#export

Editorial: The Future Is Here At Nissan – Just Not In The Way You're Expecting

The big news this past week from Nissan: lots of old iron at Pebble Beach, concept car test drives for sympathetic journalists and a pledge to have autonomous cars ready (but not on sale) for 2020. More interesting than that is news of Nissan’s booming exports from America. Some say that this is the “new normal” – Japanese OEMs expanding their manufacturing base in America as they leave Japan en masse to both insulate themselves from a volatile yen, take advantage of America’s welcoming manufacturing climate and shed a reliance on Japan’s aging and declining population. And even more interesting than that is how it was presented.

Only A Nutcase Would Import A Car To America. B.S. Wants To Change That, And He Needs Your Signature

As a worldly American and car nut, on one of your world travels, there will be a time when you fall in love with a car in a foreign land. The crush on that thing will be so big that you will want to take the irresistible beauty home with you. Just ask Sajeev or Frau Murilee.

My advice: Resist that urge at all cost. Trust me, it is easier to import a new wife from Pago-Pago to America than to bring-in a lightly used Euro-spec Porsche from Zuffenhausen. There is one man who wants to change all that: A man with the initials B.S. petitioned the White House to liberalize the immigration rules for used cars. No, it’s not THAT BS.

Rebuild, Part Out, Export, or Race Out: 2002 Toyota Camry

Every once in a very blue moon, I’ll go to a mini-warehouse auction.

The realities of this low-down clearance process is completely unlike the miracles and glories that come with episodes of Storage Wars. You want junky third world quality furniture? Or memoirs of the 1980’s and 1990’s left behind by your neighbors from their very last estate sale before they finally moved to a condominium? The local storage auctions are the place to go. 80% to 90% pure junk.

This is where I recently found this wrecked 2002 Toyota Solara SE with 140k miles. For $375, it was all mine.

Should I…

Japan Opens Up To Imports; Just Not From The Big Three

All the complaints about Japan being a “closed market” are hogwash; look at all the imports coming in to Japan from places like Thailand, Malaysia and China.

Say "As-Salamu Alaykum" To Yusuf Al-Isuzu

Isuzu is joining the “let’s flee Japan and the rising yen” bandwagon, and their latest venture involves assembling export-bound trucks in Saudi Arabia.

Italian Made Chryslers A Possible Solution For Fiat's Overcapacity Problem

Sergio Marchionne has been one of the most prolific alarmists regarding European overcapacity, and who can blame him? The economy is in the dumps in Fiat’s home market, as well as crucial export markets, and closing a plant would come with all kinds of blowback.

Coda Teams Up With Great Wall To Build "Affordable" EVs

Coda Automotive, a Southern California start-up that assembles EVs with Chinese components, announced at today’s Beijing Auto Show that it would partner with the Chinese OEM Great Wall to develop a new, lower-cost EV. Says Coda CEO Phil Murtaugh (who you might remember as a key character in American Wheels, Chinese Roads) explains in a press release

Toyota Steps Up Exports. From North America

Which country is Toyota’s second largest export hub? If all goes according to the wishes of Yoshimi Inaba, president of Toyota Motor North America, then that will be North America. Toyota has an annual production capacity of 1.8 million vehicles in the U.S. alone and wants to export increasing numbers to the world, Inaba told The Nikkei [sub].

It's Starting: BMW To Export Made-in-China 5 Series

We have always maintained that what will get exports of Chinese cars in high gear is not Chinese cars, but foreign cars. Foreign cars, made by joint ventures in China. Nevertheless, I admit my high surprise to read, from China Daily to Chinacartimes, that BMW will export Made in China cars. And not their bread and butter 3 series.

BMW will become the first foreign luxury car manufacturer to export China-made cars when it begins shipping locally produced long-wheelbase 5 Series sedans overseas at the end of the year.

Argentina: Want To Sell Porsches? Export Our Wine And Olives

With a 35% import tax on new cars, Argentina is already a touch market for foreign brands seeking to bring cars into the country. But the Argentinean government has just made it little bit harder by demanding that importers export an equal amount of Argentina-made goods for every car imported. As a result, Bloomberg reports that Porsche’s importer is exporting Malbec wines and olives, Mitsubishi’s importer is getting into the peanut export game, and Subaru’s representative is shipping chicken feed to Chile. BMW, which has had recent difficulties importing into Argentina, is focusing on its core business, exporting auto parts and upholstery… and a little processed rice to make up the difference. But why are these major manufacturers getting into all kinds of strange side businesses just because Argentina wants to improve its trade balance and foreign currency reserves? Simple: Argentina is South America’s second-largest economy, and it’s been growing at over 5% per year since 2007 (i.e. when other markets were shrinking). So if the government wants imports balanced with exports, well, Porsche’s importer is just going to have to get into the wine business, isn’t he?

