At Fiat USA, You Know It's Bad Because Even The Subcompact Crossover Is Flopping

It just keeps getting uglier.

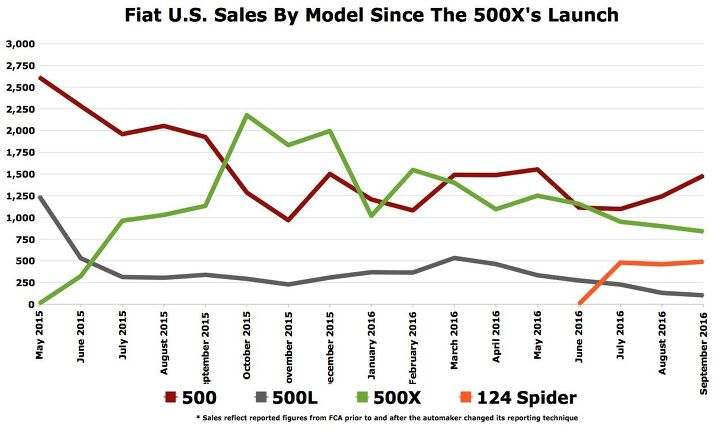

In ten consecutive months, U.S. sales at the Fiat brand have declined on a year-over-year basis. The run of declines began six months after Fiat launched an all-new model, the 500X, in America’s burgeoning subcompact crossover segment. The downward trend continued in the third quarter of 2016, through the launch of the Mazda-based 124 Spider. The losses accrued in Fiat’s U.S. showrooms were certainly worsened by 21 consecutive months of decreased volume reported by the aging Fiat 500.

But it’s the 500X that ought to shoulder much of the blame. Wasn’t the answer to the brand’s lack of mainstream appeal surely to be found in a segment that doubled in size in 2015?

Perhaps not.

LIGHT AT THE START OF THE TUNNEL

Yet while segment-wide growth continued after the 500X first crested the 2K marker — year-over-year volume jumped 130 percent in November 2015 and 175 percent in December 2015 — the 500X’s forward momentum was abruptly halted.

By January of this year, Fiat was selling less than half as many 500Xs in America as the company had three months earlier. On a month-to-month basis, 500X sales decreased in November 2015 and then in seven of 2016’s first nine months, horrendous results for a recently launched model.

It was during that third quarter that the dearth of demand for the 500X became most apparent.

Fewer than 1,000 copies of the 500X were sold in July, a modest 12-unit year-over-year decline but the lowest total sales for the model since its first month on sale 13 months earlier.

August 500X volume slid 13 percent as subcompact crossover volume rose 5 percent.

In September, sales of the Fiat 500X tumbled to only 839 units, a 26-percent year-over-year drop and a 15-month low.

Meanwhile, the boxy Jeep Renegade that shares a platform with the curvy Fiat 500X is the top-selling member of a subcompact crossover category that’s grown by a third this year.

It’s a segment that grew 12 percent during the last quarter, a period in which Fiat 500X sales declined 14 percent. Over the last three months, the Fiat 500X’s direct competitors combined for nearly 15,000 additional sales compared with the same stretch one year earlier.

Yet the 500X, with little to lose, managed to drop 437 sales in the same time span.

LIGHT AT THE END OF THE TUNNEL?

With four models, Fiat is on track to 34,000 new vehicles in the United States in calendar year 2016, a 10,000-unit sales decline from 2012, when Fiat was a one-model brand in America.

[Images: Fiat Chrysler Automobiles]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

Although 500X and Renegade are as close to each other as original Compass and Patriot, they are sold at different dealerships. Every time I see a FIAT dealership, it's a former indoor flea market building, or some other such random facility. This is really not helping. In addition, Renegade has a much better headroom and internal volume. It is rated to tow 3 times as much (which is mind-boggling, considering that mechanicals are identical). Not only there's no such thing as 500X Trailhawk, you can't even have an AWD 500X with 1.4 turbo. I suppose not everyone is as obsessed with the headroom as I am. And other differences seem minute as well. But it all adds up.

Fiat. Is. Not. Marketing. Right. Where are the commercials? The billboards with catchy phrases? Where is the advertised practicality of the larger cars? Why is everything named "500" which people automatically associate with a car too small for them? You don't just set up hipster "studios" and expect people to flock in. You have to advertise the hell out of your products, especially for a brand that few people understand. Everyone who wanted a Fiat, myself included, already has one. The 500L should have been named 600, and the 500X named something else as well.