#gmac

The Dealer Who Swindled $6 Billion From General Motors

In the opening moments of the above scene from the flick “Fargo,” Oldsmobile dealership sales manager Jerry Lundegaard is working up some bogus paperwork to cover his tracks with General Motors Acceptance Corporation (GMAC). We can infer that he sold some floor-planned cars and did not pay back GMAC, which was the impetus for the movie’s storyline of his bumbling attempt to extort money from his father-in-law.

Jerry’s store may have been “out of trust” with GMAC on a few dozen 1987 Cutlasses, but that pales in comparison to the scheme concocted by New York car dealer John McNamara.

Between 1980 and 1991, McNamara convinced GMAC to advance him $6.2 billion to pay for 248,000 conversion vans that did not exist. It was one of the largest Ponzi schemes in history and ended up costing GMAC $436 million, equal to $725 million in today’s dollars.

We would like to show you a photo of McNamara but none are to be found. That may be because it is believed he went into the Witness Protection Program a few years after his conviction for fraud in 1992. Just picture Lundegaard with a really big brain.

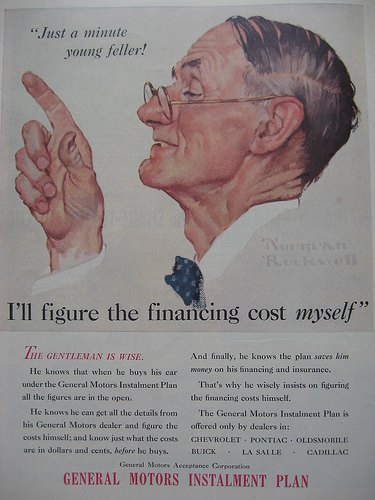

McNamara’s brilliant swindle was deliciously simple. It was based on one undeniable truth he learned from his years of owning a Buick-Pontiac-GMC dealership on Long Island: General Motors and GMAC were too incompetent and too bureaucratic to figure out that they were being scammed.

Chevrolet Offers 14.7% APR Financing To "Well Qualified" Corvette Buyers

While perusing Chevy’s website to see if there is any color of the 2014 Corvette that actually makes the car look halfway decent, I came across the financing offer pictured above. And, no, I did not enter any personal info that would lead GM’s captive Ally Financial (or whoever the hell GMAC is now) to deem me only eligible for such a high interest rate. Just what is going on here?

General Motors to Divest Remaining Ownership of Ally Financial

Ally Financial, the bank holding company formerly known as GMAC, is still a major part of the United States federal government investment portfolio in the five years since it was bailed out at the start of the Great Recession. Yet, it may be able to soon divest its ownership in part due to General Motors selling their remaining shares.

97 Months And Running

8 years to pay off a car? A report by the Wall Street Journal claims that in Q4 of 2012, the average car loan stretched out to 65 months, or just over 5 years. Loan terms were being stretched out over increasingly longer terms too, with credit firm Experian reporting that nearly 1 in 5 car loans had terms between 73 and 84 months long, with some stretching for as long as 97 months.

How A New Generation Of Sub-Prime Auto Financing Could Cause Another Catastrophe

March was the 5th straight month of a SAAR above 15 million vehicles. Industry analysts have explained the strength of the market in a number of ways. The need to replace older vehicles is one (new car sales were hit hard during the recession as consumers held on to their vehicles for longer. This also caused used car prices to skyrocket, something TTAC has been documenting), while others have cited increasing fleet demand, and the desire to replace vehicles damaged in Hurricane Sandy.

But one factor that is just starting to get attention outside of TTAC is sub-prime financing. Sub-prime lending, which involves giving high-interest loans to customers with poor credit scores, is driving the SAAR in a big way, by letting buyers with poor credit purchase new cars. In turn, the sub-prime bubble is being driven by Wall Street, whose clients cannot get enough of financial instruments backed by sub-prime auto loans.

The Artist Formerly Known As GMAC Comes Back To Mami - Partially

Bailed-out GM agreed to pay about $4.2 billion for the European and Latin American operations of likewise bailed-out Ally Financial, formerly known as GMAC.

GM's Floorplan Banker Could Take Mortgage Arm Bankrupt

There is new trouble brewing in an important part of GM’s business: Ally, the former GMAC. Nearly 75 percent of the credit that GM dealers in the United States use to finance their inventories is from Ally, says a Reuters report. The report also says that Residential Capital (ResCap) – Ally’s mortgage servicing and lending unit – is again on the verge of being put into bankruptcy.

GM's AmeriCredit Deal: Awaiting Approval

Now that GM’s acquisition of the subprime lender AmeriCredit has had 24 hours to sink in, howls of protest are starting to surface. The charge is being led by Senator Chuck Grassley, who has requested a review of the deal from the SIGTARP, saying

If GM has $3.5 billion in cash to buy a financial institution, it seems like it should have paid back taxpayers first. After GM’s experience with GMAC, which left GM seeking a taxpayer bailout, you have to think the company and, in turn, the taxpayers would be better off if GM focused on making cars that people want to buy and stayed clear of repeating its effort to make high-risk car loans.

