Chrysler: I Am Ram (Dependent)

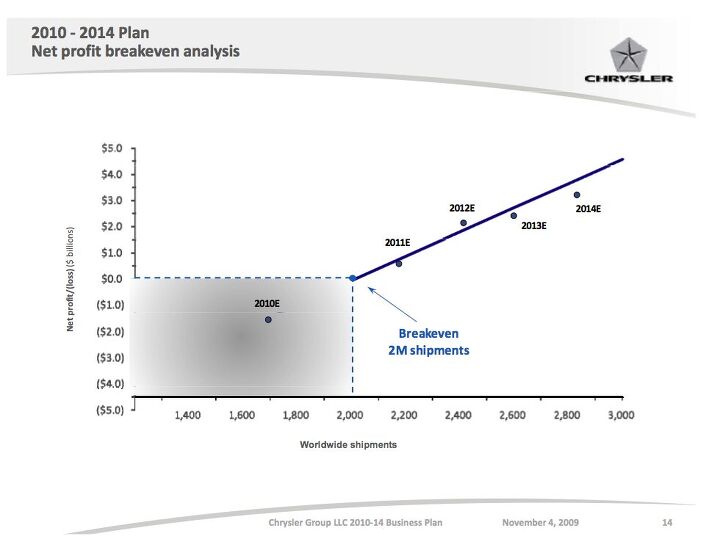

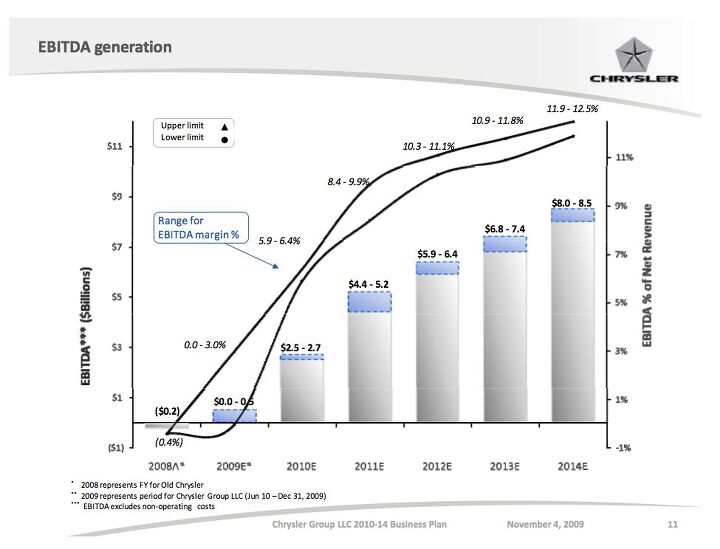

Look at Chrysler’s sales volume by model, and it’s clear that Ram is one of the few nameplates keeping Chrysler’s volume moving. Especially when you consider that pickups typically generate far more profit than car and crossover models. Which brings us to what may have been the most penetrating question of Wednesday’s question-and-answer period (which didn’t come from a journalist, but from investment bank Goldman Sachs). Namely: how does a retraction in the truck market would affect the linear relationship between volume and profit exhibited in Chrysler’s financial plan graphs? Oh yes, and what were Chrysler’s planning projections for energy costs? The answer was that every five percent shift from trucks to compact or mid-sized vehicles would result in a half-billion dollar reduction in EBITDA. Though the CFO added that in the future Chrysler would be better able to capture that shifting market, due to better offerings in the compact and mid-size segments, Marchionne made it clear that any losses in the truck market would be mitigated at best. Marchionne joked that his team would need a Ouija board to forecast energy prices, but the reply was that assumptions in the plan were for gas to be “somewhere in the $4 range.”

Well, fuel prices have been trending upwards for most of 2009, despite continued weakness in the overall economy. More importantly, even though gas prices have been considerably lower for most of 2009 when compared to 2008, truck sales are lagging considerably. Ram’s 10-month performance is down nearly 30 percent, having moved 155,467 units through October compared to 213,684 in 2008. If that trend continues and Ram sales stay off-pace by around 30 percent, Chrysler Group would be looking at a $3b shortfall in EBITDA.Take a look and see if there’s room for that kind of loss in the plan.

