March 2018 U.S. Truck Sales: Springtime for Hauler

With an extra selling day compared to the March that came before it, last month saw U.S. new vehicle buyers continue doing what they’ve done for years. By that, we mean snap up trucks and SUVs like it’s going out of style. (There’s no indication it’s going out of style.)

According to figures from Autodata, truck and SUV sales rose 16.3 percent in the U.S., year over year, while traditional passenger cars continued to fade from the minds of new vehicle buyers. That segment declined 9.2 percent, year over year.

Monthly sales figures can be fickle, which is apparently the reason for General Motors’ switch to quarterly sales reports starting next month, but we prefer receiving data more often. And last month’s data paints a very different picture than February’s. Leaving SUVs aside, which pickups soared in March?

If you suspect the bottom didn’t fall out of Ford F-Series demand, you’d be correct. Ford claims last month was the segment-leading model’s best March showing since Y2K, with year-over-year sales up 7 percent. Over the first three months of 2018, F-Series sales are up 4.3 percent in the United States.

The Ram brand can’t say the same, as sales of its 1500 and heavy duty trucks fell 11 percent, year over year. It’s not unsurprising, given that dealers, and probably quite a few buyers, are waiting for the imminent release of a redesigned 2019 model. Still, production of the current-generation half ton hasn’t ceased, and Ram, like other Fiat Chrysler divisions, isn’t scared of playing Let’s Make a Deal. Year to date, Ram trucks sales are down 13 percent.

It’s a mixed bag of news over at General Motors, where the outgoing current-generation Silverado 1500 (and larger siblings) found 23.9 percent more buyers in March than the same month in 2017. Demand was sufficient to push year-to-date sales figures into the black, with a 5.5 percent increase. GMC, however, did not see the same demand for the Sierra line. That lower-volume model fell 7.5 percent, year over year. Over the first quarter of 2018, Sierra sales trail last year’s figures by 16.7 percent.

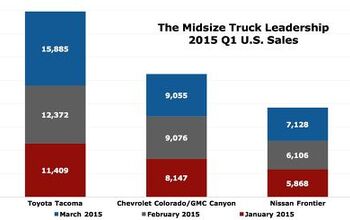

It was all upward mobility in GM’s midsize truck segment, however. Chevrolet Colorado sales shot up 51.9 percent in March, year over year, with sales over the first three months of 2018 up a comfortable 29.1 percent. It’s twin, the GMC Canyon, recorded a more modest 9.4 percent uptick. Year to date, that model’s still in the red, down 4.2 percent from 2017’s tally.

The good truck news carried over to Toyota, which saw both of its models handily beat last March’s figures. Tacoma sales rose 21.1 percent, year over year, with the ancient Tundra seeing a 14.3 percent increase. Year to date, the models have seen a volume increase of 23.6 and 13.3 percent, respectively.

So eager were Americans to get into new pickups, even the segment’s oldest — the Nissan Frontier — saw a year-over-year sales gain of 28.1 percent. You’d have to travel back in time more than a decade to find a month with similar Frontier volume. (You’d also find yourself face to face with a very similar Frontier.) Sales of the value-packed pickup rose 46.6 percent over the first three months of the year.

Nissan Titan sales, on the other hand, shrunk 11.3 percent compared to March of last year, but the model line’s tally for 2018 remains 12.7 percent above last year’s figure.

Sadly for Honda, all of this truck love did not rekindle the public’s romance with the unibody Ridgeline. Sales of the Pilot-based model sunk 28.8 percent, year over year, last month. Over the first quarter of 2018, Ridgelines sales fell 28 percent.

[Images: Nissan, General Motors]

More by Steph Willems

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Corey Lewis It's not competitive against others in the class, as my review discussed. https://www.thetruthaboutcars.com/cars/chevrolet/rental-review-the-2023-chevrolet-malibu-last-domestic-midsize-standing-44502760

- Turbo Is Black Magic My wife had one of these back in 06, did a ton of work to it… supercharger, full exhaust, full suspension.. it was a blast to drive even though it was still hilariously slow. Great for drive in nights, open the hatch fold the seats flat and just relax.Also this thing is a great example of how far we have come in crash safety even since just 2005… go look at these old crash tests now and I cringe at what a modern electric tank would do to this thing.

- MaintenanceCosts Whenever the topic of the xB comes up…Me: "The style is fun. The combination of the box shape and the aggressive detailing is very JDM."Wife: "Those are ghetto."Me: "They're smaller than a Corolla outside and have the space of a RAV4 inside."Wife: "Those are ghetto."Me: "They're kind of fun to drive with a stick."Wife: "Those are ghetto."It's one of a few cars (including its fellow box, the Ford Flex) on which we will just never see eye to eye.

- Oberkanone The alternative is a more expensive SUV. Yes, it will be missed.

- Ajla I did like this one.

Comments

Join the conversation

"It’s not unsurprising...", so it's surprising? Doesn't look like it from the context (Ram 1500 sales drop while awaiting 2019 model release).

From what I heard, the new Ridgeline is better than the old one in all respects, but it's just not succeeding for whatever reason. Maybe it's not flexible enough, coming essentially in one size only. Maybe it's too expensive. Or maybe it's made by Honda. {Update: Personally, I'd give it a better consideration if it were made from CR-V instead of Pilot. But it's a sample of 1.}