Meanwhile, in an Alternate Universe… GM's 100-Day Pre-Negotiated Chapter 11

GM’s plan to Congress for its long term financial viability results in GM being insolvent in 2012 in amounts ranging from $30-43 billion. It’s no…

Read more

Between the Lines: Jalopnik's Ray Wert Writes "Case For Rick Wagoner"

Between the Lines: Jalopnik's Ray Wert Writes "Case For Rick Wagoner"

Read more

Editorial: Bailout Watch 258: Now What? (Part Two)

If there is one man responsible for GM’s successful semi-suckle on Uncle Sam’s teat, it’s Steve Harris. I reckon GM’s PR mastermind m…

Read more

Editorial: Bailout Watch 257: Now What? (Part One)

Between 1848 and 1852 telegraph line miles in the US increased by more than 1000 percent. By 1860, most of the companies that laid those lines were gone. The…

Read more

Editorial: Bailout Watch 243: The Bottom Line. For Now.

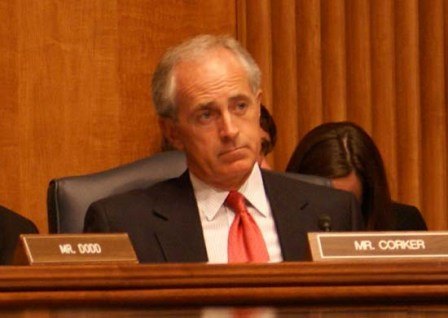

Consensus Grows At Senate Hearings: Reform Or Bankruptcy By March 31

Read more

Recent Comments