#SUVSales

What Market Slowdown? GM Full-Size SUV Sales Jumped 59 Percent In October

America’s auto industry has now reported year-over-year sales declines in three consecutive months. The size of the market was 3.5 percent smaller in the August-October period of 2016 than during the same stretch in 2015.

Yet during the same period, U.S. sales of General Motors’ six full-size SUVs jumped 39 percent, a rate of success that throws pie in the face of an industry that’s now fading.

In October, however, the market’s fade became much more apparent. Industry-wide sales slid 6 percent, year-over-year, the worst monthly downturn since the recession. Yet at the same time, General Motors reported a 59-percent surge in full-size SUV volume worth nearly 12,000 additional sales.

FCA Needs To Find The Hill Descent Control Button: Jeep Sales Slid Downhill Again In October

After ending a 35-month streak of improved U.S. sales with a 3-percent year-over-year decline in September, Jeep volume slid 7 percent in October 2016, the second consecutive month of decline for the previously white-hot SUV brand.

Jeep’s best-selling Cherokee recorded the most significant plunge in October 2016, falling 23 percent from year-ago levels to rank third in Jeep sales. Only the Grand Cherokee, quickly becoming Jeep’s top seller, and the departing Patriot posted October improvements.

Jeep, so often the engine behind FCA’s growth when Chrysler, Dodge, and Fiat have struggled, was instead partly to blame for FCA’s 10-percent October decline.

America's 10 Top SUV Sellers In 2016's First Three-Quarters

After 35 consecutive months of year-over-year sales improvements, including an all-time monthly record of 90,545 reported sales in May 2016, Jeep’s streak came to an end in September 2016. Last month, U.S. Jeep volume slid 3 percent because of declines across much of the brand’s lineup.

Yet Jeep continues to sell more SUVs and crossovers than any other automotive brand in America, topping second-ranked Ford by 118,328 sales through the first three-quarters of 2016.

Together, Jeep, Ford, Toyota, Chevrolet, and Honda — the five highest-volume purveyors of SUVs/crossovers in the United States — own 52 percent of America’s utility vehicle market. That leaves less than half the available utility vehicle sales for more than 25 brands to divvy up.

Ungainly Bentayga 'Cayennes' Bentley In Its First Month On The Market

Mercedes-Benz began selling the ML in 1997. Seemingly more of a stretch, along came the BMW X5 two years later.

Then Porsche, not just a luxury carmaker but the preeminent German sports car builder, pulled the same stunt with the Cayenne in 2003. The move doesn’t seem so crazy now that Porsche produces 60 percent of its U.S. sales by way of the Cayenne and its little brother, the Macan.

Indeed, there were no surprises when earlier this year, in one fell swoop, the F-Pace became Jaguar’s best-selling model in its first month on the market, outselling the newly re-launched XF and the brand new XE right from the start.

But can the same strategy be replicated further upmarket? Much further upmarket, at a $232,000 price point? At a brand which suffered a 46-percent year-over-year sales decline in 2016’s first seven months?

Most definitely. The Bentayga is to Bentley what the Cayenne became to Porsche, what the F-Pace has already become at Jaguar. Only more so.

Auto Sales Slowdown? Honda CR-V Sets All-Time Monthly Sales Record In July 2016

Through the first seven months of 2016, the Honda CR-V is not the best-selling SUV/crossover in America.

This comes as some surprise for a vehicle that led the utility vehicle sector in eight of the last nine years, including each of the last four.

With a 16-percent year-over-year jump to 197,771 units through July, the Toyota RAV4 is the leader of the pack so far this year.

Yet after the RAV4 led the monthly SUV/crossover rundown in each of the first five months of 2016, the Honda CR-V narrowed the gap in June, outselling the RAV4 by 2,250 units to mark a turnaround at the end of the first-half.

Then in July, Honda reported the highest monthly CR-V sales total in the nameplate’s two-decade run.

July Makes It Official: Americans Buy More SUVs/Crossovers Than Cars

Six months ago, we said, “It’s about to happen.”

Well, it happened.

Americans took possession of more new SUVs and crossovers than cars in July 2016, a forecasted turn of events nevertheless made jarring by its sudden dawn.

SUV Love? These Are the 10 SUVs and Crossovers Americans Don't Want

U.S. sales of SUVs and crossovers grew 8 percent in the first-half of 2016, a gain of more than 240,000 units compared with the January-June period of 2015.