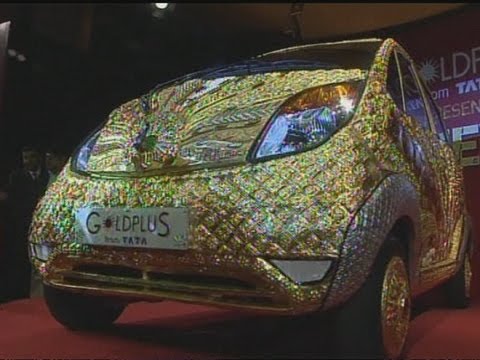

The Nano No-No: Export Launch Delayed Over… High Price?

Designed to be the world’s cheapest car, the Tata Nano is supposed to compete with scooters and three-wheelers rather than full-priced, global-brand vehicles. But the Nano has already seen several price increases since the target MSRP of $2,500 was announced, and the price in India for a base-level Nano is now about $2,870. And when you talk about such low prices, even small increases can wreak havoc on expected volumes, and as a result the Nano is turning into something of a flop (helped along by its pyromania problem).

Australia Reacts To The Chinese Invasion

China’s assault on the auto markets of the west may have been delayed another five years, but Australia is going to be the canary in the coal mine. The first mature Western-style market to see any significant imports of Chinese vehicles, led by the Chery J1, is adapting to a new era of low-cost, low-content cars. And it seems that the Chinese OEMs are right to be waiting for future generations of vehicles, as the J1 seems unlikely to make even the impact that Hyundai’s departed Excel made. One reason: safety. Or lack thereof. Hit the the jump to see what we’re on about.

Chevrolet Global Colorado Debuts In Thailand

Editor’s note: GM has officially confirmed what the UAW already let slip: Chevy’s new midsized Colorado pickup will be built at the Wentzville, MO plant and sold in the US. More details on that decision are forthcoming, but in the meantime, here’s Edd Ellison’s report from the global launch of the Colorado in Bangkok, Thailand.

Chevrolet has launched its new-generation Colorado in Thailand where it will be built and exported to 60 global markets. In true GM style, the ceremony was lavish – a cluster of truck ploughed their way through a large field of crops planted in a Bangkok exhibition hall watched by the media, dealers and VIPs packed into several grandstands – and the message was just as upbeat, the automaker feeling it has a product that can compete in the crowded mid-size segment.

Sibling Rivalry Watch: Is Kia Outshining Hyundai?

Hyundai and Kia are technically separate companies, with Hyundai owning less than 50% of its junior partner. But as the two major divisions of the Hyundai-Kia Motor Group, the two firms share resources and align their strategies through carefully-maintained relationships in the classic Korean chaebol (conglomerate) fashion. Hyundai has long been the senior partner in the relationship, getting the newest technologies and the most expensive new cars. But in both Korea and abroad, Kia is beginning to catch up with its big brother, raising questions about the future shape of its delicate relationship. Together, Hyundai and Kia enjoy a dominant position in Korea, earning 45.2% and 33.2% of the overall Korean market in 2010 (including commercial vehicles). But if you just look at sedans and SUVs, the Korea Herald reports that their 2010 market share numbers are much closer: 39.6% and 35/7% respectively, and converging

Hyundai Motor Group is focusing on the possibility that Kia will catch up with Hyundai within one year in terms of monthly market share ― for sales of sedans and sport utility vehicles ― domestically for the first time…

The gap for sales of sedans and SUVs have continued to narrow ― 22.9 percentage points in 2007, 17 percentage points in 2008, 15.4 percentage points in 2009 and 3.9 percentage points in 2010.

And this fresh-brewed sibling rivalry isn’t just about Korea: around the world, Kia is catching up. And this shifting relationship is shaking things up at the highest levels of the group’s leadership.

Are You Ready For: An American Volvo?

The national character of auto brands is a tricky thing. For decades, Volvo wore its Swedishness on its sleeve, emphasizing the values that made Ikea, Abba and Swedish porn so popular in the US… even when it was an outpost of the Ford empire. And then the unthinkable happened: Chinese up-and-comer Li Shufu bought the brand and rolled it into his Geely empire. In the world of national-character-branding, being bought by a Chinese firm is something like hiring Casey Anthony as a brand ambassador, or using a mascot called “Mr Melamine Milk” (another nightmare scenario can be found here). So, how does a brand like Volvo, that was built on Swedishness, get past the “China Factor”? By doubling down on Swedishness? How about by building cars in the US?

Recent Comments