Congress: The GMAC Bailout Might Have Been A Bad Idea

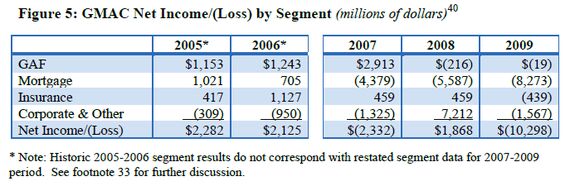

After three separate bailouts totaling over $17b, Congress is beginning to wonder if keeping auto-finance giant GMAC alive was worth it. Forbes reports that the Congressional Oversight Panel reckons at least $6.3b of that money could be gone forever, as GMAC flounders towards barely breaking even. And like the rest of the bailouts, the fundamental problem is that the influx of federal cash has allowed GMAC to pretend like it’s not struggling for survival. The panel report [ full document in PDF format here] notes [via Automotive News [sub]]

Treasury’s previous and current support is not underpinned by a mature business plan. Although GMAC and Treasury are working to produce a business plan, Treasury has already been supporting GMAC for over a year despite the plan’s absence. Given industry skepticism about GMAC’s path to profitability and the newness of the non-captive financing company model, it is critical that Treasury be given an opportunity to review concrete plans from GMAC as soon as possible.

Sound familiar?

So why didn’t congress just let GMAC fail? Is it, like so many other financial institutions claim to be, too big to fail? Not exactly, as The Atlantic‘s analysis of the report shows. According to the COP reportTreasury has never argued that GMAC itself was systemically important, although in 2008 some Treasury staff members believed that GMAC’s failure at that time – independent of its effects on the domestic automotive industry – could have thrown an already precarious financial system into further disarray during the depths of the financial crisis.The real issue? Floorplan financing. Had GM and Chrysler not been delicate taxpayer “investments” there would have been a lot less impetus to send billions to GMAC. Strangely, GMAC’s auto-finance business has very nearly returned to profitability, and the COP suggests that GMAC should have had its auto-finance division stripped away from the firm’s other money-losing ventures (and possibly even returned to GM).

Then there are the other issues with GMAC’s bailout: the lack of Treasury conditions, the possible WTO implications, the stress-test failure, the GMAC-unique Capital Assistance Program, and more. As The Atlantic’s Daniel Indiviglio concludes, “for now, it looks like GMAC will continue to enjoy unconditional government support as long as GM does.” Which is problematic in and of itself. As former Car Czar Steve Rattner has graphically illustrated, the GMAC bailout also helps make the GM bailout look better than it might otherwise, when they should in fact be considered one and the same bailout.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- 1995 SC Man it isn't even the weekend yet

- ToolGuy Is the idle high? How many codes are behind the check engine light? How many millions to address the traction issue? What's the little triangular warning lamp about?

- Ajla Using an EV for going to landfill or parking at the bad shopping mall or taking a trip to Sex Cauldron. Then the legacy engines get saved for the driving I want to do. 🤔

- SaulTigh Unless we start building nuclear plants and beefing up the grid, this drive to electrification (and not just cars) will be the destruction of modern society. I hope you love rolling blackouts like the US was some third world failed state. You don't support 8 billion people on this planet without abundant and relatively cheap energy.So no, I don't want an electric car, even if it's cheap.

- 3-On-The-Tree Lou_BCone of many cars I sold when I got commissioned into the army. 1964 Dodge D100 with slant six and 3 on the tree, 1973 Plymouth Duster with slant six, 1974 dodge dart custom with a 318. 1990 Bronco 5.0 which was our snowboard rig for Wa state and Whistler/Blackcomb BC. Now :my trail rigs are a 1985 Toyota FJ60 Land cruiser and 86 Suzuki Samurai.

Comments

Join the conversation

In 2009 GMAC paid $7.7 million to Sam Ramsey, its chief risk officer who was hired in 2007. Is that pay for performance?

If GMAC is barely breaking even then the intervention was successful. Agree on cynical interpretation of anything Senate and Congress does, whatsoever. "Trained professional liars".