Canada Sales Recap: October 2013

With forecasters calling for another year of improved Canadian auto sales, 2013’s early months didn’t add up. January volume fell 2.2%, February sales were down 3.3%, and March’s results were off the pace by 0.7%. But not since the first quarter ended have the players competing for sales in Canada reported anything but collective improvement.

55,000 more vehicles have been sold during the first ten months of 2013 than during the equivalent period in 2012, a 3.8% increase. 2013’s rise follows three consecutive years of improved Canadian auto sales. The current pace suggests Canadians will end 2013 having registered more than 1.7 million new vehicles for the first time since 2002.

Car sales in October punched above their year-to-date weight at BMW, Cadillac, Honda, Hyundai, Infiniti, Jaguar, Lincoln, Maserati, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Smart, and Volvo.

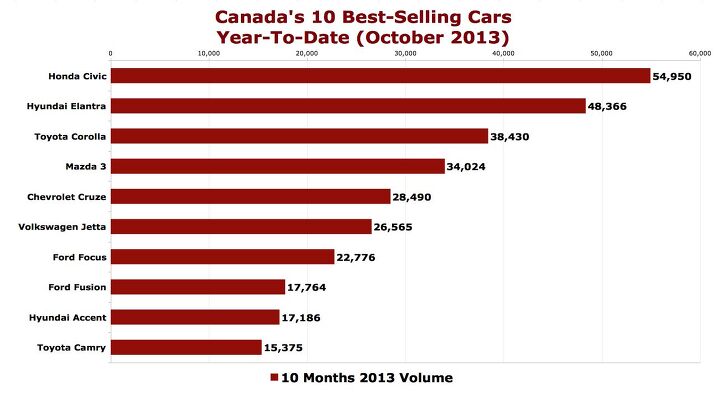

Canadian car sales rose by fewer than 3000 units, yet the Honda Civic (up 1811 units), Mazda 3 (up 1313 units) and Toyota Corolla (up 794 units) combined for a 35.4% increase. The Civic was responsible for more than one out of every ten new car sales in Canada in October. Its year-to-date lead over the Hyundai Elantra grew to 6584 units. The Elantra led at 2013’s halfway point by 305 sales.

Passenger cars did not, however, manifest across-the-board gains. Combined, car sales were down 4.8% at GM, Ford Canada, and the Chrysler Group. Total Toyota brand car sales fell 5.2% as sales of the brand’s hybrid passenger cars slid 15.6%. Kia car sales fell 6.4% despite Rio and Soul increases. Audi’s cars were down 9.1%. Scion, which offers no crossovers, was down 24.6%. The Fiat 500 was off by 19.6%, a 93-unit decline, and the Mini Cooper range fell 22.3%.

Many of the increases reported by leading utility vehicles were significant. The Nissan Pathfinder, Subaru Forester, Mitsubishi RVR, BMW X5, and Mercedes-Benz M-Class all produced gains of at least 30%. Even without its 10.7% jump, the Ford Escape would have outsold the surging Toyota RAV4 by more than 1300 units. But Escape sales did jump 10.7%, and the Escape outsold the second-ranked RAV4 by 1769 units. Ford sold more than three Escapes for every two RAV4s in October.

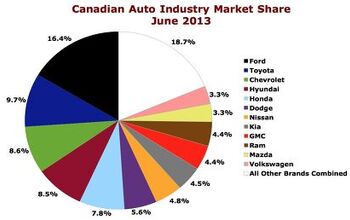

So far this year, pickups account for 18.2% of the Canadian auto industry’s sales volume. Trucks make up 13.9% of U.S. auto sales.

Three in ten Chrysler sales are Ram-derived. The F-Series is responsible for more than four in ten Ford Canada sales and nearly four in ten GM Canada sales come from pickups.

The impression that Canadians buy more trucks, SUVs, crossovers, and minivans than cars isn’t inaccurate, but it is skewed by the presence of Chrysler, Ford, and General Motors. Remove their presence from the equation and cars go from forming just 44.6% of the industry’s October volume to 61.4%.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- SCE to AUX With these items under the pros:[list][*]It's quick, though it seems to take the powertrain a second to get sorted when you go from cruising to tromping on it.[/*][*]The powertrain transitions are mostly smooth, though occasionally harsh.[/*][/list]I'd much rather go electric or pure ICE I hate herky-jerky hybrid drivetrains.The list of cons is pretty damning for a new vehicle. Who is buying these things?

- Jrhurren Nissan is in a sad state of affairs. Even the Z mentioned, nice though it is, will get passed over 3 times by better vehicles in the category. And that’s pretty much the story of Nissan right now. Zero of their vehicles are competitive in the segment. The only people I know who drive them are company cars that were “take it or leave it”.

- Jrhurren I rented a RAV for a 12 day vacation with lots of driving. I walked away from the experience pretty unimpressed. Count me in with Team Honda. Never had a bad one yet

- ToolGuy I don't deserve a vehicle like this.

- SCE to AUX I see a new Murano to replace the low-volume Murano, and a new trim level for the Rogue. Yawn.

Comments

Join the conversation

You can gauge a country in decline, by how many welfares buy elantras. Poor Canada