Of course, there is a chance for a housing-market rebound next year, which could bump pickup sales considerably. On the other hand though, if the global economy turns around and US housing starts stay weak, the Ram could be caught between slak demand and climbing energy costs. Though Chrysler’s lack of electrification and hybrid plans are troubling in the long term (especially come IPO time), it would be hard for Chrysler to justify the extreme expense of trying to compete with the Toyotas of the world. In the short-to-middle term though, Chrysler’s extreme dependence on Ram as a profit center shows just how vulnerable their turnaround plans are. Since Fiat has no intention of injecting its own cash, those Ram profits are as good as spent as part of the $23b product expenditure over the next five years. If they’re not there, Chrysler’s products, advertising and overall financial health are all called into question. And that’s before we even begin to break down how competitive Ram is within its segment. Regardless of the overall truck market, Ram needs to gain share in order to keep the optimism (and belief in straight-line relationships between volume and profit) alive.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Master Baiter The picture is of a hydrogen fuel cell vehicle.

- SCE to AUX SAE Level 2 autonomy requires the driver to be the monitor, nothing more.That's the problem, and Tesla complies with this requirement.

- Lou_BC I read an interesting post by a master engine builder. He's having a hard time finding quality parts anywhere. The other issue is most young men don't want to learn the engine building trade. He's got so much work that he will now only work on engines his shop is restoring.

- Tim Myers Can you tell me why in the world Mazda uses the ugliest colors on the MX5? I have a 2017 in Red and besides Black or White, the other colors are horrible for a sports car. I constantly hear this complaint. I wish someone would tell whoever makes theses decisions that they need a more sports car colors available. They’d probably sell a lot more of them. Just saying.

- Dartman EBFlex will soon be able to buy his preferred brand!

Comments

Join the conversation

Full sized truck sales are never going back to where they were a few years ago. Historically, trucks represented about 25% of the US market for many, many decades. There was an anomaly wherein that shot up to over 50% by the late 90s, early 00s. Much of that anomaly was triggered by CAFE rules and the US based automakers realization that they could get around the rules by building large passenger vehicles but calling them trucks. The profit bonanza was on, and everyone inside the game knew exactly what was going down. Congress was highly reluctant to change the rules even though the way the rules were being used didn't match the original intent because this was the one market the US based companies still dominated.

Originally, trucks were give much greater leeway visa-vis fuel economy because they supposedly needed to burn all that fuel in order to do the hard work trucks were sold to do. Once upon a time, most trucks were indeed sold to people who worked 'em hard. But post-CAFE, trucks (including SUVs) became the new large, RWD, V-8 powered body on frame car substitute. The LTD of 1970 morphed into the Explorer of 1980 and the Impala reincarnated as a Chevy Tahoe. Companies did a brilliant job of exploiting the loopholes in the law to maximize short-term profits. Perhaps this is the lesson they learned from participating in auto racing.

But, just as the oil embargoes of the 1970s put the kibosh on old style American land yachts, so did the gas price spike of 2007/2008. Suddenly the majority of people buying trucks are those who actually need trucks. The real truck market is certainly headed back to the 20-25% of the market number it once had. I think the gov't counts unibody SUV/Crossovers as "trucks", so it is going to be hard to see the actual numbers.

The bottom line is that traditional pickup trucks are still going to sell, but in nothing like the numbers they did just a few years ago. I expect to see the Nissan Titan simply go away, and Toyota would be wise to shallow their pride and kill off the Tundra.

Unfortunately for Ram, Dodge's breakout in the pickup market was driven by image conscious buyers who like the I.Am.Peterbuilt look which came out in 1994. That agressive new look lifted Dodge from the shadows of GM and Ford and into a good sized market niche of its own. Unfortunately, that niche is dominated by fashion buyers, not people who need a serious truck for their work. Ram's recent redesign further improved its manners as a car substitute, but did little to increase desirability with the work truck buyer.

Finally, I am impressed that Chrysler gave an honest answer to the Goldman Sachs guy instead of just repeating nonsense.

The RAM 1500 is a top 10 seller and in a downmarket for pickups. As of October 2009, the RAM was ranked 9th in sales in the US. The RAM has basically maintained marketshare while having a 27% decrease in sales YTD (less than the Silverado and Tundra I think). Also, as far as the RAM not being a "work truck"...explain how the RAM is any less a work truck than any other pickup...especially considering the RAM HD's are considered by many as the best "work truck" available. Why would the RAM 1500 want to compete with the RAM HD's? The RAM 1500 is just as capable to do what most people need, be it pleasure or work, as any other 1/2 ton pickup. Why does a RAM 1500 need to tow over 11,000 lbs when there is already a RAM HD available that can? That's just good marketing. So, let's just kill off a top 10 seller. Put the RAM brand up for sale and just watch how fast Nissan and Hyundai get in a bidding war.