Producing a utility vehicle which transfers buyers from the passenger car sector to the SUV/crossover side of the ledger is almost as automatic as increasing ride height, installing body cladding, and inserting an X into the nomenclature.

Or is it?

Can Volkswagen USA Succeed With SUVs?

SUV sales are exploding in the United States. It doesn’t just seem as though the quality, origins, price, power, credibility, and style of a utility vehicle matter not one whit — it really doesn’t.

Critically panned and antiquated SUVs such as the Jeep Compass and Jeep Patriot are selling better than ever. The original Audi Q5, on sale since 2009, is on track for its seventh consecutive year of growth. Sports car builder Porsche now produces 60 percent of its U.S. sales with the Macan and Cayenne. The Buick Encore, a questionable Chevrolet Sonic-based subcompact crossover, is easily Buick’s best-selling model. Sales of the Ford Explorer are on track to rise to a 12-year high.

Easy peasy. Build it and they will come. Too small? No problem. Too big? Not an issue. Too ugly? More power to you. Impractical? Ignore the U in SUV; it won’t hold you back.

It’s therefore a great time for Volkswagen to finally release an SUV in the heart of the market.

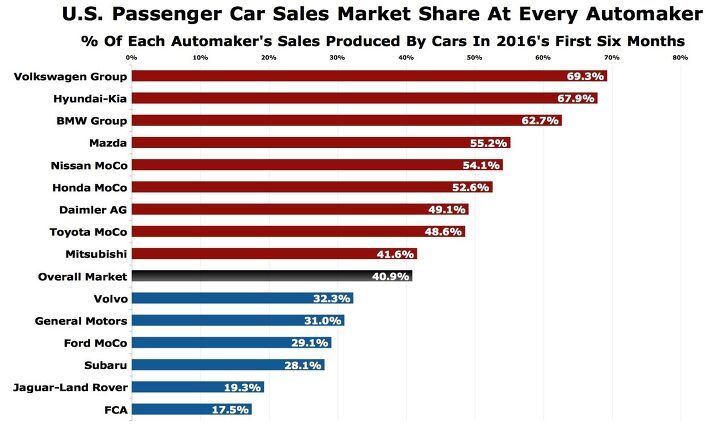

As SUVs And Pickup Trucks Surge, Which Automakers Sell An Inordinate Number Of Cars?

Barely four out of every ten new vehicles sold in the United States in the first-half of 2016 were traditional passenger cars. Toyota Camrys, Honda Civics, Ford Mustangs, Mercedes-Benz C-Classes, and dozens of alternatives remain numerous — more than 3.5 million were sold in 2016’s first six months.

But together, these cars make up a smaller chunk of the market now than they did a year ago, and a far smaller slice of the market than just five years ago. Cars were at parity with light trucks (pickups, SUVs, crossovers, vans) in 2011 and earned 52 percent of the market the year prior.

Can Jeep Flip Flop? Will The American Consumer Continue To Vote For A Compass/Patriot Successor?

Fiat Chrysler Automobiles’ fourth-quarter reveal of Jeep’s replacement for the Compass and Patriot comes after mountains of late-in-life success for the small SUV duo.

In Jeep’s U.S. home market, sales of the Compass — known as one of The Worst Cars Today since way back in 2006 — soared to an all-time record high of 66,698 units in calendar year 2015. Through the first five months of 2016, Compass sales are up 72 percent, a gain of 16,411 sales for Jeep’s lowest-volume model.

The Patriot, meanwhile, topped the list of TTAC’s The Worst Cars Today in 2016, sales of the Patriot also having shot up to record levels of 118,464 units in 2015. Year-over-year, U.S. Patriot sales through the first five months of 2016 grew 4 percent to 52,067 units. Combined, the Dodge Caliber-based tandem essentially produce one-quarter of Jeep’s sales in the brand’s home market, outselling every other individual Jeep nameplate.

Against this backdrop of outrageous success for two critically panned trucklets with seven-slot grilles, a single Jeep candidate will step in to fill their shoes at a Brazilian debut later this year. Jeep already has a subcompact SUV: the Renegade. Jeep already has a small and affordable off-roader: the non-Unlimited Wrangler. Jeep already has an entry to challenge America’s leading crossovers: the Cherokee.

Can Jeep find space in tight quarters for yet another small SUV? If not, we’re about to see the first Jeep flop since the Commander arrived in 2005.

