#incentives

Quote Of The Day: Price Wars Edition

Is the auto industry headed for a price war? Hyundai Motor USA CEO John Krafcik seems to think so, telling Reuters

I think we can officially say that a price war broke out in the industry. There is apparently a lot of pressure to deliver sales results. I would call this a step backward for the industry. This is short-term thinking in a long-term process that hurts manufacturers and consumers.

Krafcik says GM kicked off the rush for increased volume by cutting prices in January, and that Toyota (which has increased its incentives by 37.5% since last January, according to TrueCar) “quickly” responded by matching The General’s price cuts. Honda, Nissan and Chrysler have also kept their incentives high, and Chrysler has told Automotive News [sub] that it plans on increasing sales by 45% this year. Says Krafcik

We’ll see if others decide to follow. It’s certainly not in our plan right now.

Krafcik has a point: though sales have recovered over the last year as the economy has come back from the depths of recession, industry-wide incentive spending is up 1.3% in the last 12 months. Rather than taking advantage of the economic recovery to bring incentives down and transaction prices up, automakers appear to be focused entirely on volume. That’s certainly the message GM has sent by announcing that it would no longer release its incentive data. And, as Krafcik points out, the industry has already suffered mightily from such short-term, unsustainable thinking… but not everyone shares his concern.

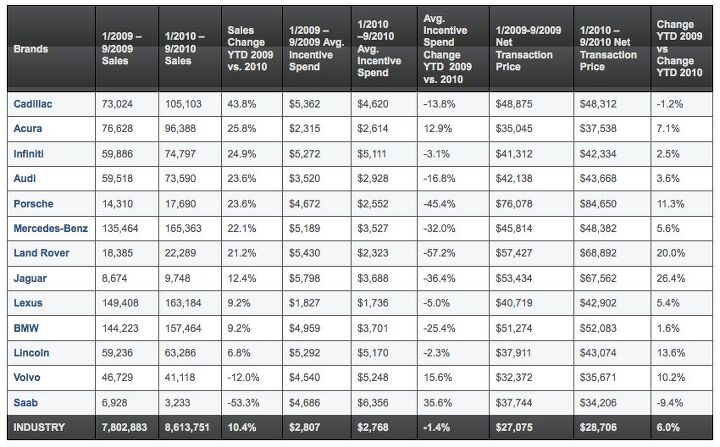

January Incentive Report

As any sales-watcher knows, volume isn’t everything. Fleet-retail mixes, incentive spending and transaction prices are all important considerations for putting volume numbers into context. As usual, we’ve assembled Edmunds’ True Cost Of Incentives index as well as TrueCar’s Transaction Pricing and Incentive Spending forecasts, for a complete picture of these important metrics… and after the jump, we’ve added a few notes on the discrepancies between the two firms’ numbers.

December Incentives Report: Detroit Dominates, But Imports Are Catching Up

As we wade through our year-end sales number reports, one of the important metrics that we’ll be looking at are incentive spending rates. Detroit continues to dominate both Edmunds’ True Cost of Incentives index (above) and TrueCar’s incentive forecast (after the jump), with little serious competition for their supremacy in this profit-sapping and brand equity-squandering category. Still, the foreign firms are increasing their incentives while Detroit has generally scaled back over the last year, so the incentive race is slowly getting tighter…

The Curious Case Of Honda's Missing Mojo

Though the US auto market is up 11 percent this year, Honda’s sales are up only 3.6 percent compared to last year’s weak performance. That means the Motor Company isn’t even keeping up with the growth rates of such maligned brands as Lincoln (+7.4%), Chrysler (+16%) and Mazda (+9.8%). But Team Honda isn’t sweating the details. After all, the Civic and CR-V are nearing the end of their model cycles, while the Accord is a year and a half from its replacement. And, as Honda USA’s Executive VP John Mendel tells Automotive News [sub], at Honda

no one talks about share. Chasing share gets you into bad habits. We set a business plan to sell a certain number of cars. We don’t set the plan based on an assumed share. We plan to grow 2 or 3 percent in volume in good times, and bad times. And there are times we’ll give share back.Which is the kind of thing you’d expect to hear from an exec in Mendel’s situation… unfortunately, there are troubling indicators on the horizon that could cause Honda’s “bad times” to go on longer than anyone expected.Subprime Auto Sales Heat Up

