Midsize Sedan Deathwatch #15: Toyota Camry Proves to Be a Killer In August 2017

The launch of the all-new 2018 Toyota Camry began in July 2017 and delivered a big boost to America’s best-selling midsize car in August 2017.

As its competitors combined for a 12-percent loss valued at nearly 16,000 fewer sales than in August 2016, Toyota Camry sales jumped 13 percent, a gain of 4,187 sales. That figure includes 6,805 new-gen Camrys imported from Japan, where the Camry’s home market factory is being relied upon while Toyota’s Georgetown, Kentucky, assembly plant gathers steam for the entirely different Toyota New Global Architecture.

With falling sales across much of the category and rising volume at the top seller, Toyota got exactly what it called for in August 2017: a huge market share increase. But did the Camry provide the rumored boost to the segment overall? Quite clearly no, not yet.

This is the fifteenth edition of TTAC’s Midsize Sedan Deathwatch. The midsize sedan as we know it — “midsizedus sedanicus” in the original latin — isn’t going anywhere any time soon, but the ongoing sales contraction will result in a reduction of mainstream intermediate sedans in the U.S. market.

How do we know? It already has.

Granted, the Camry’s surge slowed the rate of the segment’s decline overall. Through 2017’s first seven months, midsize sedan sales in America had fallen 18 percent. Total midsize car sales were down just 7 percent in August, the slowest rate of year-over-year decline since November of last year.

The Camry’s boost wasn’t the only one deserving of credit. While sales of the transitioning Buick Regal and discontinued Chrysler 200 each fell by more than half; while the Nissan Altima, Hyundai Sonata, Kia Optima, Volkswagen Passat, and Subaru Legacy all reported double-digit percentage losses; while the Mazda 6 and Ford Fusion fell 17 percent and 8 percent respectively; while Honda Accord sales were flat; Chevrolet Malibu sales skyrocketed.

Shot through the roof.

Exploded.

Leapt over tall buildings.

The Malibu was America’s third-best-selling midsize car in August 2017, strengthened by a 36-percent year-over-year improvement.

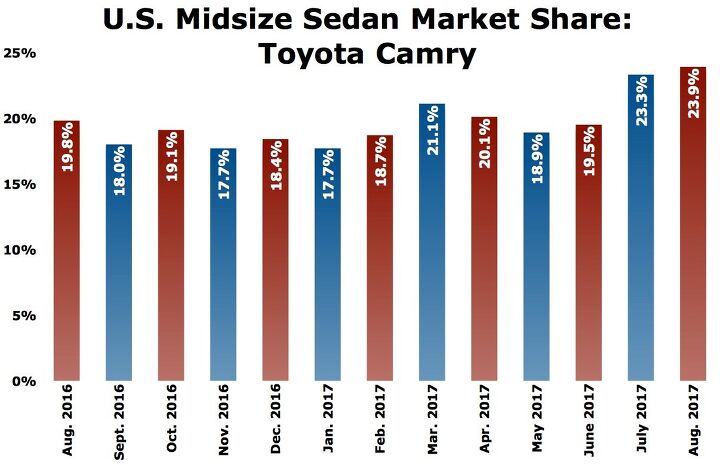

But it is the Camry, blessed with clear-out pricing on the outgoing 2017 and the oft-discussed 2018 model, that did just what Toyota thought the Camry could do: make massive market share gains. Toyota owned 17 percent of America’s midsize segment in 2013, nearly 18 percent in 2014, a full 18 percent in 2015, and marginally more in 2016. Through 2017’s first-half, Camry market share rose to nearly 20 percent.

But in August 2017, with the new Camry beginning to punch a bigger hole, Toyota owned 24 percent of America’s midsize sedan segment, a frightening figure for smaller brands that are about to see an all-new 2018 Honda Accord attempt to re-exert its influence in a shrinking category.

Not only are midsize car sales falling, the prices automakers are charging for midsize cars are falling, as well. Year-over-year, midsize car transaction prices fell 1 percent in August 2017 to $24,782, according to Kelley Blue Book. Transaction prices across the industry rose 1 percent last month, KBB says. This poses a problem for automakers competing in narrow niches of the category, where the drop in demand is accompanied by decreased margins. Mazda, for instance, owned just 2.1 percent of America’s midsize segment in August 2017, down from 2.4 percent in August 2016.

Mazda, which says it has no plans for cutting any nameplates “right now,” was certainly not the only car to lose great swathes of market share to the fast-rising Toyota Camry in August. Combined market share of the Ford Fusion, Nissan Altima, Hyundai Sonata, Kia Optima, Volkswagen Passat, and Subaru Legacy plunged from 46 percent in August 2016 to 39 percent last month.

[Image: Toyota; Chart © The Truth About Cars]

Timothy Cain is a contributing analyst at The Truth About Cars and Autofocus.ca and the founder and former editor of GoodCarBadCar.net. Follow on Twitter @timcaincars and Instagram.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- ToolGuy Clearly many of you have not been listening to the podcast.

- 1995 SC This seems a bit tonedeaf.

- 1995 SC Well I guess that will be the final nail in the Mini EV's coffin here. It was already not especially competitive, had no range and was way overpriced for what you get, but I like to get stuff like that used and well depreciated on occcasion though I likely would have passed anyway due to the Chinese manufacture.

- MKizzy If China-branded vehicles arrive on these shores filling the gaping hole of sizes, body styles, and price points largely abandoned by established automakers, they will immediately find an interested customer base among those low/middle income consumers whose parents were (un)happily puttering around in old Hyundai Excels and Yugo GVs. Personally, I do think BYD or another of their major automakers will eventually circumvent the tariffs by building in Mexico and sending vehicles north.

- Lou_BC Are you not entertained?

Comments

Join the conversation

With the end of the J-series V6, the Camry XSE may well replace my Accord Touring. My mother was a Volvo fanatic before she was royally screwed by them. In that time, I grew up driving enough Volvo 240s, S70 GLTs and T-5s and S60 T-5s to be simultaneously familiar, yet completely disinterested in turbos, turbo lag, and the attendant complexities and idiosyncrasies that accompany them. My first car was a 1993 Camry V6 XLE handed down from my parents, so I suppose it'll be a long-awaited homecoming.

Chrysler is probably the only major carmaker in the world without a midsize car in its lineup. No wonder they are ranked at the back of the pack. Chrysler sucks............