And though Grassley’s criticism could be read as mere partisan gamesmanship from a leader of “the party of no,” there are a number of very good reasons for opposing the deal.

Desperately Seeking Subprime: White House Admits GM's IPO Dash Hurting Ally's TARP Payback

The WSJ [sub] reports that GM is officially looking outside of its former captive finance arm Ally Financial (formerly GMAC) as it seeks more subprime loan deals to drive sales volume ahead of its IPO. GM execs tell the WSJ that The General could do even better with an in-house finance arm, but that these deals will help. And, according to Experian Automotive’s Melinda Zabritski, GM needs the help because

By not financing [subprime] consumers, they are locking out about 40% of the U.S. population

GM’s restructuring consultants AlixPartners add that loyalty improves for customers who buy using a captive lender. The downsides? Higher default risks, the temptation to overload on incentives, and then there’s one more biggy…

GM Captive Finance Push Explained: The General Wants More Subprime Business

When we first heard that GM was eying a return to in-house financing, our first reaction was to worry that

the potential for falling back into old bad habits can’t be ignored.

Clearly our concern wasn’t wasted, as the AP [via Google] reports that The General’s major motivation for considering re-creating a captive lender is to chase subprime business its current major lender won’t touch. And considering that that lender is GM’s bailed-out former captive finance lender GMAC (now Ally Financial), which was badly burned by subprime mortgages, it’s not surprising that GM is frustrated by GMAC’s tentative approach. But should The General charge into the low-standard lending sectors where Ally fears to tread?

GM And Chrysler Racing Towards Captive Finance?

News that GM is considering a number of options for a return to captive finance, has lit a fire under Chrysler CEO Sergio Marchionne, who tells the Detroit News that

One of the things that we do not wish under any circumstance is to have an uncompetitive relationship vis-À-vis GM

That would certainly be the case if GM bought up its recently-bailed-out former captive finance arm, GMAC (now known as Ally Financial). Chrysler relies on GMAC for leasing and loans just as much as GM does at the moment, so an Ally buyout would create major long-term problems. But even if GM created a new finance arm, Chrysler doesn’t seem to think that it will be able to survive without forming its own in-house finance department. Which would then compete with GM and Ally, to say nothing of the industry’s other finance competitors. But is the rush to captive finance going to be good for anyone?GM Eying Return To Captive Finance?

GMAC Renames Itself Ally Financial

Perhaps the most fundamental challenge facing bailed-out financial and auto firms is convincing consumers to leave aside their anti-bailout prejudices and start buying their products. For GM, the first step in this process was as simple as repaying a loan and airing a “Mission Accomplished” advertisement that did everything but show Ed Whitacre landing on an aircraft carrier. For GM’s former captive finance arm, GMAC, escaping the stain of the bailout is a more prosaic matter. Having already launched an online consumer-oriented banking arm by the name of “Ally Bank,” the finance company is adopting the innocuous Ally moniker for its entire business, reports the Detroit News.

GM, GMAC Go Their Own Ways

In their latest report, the Congressional Oversight Panel suggested that GM’s formerly captive finance arm GMAC shouldn’t have been split from the automaker it still supports. If this led you to believe that GM would take the troubled finance firm back under its corporate wing, you have another thought coming. The WSJ [sub] reports that

The idea appealed to GM, in part because auto maker would have more control over lending practices. GMAC’s move in 2008 to dramatically restrict leasing amid the U.S. financial crisis helped trigger the spiral that sent GM into bankruptcy the last year… But taking over GMAC would have many complications. GM sold a majority stake in GMAC in 2006 as a way to buck up the auto maker’s credit standing and its access to capital. As it turned out, GM still remains largely cut off from the markets.

Congress: The GMAC Bailout Might Have Been A Bad Idea

After three separate bailouts totaling over $17b, Congress is beginning to wonder if keeping auto-finance giant GMAC alive was worth it. Forbes reports that the Congressional Oversight Panel reckons at least $6.3b of that money could be gone forever, as GMAC flounders towards barely breaking even. And like the rest of the bailouts, the fundamental problem is that the influx of federal cash has allowed GMAC to pretend like it’s not struggling for survival. The panel report [ full document in PDF format here] notes [via Automotive News [sub]]

Treasury’s previous and current support is not underpinned by a mature business plan. Although GMAC and Treasury are working to produce a business plan, Treasury has already been supporting GMAC for over a year despite the plan’s absence. Given industry skepticism about GMAC’s path to profitability and the newness of the non-captive financing company model, it is critical that Treasury be given an opportunity to review concrete plans from GMAC as soon as possible.

Sound familiar?

Recent Comments