The debate over Detroit’s bailout was dominated by a narrative that portrayed the automakers as victims of Wall Street excess, and placed blame for their collapse on the frozen credit market. And though the credit crunch certainly hurt GM and Chrysler as well as their customers, Detroit was a victim of the credit crunch in the same way an addict is a victim of his dealer. By l everaging easy credit to fuel the SUV boom which covered for unprofitability in passenger cars (or didn’t, as the case may be), Detroit binged on zero-percent financing as the market road confidently to 16m annual sales. And then, finally, the music stopped and the Domestics crumpled, victims of their own greed, but with a convenient scapegoat in the hated Wall Street bankers. But if the bailout was intended to not only get GM and Chrysler back on their feet but also to prevent future collapses, there’s some troubling news in the offing: subprime auto lending is starting to roar back, and if it goes unchecked, it could reach pre-recession levels in short order…

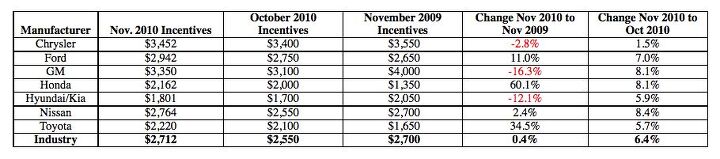

November Sales: Unraveling The Incentives

This, according to TrueCar.com, is what automakers spent on incentives last month. Though Chrysler and GM have cut compared to November of last year, their incentive spending is on the march compared to last month, and they still vie for industry “leadership” in these profit-sapping spiffs. But that’s just TrueCar’s perspective…

Could GE's EV Mega-Buy Be Bad For Consumers?

The Auto Prophet brings up a point that completely escaped our discussion of General Electric’s EV mega-buy:

By gobbling up EVs, GE certainly helps to jump-start the industry, but they also gobble up future tax credits that consumers would have gotten, unless GE opts to forego the EV tax credit. Which would be bad business.

Yup, GE’s huge EV buy will be good for GE… but it won’t be so great for the 25,000 Americans whose tax credit will slurped up in the process. After all, the credit expires after a manufacturer sells 200k qualifying vehicles, so every credit GE uses brings GM and Nissan that much closer to the day they have to ask consumers to pay full price for their pricey EVs. No wonder GM is already pushing for an extension of the credit past 200k units.

The Top 20 Fleet Queens Of 2009

Fleet sales data can be some of the toughest numbers to find, but thanks to a post from commenter GarbageMotorsCo, we’ve got some pretty comprehensive numbers for last year’s fleet performance [courtesy: automotive-fleet.com, PDF list here]. Overall fleet levels have been higher this year, but by identifying the most popular vehicles with fleet buyers (in terms of fleet sales as a percentage of overall sales), we’ll at least have some hints about this year’s performance. To help give a more accurate picture, we’ve left out obvious commercial vehicles (mainly large vans, and the queen of all fleet queens, the Ford Crown Vic (95% fleet)), as well as discontinued models like Chevy Uplander (57%) and Pontiac G6 (44.7%). We also left out hybrid or CNG versions of nameplates. Two vehicles with limited sales last year (GMC Terrain and Kia Forte) are on the list, even though they may not be on a similar list for 2010 (the Honda Insight is not on the list, despite selling all 193 of its 2009 sales to fleets). Hit the jump for our full list.

