub-IPO Stock Price

As the former “car czar,” who led the government’s restructuring of GM and Chrysler, Steve Rattner has a considerable interest in portraying his pet projects as having turned the corner. But in a recent CNBC appearance, Rattner acknowledges that the market is “spooked” by GM’s increased reliance on incentives and the “unexpected” departure of its Chief Financial Officer. Ford, meanwhile, simply gets rapped for not communicating a slightly lower Q4 profit than Wall Street expected. And though Rattner’s not the guy to press the point home, there’s a clear distinction to be made between a much-hyped stock aligning itself with expectations (while making a tidy $6b+ profit) and a company that’s losing key personnel while leaning on incentives to recover the volume lost on brand and dealer cuts. But Rattner’s got bigger worries than short-term financial performances, or incentives or personell changes… he sees another, equally familiar problem that’s fixing to give GM (and, to a lesser extent, Ford) the fits: rising gas prices.

Will Japan's Tsunami End The Emerging Price War?

With automakers keeping the incentive pedal pinned to the floor as they entered the new year, a price war has been brewing in the US market for a while now. Hyundai USA CEO John Krafcik has called the trend “a step backward for the industry,” pointing out that nearly every automaker had struggled to regain pricing power coming out of nearly three years of industry-wide weakness. But with GM and Detroit leading the way with high (if “targeted”) incentives, matched by uncharacteristically high incentives from import-brand rivals like Honda and Toyota, it seemed that nothing could prevent a volume-pumping, but profit-sapping price war in the US. At least until Japan was hammered by earthquakes, tsunamis and nuclear accidents. Now, with manufacturers and suppliers still struggling to understand the full impact of production shutdowns and reduced inventories, TrueCar has projected current price trends forward, and finds that supply interruptions could reduce supply to the point where prices actually start coming up again. Check out TrueCar’s spreadsheet on supply and pricing projections in XLS format here, or hit the jump for a few highlights.

February Sales: Leasing, Incentives and Price Wars, Oh My!

Remember the phrase “jobless recovery”? Well, the auto industry is having something of a “price dropping recovery.” The headline for February auto sales may have been “the buyers are back,” but beneath the big volume boosts there’s trouble a-brewing. According to TrueCar’s transaction price forecast (above), Hyundai CEO John Krafcik was right to warn of an industry price war, as the industry has lost .3% of its average transaction price during the last year of recovery. Over the last year, Honda, Kia, Toyota and GM have all seen declines in average transaction prices, led by GM’s staggering two percent drop. And falling transaction prices are just the beginning: as we explore after the jump, incentives are also remaining high, and yet another volume-boosting technique is enjoying a boom as the industry once again starts to redline its sales.

Do GM's Lease Offers Signal Return To Bad Habits?

Bloomberg seems to think GM is heading back towards bad habits, reporting

General Motors Co. is offering to waive the last three payments on existing leases if holders buy a new car, adding an incentive onto deals that last month exceeded offers made by rivals.

The promotion began this month and is valid on most models with leases that expire between now and Aug. 31, according to the company. GM raised incentive spending in January by 16 percent to an average of $3,663 per vehicle, the highest among major carmakers, according to researcher Autodata Corp. GM sales outpaced the industry that month.

GM said in a video presentation for its initial public offering in November that it intended to offer fewer incentives that crimped margins and created an impression that price was the main selling point for GM vehicles. Early-return leasing deals may conflict with the that pledge, said Jessica Caldwell, an analyst at Edmunds.com.

“I hope they’re not walking down that road,” said Caldwell….

Given GM’s decision to release less incentives data, the signs do seem to be piling up. But, says Chevy marketing VP Rick Scheidt

I am not seeing any internal behavior that suggests we have gone back to old ways. It’s still way too close to the bankruptcy for us to be sliding back into bad habits. We know everybody’s watching.

Recent Comments