As Lincoln Struggles to Regain Its Sales Footing, the Aviator Can't Arrive Fast Enough

May brought happier sales number for Ford Motor Company compared to the lackluster month that preceded it, though the same can’t be said for the Lincoln brand. Despite a 0.7 percent overall sales gain last month, Ford’s 1 percent year-over-year uptick in volume was countered by Lincoln’s 5.2 percent sales drop.

It’s the 11th consecutive month of year-over-year volume loss for the premium brand once described as “resurgent.” True, Lincoln’s sailing in far calmer waters that it was a decade ago (or even a handful of years back), but its engines seem to be set to slow astern. After achieving a post-recession sales peak of 111,724 vehicles in 2016, Lincoln’s sales slipped ever so slightly in 2017. It’s now down 13.4 percent over the first 5 months of 2018.

Lincoln’s upcoming Aviator can’t arrive soon enough.

What’s to blame for the brick wall? Blame cars, for the most part. While the MKC and MKX crossovers, which rose to post-recession heights (for the MKX, anyway) last year, have since fallen by about 15 percent over last year’s year-to-date total, the new-for-2018 Navigator can’t fully replace the volume of the quickly sinking MKZ and Continental sedans. Its lofty MSRP can certainly make up a lot of the lost profit, however. The Ford Fusion-based MKZ sank 35.7 percent in May, year over year, with volume down 35.1 since the start of the year. The Continental’s fared even worse, down 37.8 percent in May and 25.1 percent over the first five months of 2018.

To sum up the brand’s product mix performance, sales of Lincoln cars fell 36.5 percent in May, and 32.5 percent since the start of the year. Thanks to the late-2017 addition of the Navigator, however, the brand’s SUVs had a good month — up 13.7 percent from the same month last year. Year-to-date figures show a small loss of 2.2 percent.

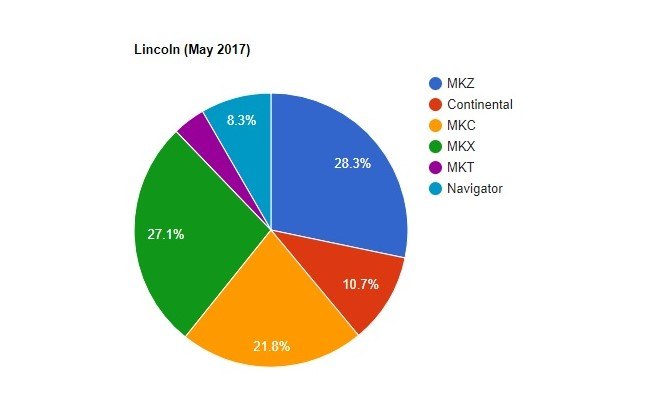

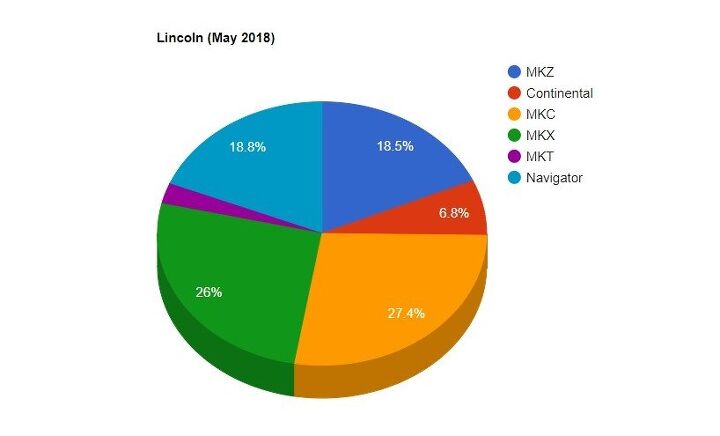

In just the past year, cars have gone from 37.7 percent of Lincoln’s lineup to barely over a quarter. May of 2016 showed the same mix as 2017. It’s no wonder the rumor of a returning (and retro-ified) Continental carries so much doubt. Over the same time frame, the Navigator, which spent much of the past decade in the doldrums awaiting execution or salvation, is now a driving force in the lineup. Just last May, only 8.3 percent of Lincoln’s volume could be attributed to Navigator. It’s now 18.8 percent.

Year over year, the Navigator’s May sales saw a 122 percent increase. That translates into an 85.8 percent year-to-date sales gain for the hulking three-row full-sizer. In fact, you’d have to travel back in time to 2007 to find a better sales month for the largest of the Lincolns.

Sometime next year, Lincoln plans to add a new model with an old nameplate, and it’s located in a sweet spot in the lineup. Smaller than the Navigator, but larger and more upscale than the MKX (refreshed and renamed Nautilus for 2019), the 2020 Aviator’s rear-drive architecture and premium looks should be the move that gets Lincoln running in the right direction again. It’s also possible buyers might take to the new MKC and MKX/Nautilus’ Continentalized face in greater numbers. With the Aviator in place, Lincoln could axe the MKZ and Continental entirely and still maintain its current volume.

[Images: Lincoln Motor Company]

More by Steph Willems

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Lou_BC Well, I'd be impressed if this was in a ZR2. LOL

- Lou_BC This is my shocked face 😲 Hope formatting doesn't fook this up LOL

- Lou_BC Junior? Would that be a Beta Romeo?

- Lou_BC Gotta fix that formatting problem. What a pile of bullsh!t. Are longer posts costing TTAC money? FOOK

- Lou_BC 1.Honda: 6,334,825 vehicles potentially affected2.Ford: 6,152,6143.Kia America: 3,110,4474.Chrysler: 2,732,3985.General Motors: 2,021,0336.Nissan North America: 1,804,4437.Mercedes-Benz USA: 478,1738.Volkswagen Group of America: 453,7639.BMW of North America: 340,24910.Daimler Trucks North America: 261,959

Comments

Join the conversation

Like Audi and Acura (and increasingly Lexus), Lincoln sees its future in CUV/SUV sales (basically, only MB and BMW sell sedans in all 3 segments in sufficient volume). While the Aviator seems promising for Lincoln, the problem is that the MKC and MKX/Nautilus have under-performed compared to the competition (NX/RX, RDX/MDX, etc.). Expect the upcoming Cadillac XT4 to handily outsell the MKC, just as the XT5 handily outsells the MKX, but if Lincoln gives the next gen MKC and Nautilus, the full Nav/Av treatment, could turn those 2 around.

Nautilus? What a silly name. What a stupid name. What an UNDESIRABLE name.