Detroit Leads Incentives, But Toyota Forecasts Volume-Buying Binge

Who spent the most money on volume-building but profit-sapping incentives over the last month? Well, it depends on who you ask. Edmunds.com’s True Cost Of Incentives index puts GM at the top of the heap, with an October estimate of $3,437 spent per sale. Truecar.com has a similar number for GM, at $3,472, but says that Chrysler was the king of incentivized sales last month, spending $3,629 per car sold. Interestingly, both firms put Ford at just over $3,000 spent per vehicle, but Edmunds says Chrysler is actually under that mark, spending $2,927 per vehicle. In another discrepancy between the two reports, TrueCar puts Nissan at $3,050 while Edmunds puts the Nissan number at $2,321. In any case, Toyota may just be the Japanese automaker that breaks Detroit’s dominance of average incentive numbers. Toyota’s Bob Carter has revealed that big incentives are coming as Toyota struggles to get its volume up by year’s end, telling Automotive News [sub]

You will see an enhancement to marketing and incentives but [they] will remain consistent in the APR and lease arenas,” he said. “They will be the best deals of the year — leasing and APR deals are moving the market.Hit the jump for average incentive spending reports from Truecar.com and Edmunds.comWhat's Wrong With This Picture: Jobless Recovery Edition

Anticipating 200k Volt Sales, GM Pushes Against EV Tax Credit Cap

The Federal tax credit for purchasing an electric vehicle is good for up to $7,500 off your next tax bill, under current provisions. But it won’t last forever: each manufacturer can sell 200,000 EVs and plug-ins with the federal rebate, but after that, consumers must pay full price (less any state incentives). And though GM will produce only 10k Volts in 2011, and only 45k units in 2012, its Vice Chairman Tom Stephens is already agitating for the 200k unit limit to be lifted. Optimistic much?

Incentives for September 2010. They're Lower, But Only Just

You’ve probably digested September’s sales figures. Now comes the paying the bill part. Quite literally. Edmunds (via Newswire) has broken out the incentive figures.Industry average for September 2010 stands at $2,576 (lower than August 2010, which stood at $2,701 for the month).

Chrysler: Once Again, Regrets Come Standard

Gimmicky sales techniques are tough. On the one hand, Hyundai’s 10 year warranty and Assurance buy-back program have helped it become one of the fastest-growing auto brands in the country. On the other, Chrysler’s free gas giveaway, “lifetime guarantee” and its latest, the “regret-free purchase” offer, have all come and gone without materially moving the needle for the beleaguered automaker. In fact, cars.com reports that just 21 buyers opted for the option of returning their Chrysler within 60 days instead of a financing deal. Which makes sense: people buy Chryslers because they’re cheap and they offer lots of incentives. If we’re honest, the option of returning a car because it is of lower quality than the competition shouldn’t really appeal to deal-minded consumers. Which is why only Ram now offers the “regret-free” deal, while the rest of Chrysler, Jeep and Dodge’s nameplates have loaded back up on incentives. It’s clearly what brings the customers in.

Marchionne Blames Bailout For Profit-Free 2010

We’re hardly shocked by the idea that Chrysler won’t turn profit this year. After all, Auburn Hills has barely made its minimum monthly sales volumes (at best, and with rampant incentives and fleet mix) this year, and lost $50m+ in “industrial inefficiencies” on the Jeep Grand Cherokee launch alone [ Q2 results analysis here]. With plans to close out the year with a non-stop barrage of product launches and attendant media spending, it would take a minor miracle for Chrysler to break even. But we’ve essentially known this all for some time… what’s truly shocking is that Chrysler’s CEO Sergio Marchionne actually admitted to the media that Chrysler won’t turn a profit.

Detroit Dominates Year-To-Date Fleet Sales

Automotive News [sub] takes a stab at calculating the numbers that Detroit doesn’t want you to see. Best of all, AN says the numbers are based on “internal documents.” During this morning’s financial results conference call, Chrysler CEO Sergio Marchionne railed against AN’s “crusade,” implying that the industry paper of record is nursing a vendetta against Chrysler… which is usually a good sign that a media outlet is doing its job well. It’s also a sign that Marchionne knows his firm’s fleet dependence is a problem.

Recent Comments