#doe

White House Announces Up To $4.5B in EV Infrastructure And 'Unprecedented' Public/Private Market Growth Plan

Yesterday the Obama administration announced “an unprecedented set of actions” to grow the U.S. plug-in electrified vehicle market.

The initiative represents a broad collaboration between federal agencies, state governments, major automakers, utilities, and others to aid the ongoing push to make electric cars viable alternatives to the internal combustion variety.

Perhaps chief in a laundry list of public and private sector agreements is up to $4.5 billion in loan guarantees for commercial scale charging — including fast charging — to create a nationwide network.

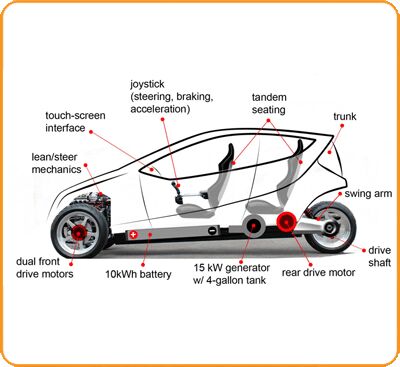

Elio Motors Applies for $185 Million Dept of Energy ATVM Loan

The most recent news out of the Elio Motors will provide grist for the rhetorical mills of both skeptics and enthusiasts of the startup car company. As we anticipated in our most recent post about Elio, the company has applied for a loan from the U.S. Department of Energy’s newly revived Advanced Technology Vehicles Manufacturing (ATVM) loan program. Though Congress had allocated $25 billion for the ATVM loans, less than half was disbursed before the program was put on hiatus in the wake of the failure of Fisker, which had been granted about half a billion dollars in loan guarantees. Elio Motors announced that it will be seeking a loand of $185 million to “accelerate the company’s plans to begin production” of their enclosed tandem reverse trike next year.

DOE Head Moniz: Whichever Chinese Company Buys Fisker Must Keep Work in U.S.

United States Energy Secretary Ernest Moniz said the whichever of the two Chinese bidders for the assets of Fisker Automotive wins the court ordered auction on February 12th it will still have to keep Fisker’s manufacturing and research in the U.S. Automotive News reports that Hybrid Tech Holdings LLC and Wanxiang America Corp. are fighting over the remains of Fisker in U.S. bankruptcy court for the remains of Fisker, an Energy Department loan recipient that stopped making its luxury plug-in hybrid cars in 2012.

“I’m not going to pick a winner of the auction,” Moniz said at the Washington Auto Show. “What’s key for us is of course the terms of our loan have to be respected. We have technology transfer limitations first of all. No matter who the winner is we will be looking at both engineering and manufacturing in the U.S. That’s the key for us.”

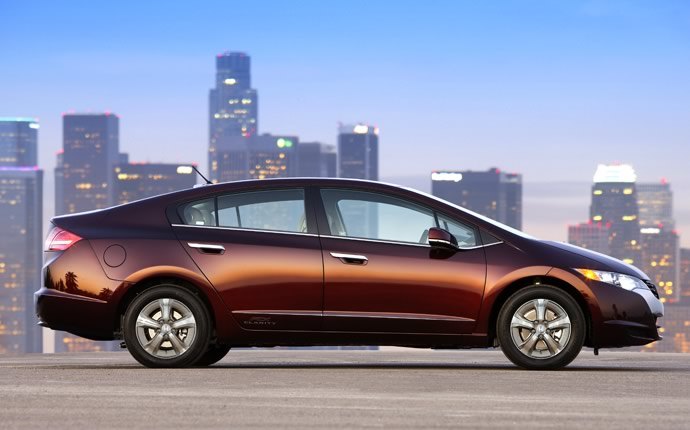

Never Say Never: Hydrogen, Diesel En Vogue Again

Remember this piece from the Honda Summer 2008 Hydrogen Collection? It was supposed to point the way to future of green fuel technology before the Tesla brought plug-in sex appeal down the ramp with their Roadster and, later on, the S, as well as the trend of compliance EVs from Chevrolet, Volkswagen and Kia.

But with sales of plug-in hybrids advancing far slower than originally expected regulators are taking another look at alternative ZEV powertrains.

Has the Dept of Energy's Advanced Technology Vehicle Manufacturing Program Been a Failure? Not Really

Critics of the current administration have pointed to the impending bankruptcy of Fisker Automotive and the recent suspension of operations at taxi maker Vehicle Production Group as examples of why the government shouldn’t be picking winners and losers in it’s zeal to promote alternative energy. The DoE effort under which those two companies received financing is the Advanced Technology Vehicle Manufacturing Program, ATVM. Putting aside political ideologies, contrary to the image given by the apparent failure of Fisker and VPG, the ATVM program actually has a pretty decent track record when it comes to picking winners and losers.

