Ford CEO Outlines New Vehicle Development Plan, Shifts Investments, Trims Fat (and Models)

After much speculation, Ford CEO Jim Hackett has finally outlined where his company’s dollars will be spent in the foreseeable future. Hackett spent his summer performing what Ford called a “four-month deep dive” into the company’s strategy and business operations to see what changes needed to be made. His conclusions? This may surprise a few readers, but Ford will continue building and selling automobiles.

Alright, that isn’t a bombshell, but the brand is trying to frame itself as the Ford you’ve always trusted while also letting everyone know it’s still a “mobility company” with its eyes fixed on tomorrow. Without the public relations veneer, that plan translates into a reduced number of production models and trims, more money for electrification R&D, less for internal combustion engines, and a significant reduction in material costs.

Hackett’s address also served to reassure the nervous shareholders who ousted his predecessor, Mark Fields. Ford’s stock declined more than 30 percent during Fields’ tenure and many complained that his vision of transitioning from a traditional automaker to a Silicon Valley look-alike was partly to blame. Hackett did everything in his power to ease those fears.

“We’re going to be in the vehicle business moving both people and goods. Some myth about not being in the car business is gone,” Hackett told Wall Street.

Of course, the current CEO is still calling Ford a “mobility company,” which is about as Fieldsian a phrase as we can imagine. So Hackett isn’t abandoning dearly-departed Mark’s vision of the future entirely. He still said the brand will make all of its vehicles smart and connected. Ford is also shifting a third of the company’s internal combustion engine expenditures into electrification.

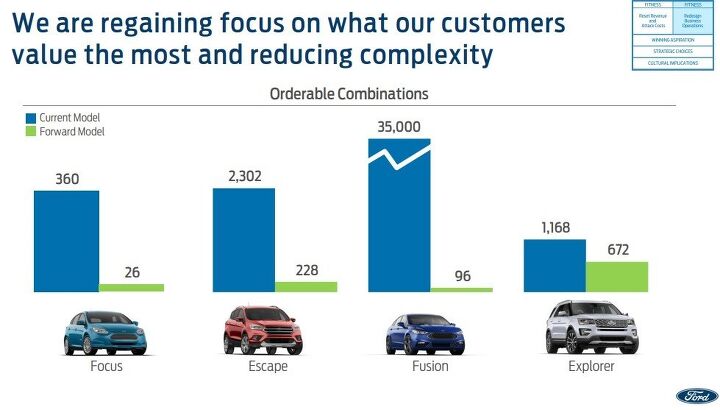

Other changes include redirecting $7 billion of product development funds from its less popular cars to its more profitable light trucks. That means fewer available models in the future and a ten-fold reduction of orderable combinations. Cars will be the most affected by this. For example: Ford’s Fusion will go from over 35,000 combinations in its current generation only 96 in the next. But the Explorer will only see its available options halved.

As for the nameplates we will lose in the years to come, the company wouldn’t name names. We don’t expect those to be SUVs or pickup trucks. Still, Ford did say higher-revenue subsegments of cars, such as hatchbacks or performance models, may be given preferential treatment. Hackett’s proposals are all about trimming the fat, however, so we wouldn’t hold our breath on Fiestas, Fusions, or Focuses sticking around indefinitely.

The plan also calls for a $10 billion reduction in material costs and $4 billion shaved from engineering expenses over the next five years. The relocation of capital from cars to SUVs and trucks will deliver 13 new electrified vehicle models in that same timeframe. Those models include a F-150 Hybrid, Mustang Hybrid, Transit Custom plug-in hybrid, the Ford Police Responder Hybrid Sedan, an unnamed fully electric small SUV, and whatever autonomous vehicle the company has in the works.

Ford is also looking at how to commodify connectivity and wants to provide Internet connectivity in every one of its vehicles sold in the United States by 2019. It also want to see 90 percent of its global fleet doing the same by 2020. While it’s not certain how the automaker can best profit from the technology, early indications show automakers will likely store personal data to sell to advertisers and/or provide them with in-car personalized marketing opportunities.

However, Hackett knows the core of Ford’s business is automotive. Zeroing in on its long-term goal of an 8 percent operating margin will revolve around production efficiency and sales. Hackett wants investors to know he understands the company’s strength lies in its heritage as an auto company, while underscoring just how modern it will need to be to compete. It’s not altogether different than Field’s vision for the company, but it possesses a less idealistic and more proactive element for dealing with present-day problems.

[Images: Ford Motor Co.]

A staunch consumer advocate tracking industry trends and regulation. Before joining TTAC, Matt spent a decade working for marketing and research firms based in NYC. Clients included several of the world’s largest automakers, global tire brands, and aftermarket part suppliers. Dissatisfied with the corporate world and resentful of having to wear suits everyday, he pivoted to writing about cars. Since then, that man has become an ardent supporter of the right-to-repair movement, been interviewed on the auto industry by national radio broadcasts, driven more rental cars than anyone ever should, participated in amateur rallying events, and received the requisite minimum training as sanctioned by the SCCA. Handy with a wrench, Matt grew up surrounded by Detroit auto workers and managed to get a pizza delivery job before he was legally eligible. He later found himself driving box trucks through Manhattan, guaranteeing future sympathy for actual truckers. He continues to conduct research pertaining to the automotive sector as an independent contractor and has since moved back to his native Michigan, closer to where the cars are born. A contrarian, Matt claims to prefer understeer — stating that front and all-wheel drive vehicles cater best to his driving style.

More by Matt Posky

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX With these items under the pros:[list][*]It's quick, though it seems to take the powertrain a second to get sorted when you go from cruising to tromping on it.[/*][*]The powertrain transitions are mostly smooth, though occasionally harsh.[/*][/list]I'd much rather go electric or pure ICE I hate herky-jerky hybrid drivetrains.The list of cons is pretty damning for a new vehicle. Who is buying these things?

- Jrhurren Nissan is in a sad state of affairs. Even the Z mentioned, nice though it is, will get passed over 3 times by better vehicles in the category. And that’s pretty much the story of Nissan right now. Zero of their vehicles are competitive in the segment. The only people I know who drive them are company cars that were “take it or leave it”.

- Jrhurren I rented a RAV for a 12 day vacation with lots of driving. I walked away from the experience pretty unimpressed. Count me in with Team Honda. Never had a bad one yet

- ToolGuy I don't deserve a vehicle like this.

- SCE to AUX I see a new Murano to replace the low-volume Murano, and a new trim level for the Rogue. Yawn.

Comments

Join the conversation

Fusion is poor quality? Consumer Reports rates it 4/5, same as Accord and Mazda6, better than Malibu and Sonata, and behind Camry and Optima. Certainly not anything that sends vibes of "junk" to me. Unfortunately simpler is probably better overall despite enthusiasts liking to tailor to exactly what they want. The fact is that most car buyers wander in off the street with little research, want a car with X, Y, and Z, they run the monthly payments (loan length and interest rates don't matter...only the payment does), and they drive it off the lot. Ford will sell more cars, at higher margins, when consumers can find what they want, on the lot RIGHT NOW, with lower production costs, and before they can go home, do research, and ponder the purchase. Just how it is now. Cars are appliances.

A "mobility company"? So they are going to manufacture electric carts for lazy people to use in WalMart?