Small Commercial Vans Rapidly Losing Their Appeal With Handy Mannys and Bob The Builders of America

On the surface, little Euro vans seem to make so much sense. Not every contractor needs a football field’s worth of space behind two front seats.

City-friendly exterior dimensions, a more affordable price tag, and four-cylinder fuel economy should, in theory, cause Bob the Builder or Handy Manny to take a serious look.

But enticing as the idea sounds, the value quotient proffered by 2017’s crop of five small commercial vans simply doesn’t add up for the overwhelming majority of commercial van buyers. Sure, the Ford Transit Connect may be a decent deal. But the Ford Transit is a comparatively great deal.

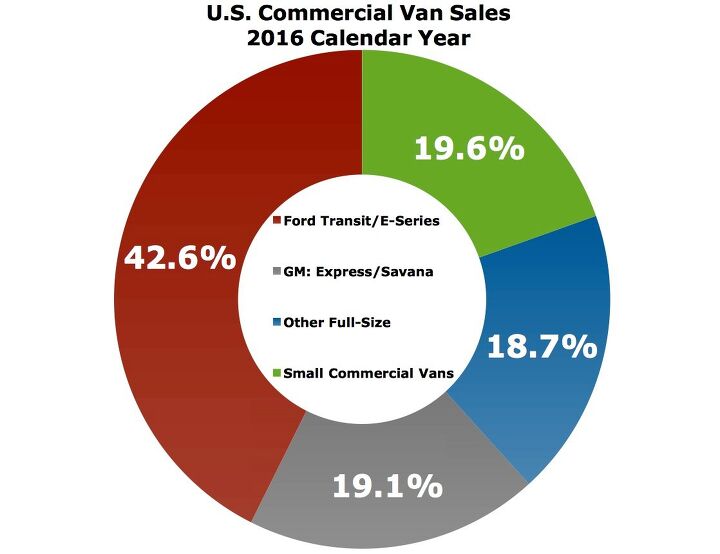

As a result, full-size commercial van sales are consistently on the rise. But small commercial van sales? Plunging like Paul the Plumber.

Despite declines in the last two months from the top-selling Ford Transit, full-size commercial van sales have grown in 18 consecutive months, rising 15 percent in calendar year 2016.

Yet January 2017 marked the sixth consecutive month of sharp decline for America’s small commercial vans. January 2017 was the sixth consecutive month in which small vans owned less than one-fifth of America’s overall commercial van market. January 2017 was also the thirteenth consecutive month in which U.S. sales of small commercial vans failed to climb into five-digit territory.

The Ford Transit Connect, Nissan NV200, Ram ProMaster City, Chevrolet City Express, tweener-sized Mercedes-Benz Metris, and discontinued Ram Cargo Van combined for nearly 91,000 sales in calendar year 2016, a modest 3-percent year-over-year decline. Yet the decline was modest only because of a surge in the first half of the year, a successful follow-up to a 2015 calendar year in which small commercial van sales jumped 38 percent to form 22 percent of the overall commercial van market.

More recently, over the last half-year, sales have fallen by a fairly astonishing 27 percent, a loss of more than 13,000 sales, year-over-year. Last month, small vans accounted for just 17 percent of America’s commercial van sales tally.

Meanwhile, full-size commercial van sales continue to expand, month after month after month.

With fuel prices well below $2.50/gallon, the economic climate for small vans today is very different than it was in early 2008, when average fuel prices spiked to an all-time high and Ford announced that it would begin selling the Transit Connect in the United States. Even upon the Nissan NV200’s arrival in early 2013, Americans were paying an average of $3.70/gallon.

Fuel costs are only part of the issue, however. Full-size commercial vans — particularly at a time when saving every last penny on fuel, no matter the compromise, isn’t necessary — simply provide more bang for the buck. For 31-percent more money than the largest Ford Transit Connect, even the smallest Ford Transit provides 92-percent more cargo volume.