DoE Gets Some Money Out Of Fisker

The U.S. government has managed to recover $21 million in cash from Fisker, funds that will go towards repaying the nearly $200 million its received from the government in the form of loans.

VC Firms Expected To Take A Billion Dollar Bath On Fisker

PrivCo, a private corporate intelligence firm, has published a 20+ page dossier on Fisker’s seemingly strong ability to fundraise for itself, while failing to do a good job of actually creating cars. With Fisker teetering on the verge of bankruptcy, the results are staggering; with just under 2000 units sold, Fisker burned through an estimated $1.3 billion in venture capital, taxpayer-funded loans and private investor funds.

Tesla To Pay Down DoE Loan In 5 Years Or Less

Tesla announced plans to pay down their $465 million dollar Department of Energy loan in 5 years or less, as Tesla seeks to achieve profitability.

Romney Dubs Tesla, Fisker As "Losers", As Tesla Issues Stock To Stay Afloat

Viewers of last night’s Presidential debate may have caught Mitt Romney bad-mouthing Tesla and Fisker during his remarks. Meanwhile, Tesla’s new prospectus shows that they’re hardly out of the woods yet, financially speaking.

Your Tax Dollars At Stake: Battery Maker A123 Running Out Of Runway

The irrational electrification exuberance claims another victim: Battery maker A123 Systems Inc is running out of money. A lot of it is your money. Says Reuters:

Tesla To Pay Back DOE Loans By Year End

Tesla Motors has almost used up funds from a Department of Energy loan program – but the startup car maker also says that they’ll start paying back the money at the end of 2012.

Coda Withdraws DOE Loan Request Worth $334 Million

Coda Automotive withdrew a Department of Energy loan application after two years of waiting. The $334 million loan was supposed to have gone towards establishing an assembly plant in Columbus, Ohio, but for now, production will continue in China.

Denied DOE Loan Makes Carbon Cop Cars DOA

When solar panel maker Solyndra went bankrupt last year, which cost the taxpayer $528 million in DOE loan guarantees, the end of the DOE loan program was quickly prognosticated. The loan program is still around, but new loans have for all intents and purposes dried up. Just a week after presumptive EV maker Bright Automotive called it quits and withdrew a DOE loan application, the program claims another victim. It is Carbon Motors, the Connersville, Ind. startup that wanted to sell fuel-efficient cop cars.

Feds Predict The Future Of The Auto Industry, Foresee Chrysler Freefall, GM Stagnation

Reasonable minds can disagree about the wisdom of the auto bailout, but according to analysis by the EPA and Department of Transportation (based on data from the Department of Energy and auto forecasters CSM), the Government’s rescue of GM and Chrysler may not have been the best idea (at least from a market perspective). According to data buried in the EPA/DOT proposed rule for 2017-2025 fuel economy standards [ PDF here], Fiat-Chrysler is predicted to be the sick man of the auto industry by 2025, losing over half of its 2008 sales volume, while GM is expected to improve by only 3%, the second-worst projected performance (after Aston-Martin). In terms of percentages, even lowly Suzuki and Mitsubishi are projected to grow faster than The Mighty General. Ouch.

On the other hand, the proposed rule notes that data will be finalized before the final rule comes out. Besides, the agencies appropriately admit (in as many words) that projecting auto sales so far into the future is one hell of a crapshoot. Still, with the obvious exception of “Saab-Spyker” and with some skepticism about the projection’s optimism about overall market growth aside, these are not the craziest guesses I could imagine. Who knows what the future holds, but it certainly is a bit troubling that the government’s own data suggests the two automakers it bailed out may well have some of the weaker performances of the next 14 years. At least the Treasury could have sold off their remaining GM stock before this report was released…

Smyrna And The Solyndra Problem

Ever since the messy collapse of solar panel maker Solyndra just two years after it received over half a billion dollars in government loans, the political climate around all green energy loan programs has heated up considerably. As the White House opened an investigation of the Department of Energy’s entire loan portfolio, loan recipients and startup automakers Tesla and Fisker found themselves under attack. And why not? Fledging firms with unproven products in brutal, scale-driven industries are hardly safe bets, even in the best of times. And with the government drowning in deficits, who’s in a gambling mood?

What gets left out in the hue and cry is that Tesla and Fisker between them represent “only” about a billion dollars worth of DOE loans in a program that was supposed to be able to loan out $25b (the final tally could be closer to $18b). Dwarfing the half-billion-each investments in Fisker, Tesla, and Solyndra are projects that seem a lot less risky in contrast to the startups. Here, in Smyrna, TN, I got to see one of them being built.

Recent Comments