Chart Of The Day: The Electric Future

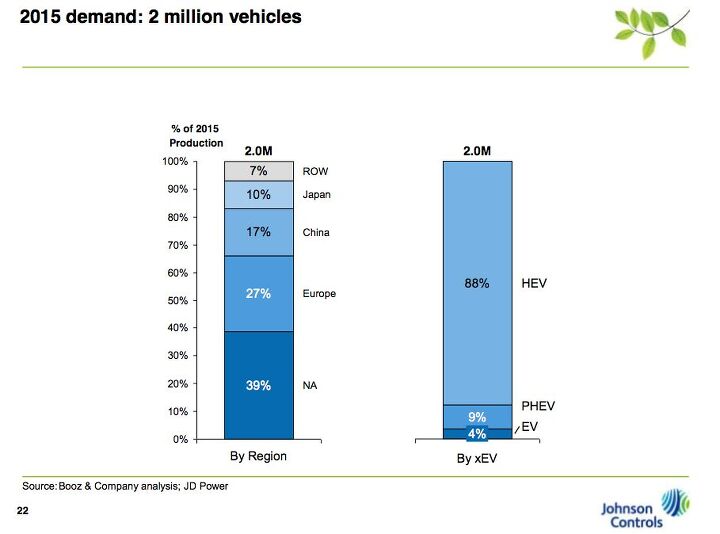

Whither the electrified market? According to this slide from a recent Johnson Controls analyst presentation [full PDF here], 2m global units by 2015 seems to be one of the models the industry is working on. And compared to other 2015 estimates, like Pike Research’s 3.1m worldwide number, it’s a fairly conservative approach. Still, there’s a long road ahead for plug-in and even hybrid vehicles. Toyota’s Prius, by far the best selling hybrid nameplate in America, sold about 152k units in the last 12 months. All hybrid nameplates sold 27,800 units last month [per Edmunds], for an annualized rate (non-SAAR) of about 333,600 or about half of the estimated 2015 market. Why that’s a problem, after the jump…

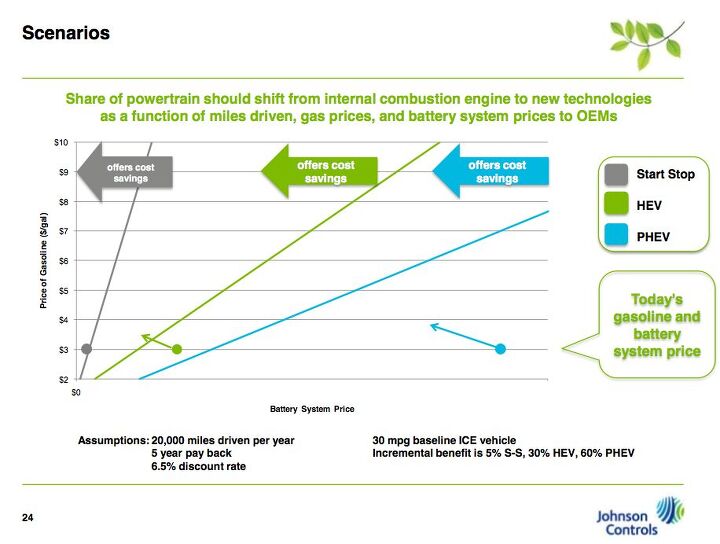

Hybrids don’t start making sense at their current prices until gas reaches $4/gal, and electrics are even farther from economic viability. Short of a gas price spike or the passage of a gas tax, it’s hard to see demand doubling for hybrid technology’s marginal economic advantages. And let’s not even start with plug-ins. Meanwhile, despite offering cost savings even at $3/gallon gasoline, stop-start technology doesn’t appear to be in any rush to arrive stateside. By 2015, JCI’s estimates show European stop-start penetration at nearly $14m, while the rest of the world will barely be hitting 2m stop-start-equipped sales. That’s fairly counter-intuitive, given the ramp-up in CAFE and GHG emissions standards in the US, which by 2015 will be about to hit full stride. Of course, when the EPA testing system doesn’t show any of stop-start’s benefits, common sense isn’t going to be enough.

Have a chart that illustrates a trend or truth about cars, automotive technology or the car market? Send it to editors@ttac.com. Want to request a chart for Chart Of The Day? Drop us a line at the same address, and we will do what we can to oblige.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

Ed, you seem to be using some numbers that apply to the world market and others that apply to the US market, without distinguishing between the two. Can you clear that up?

Unless you see mass adoption of car-sharing programs, city-based EVs will not make much financial sense down the road. The only way to truly get the ball off the ground is to make certain business districts carless and offer EV rental and car-sharing programs so people who don't want to walk or bike (or can't) can get around. The US is where it's at because every other market has been incentivizing economical ICEs for decades with high gasoline taxes. The wallet is the easiest lever to use in modifying people's buying habits. As for China and India... cheap and (very) economical cars are the only ones within the purchasing ability of the middle class... until they reach US levels of prosperity, that's not going to change much.