After peaking at 52,221 units in 2015, U.S. Ford Transit Connect sales plunged 17 percent in 2016. On a monthly basis, Transit Connect volume has decreased in six consecutive months and in 10 of the last 13 months. The small Ford continues to be the dominating player in the segment, claiming just under half of all non-full-size commercial van sales in 2016.

January volume, however, fell to a 72-month low.

2016 produced another year of growth for the Nissan NV200, sales of which expanded for a third consecutive year. In keeping with the category, however, NV200 sales decreased in six of the last seven months.

Still a fresh face in 2016, the third-ranked Ram ProMaster City likewise reported improvement last year. Much of that growth came early in the year, however, when 2016 sales were being compared with the launch period of 2015.

Over the last three months, Ram ProMaster City sales have essentially been chopped in half, falling 46 percent since November.

The Nissan NV200-related Chevrolet City Express has progressively proven to be less and less of a player in the segment. Only 8 percent of the small commercial vans sold in 2016 were Chevrolets, down from 11 percent one year earlier. City Express sales have crumpled in nine consecutive months, sliding by nearly two-thirds — a 64-percent drop — since May of last year.

Mercedes-Benz, meanwhile, does not provide a breakdown of Sprinter and Metris sales in its monthly sales report, although we have acquired the information for much of its tenure. Of the 34,304 vans sold by Mercedes-Benz last year, 17 percent were midsize Metrises.

No other commercial van on sale in America sold less often than the Metris last year.

Of course there are buyers who, regardless of the value quotient, simply won’t want to spend the extra cash on a full-size van. Fortunately, for the time being, there are a variety of non-full-size options for that demographic.

But it’s a demographic that appears much smaller now than we thought it would be back when fuel prices were high, when businesses of every size were looking for cost-saving measures, when we assumed new contenders would exponentially grow the category and not fight over smaller slices of a shrinking pie.

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Namesakeone Yes, for two reasons: The idea of a robot making decisions based on algorithms does not seem to be in anyone's best interest, and the thought of trucking companies salivating over using a computer to replace the salary of a human driver means a lot more people in the unemployment lines.

- Bd2 Powertrain reliability of Boxer engines is always questionable. I'll never understand why Subaru held onto them for so long. Smartstream is a solid engine platform as is the Veracruz 3.8L V6.

- SPPPP I suppose I am afraid of autonomous cars in a certain sense. I prefer to drive myself when I go places. If I ride as a passenger in another driver's car, I can see if that person looks alert and fit for purpose. If that person seems likely to crash, I can intervene, and attempt to bring them back to attention. If there is no human driver, there will probably be no warning signs of an impending crash.But this is less significant than the over-arching fear of humans using autonomous driving as a tool to disempower and devalue other humans. As each generation "can't be trusted" with more and more things, we seem to be turning more passive and infantile. I fear that it will weaken our society and make it more prone to exploitation from within, and/or conquest from the outside.

- JMII Based on the human drivers I encounter everyday I'll happily take my chances with a computer at the wheel.The highway driver assist system on my Santa Cruz is great, it can self drive perfectly in about 90% of situations. However that other 10% requires you to be in control and make decisions. I feel this is the problem with an AI driving a car, there are times when due to road construction, weather conditions or other drivers when only a human will know what to do.

- Hari Your route home sounds like the perfect stretch for a car like the Alfa Romeo Giulia. Its renowned handling and dynamic performance make it an ideal match for those curves. For enthusiasts or potential owners interested in understanding all the capabilities of the Giulia 2017, the owner’s manual is an invaluable resource. Check it out here: https://chatwithmanuals.com/automobiles/2017-alfa-romeo-giulia-owners-manual/. Our AI-powered chat makes navigating the manual simple, helping you quickly find specific details about the car's features and specs. Perfect for making the most out of those driving moments and truly understanding your vehicle!

Comments

Join the conversation

I can't understand that value proposition behind a $29k Metris.

These types of vehicles could be a good barometer for all light commercial vehicle sales. It would be interesting to see how many real working midsize and 1/2 ton pickups are moving at the moment. I'm not describing the more than half which are a tax write off, but pickups that are purely for work. From what I've read most pickups are those for "personal" use.