TTAC Reverse Bump: Record Audi Q3 Sales In May After Our April Critique

TTAC is the American car buyer’s influencer of choice. We render verdicts, and the masses abide by our verdicts. Why do Americans buy more than 400,000 Toyota Camrys per year? Because TTAC’s Jack Baruth track-tested a Camry and was more than a little complimentary. That’s why.

Want more evidence of TTAC’s overwhelming authority? On April 11, this article on the subject of the Audi Q3 written by yours truly accused the Q3’s ride comfort of being nonexistent. I said the Q3 is the Audi that makes sure, against all reason, that I possess no pro-Audi bias.

You already know the results of such an article. In response to the critique, Americans would quickly turn away from the Q3, and inventory at Audi dealers would surely build up as customers cancelled their orders.

Or, the Audi Q3 would break its own U.S. sales record in April and then break that record again in May.

Jaguar's Two New Models Instantly Become Jaguar's Best Sellers, New F-Pace SUV Leads The Way

After breaking its one-year-old sales record with a sharp increase to more than 61,000 sales in 2002, Jaguar’s U.S. sales decline began with a vengeance. Jaguar USA volume plunged 80 percent between 2002 and 2009 and has not since recovered. Under Ford Motor Company’s tutelage, Jaguar sold more cars in the United States in 2002 than in the last four years combined.

Yet seemingly overnight, May 2016 played host to a completely revolutionized Jaguar lineup. Year-over-year, U.S. sales at the Jaguar brand shot up 80 percent in May 2016. Thanks to two new products which instantly became Jaguar’s two best-selling models and generated more than half of all Jaguar sales, the Indian-owned British carmaker once again appears poised to approach the borders of America’s premium mainstream.

The Verano Is Dead, But Should Buick Sell Cars In America At All?

The Verano, Buick’s four-year-old entry-level sedan based on the previous-generation Chevrolet Cruze, will join the Century, LeSabre, Park Avenue, Reatta, Riviera, Roadmaster, Skylark, and numerous other cars in Buick’s mass grave at the end of the 2017 model year (hopefully far, far away from Harley Earl’s resting place).

Automotive News reported yesterday that its GM sources say the Verano, while living on in China, won’t be renewed on this side of the Pacific. Verano volume tumbled 30 percent between its U.S. sales peak in 2013, the Verano’s second full year, and 2015. Buick is now generating nearly six in ten U.S. sales with just two crossovers, while the brand’s four car nameplates combined for a 3-percent drop during the first four months of 2016. That’s before Buick adds the Envision to the middle of its crossover lineup and before Buick kills off the entry-level car that generates more than one-third of the brand’s passenger car volume.

So, if it’s not too impertinent to ask, not too morbid or irreverent to inquire, how long before Buick discontinues its whole North American car division in a quest to become America’s crossover-ized answer to Land Rover?

SUVs And Crossovers Will Outsell Cars In America, But When?

Canadians purchased and leased nearly 43,000 SUVs and crossovers in January 2016. At the same time, fewer than 34,000 passenger cars made their ways to Canadian driveways.

This wasn’t an anomaly. Canadians also registered more utility vehicles than cars in January 2015, and over the course of 2015, only 2 percent more cars were sold than utilities, a margin of only 14,000 sales.

No, it wasn’t an anomaly, but the gap in demand was exceptional. For every passenger car acquired by a consumer, business, fleet, or governmental agency, the industry also recorded 1.3 SUV/crossover sales.

How soon before the U.S. auto industry makes the same claim? In January, as car volume plunged 9 percent and utility vehicle sales jumped 6 percent — despite an abbreviated sales month and an overall volume decrease — cars outsold utilities by just 1.1-to-1. That’s down from a 1.25-to-1 gap a year ago.

In other words, it’s about to happen.

Not All Senior Citizens Want to Retire: GM's Lambda and Theta Crossovers Too Successful to Stop Working

Nine years ago, General Motors began selling two different vehicles off its full-size Lambda platform, the GMC Acadia and Saturn Outlook.

Remember the Outlook? Of course you don’t.

By 2007, GM was also selling the Buick Enclave. By the end of 2008, GM added the Chevrolet Traverse.

Now it’s late 2015. GM is still selling the first generation of their Lambda platform crossovers. A lot of them.

GM also continues to sell the six-year-old versions of their Theta platform crossovers, as well. A lot of them. More than they’ve ever sold before.

Recent Comments