Cain's Segments: July 2013 Canada Recap

For the fourth consecutive month, Canadian auto sales increased in July 2013. An extra 10,600 units translated to a 7% increase, the second-best improvement so far this year. Passenger car volume, which travelled in the wrong direction in the first half of 2013, jumped 11% in July.

Strong performances by Canada’s three best-selling cars – Civic up 36%, Elantra up 25%, Corolla up 23% – induced the progress. The trio accounts for one in five car sales in Canada. Although the Elantra lost its lead as Canada’s best-selling car, the Hyundai is only 351 sales back of the momentum-carrying Civic with five months remaining.

BMW’s 3-Series was Canada’s 15th-best-selling car in July. After finishing the first half 1371 sales ahead of its next-best-selling rival, the 3-Series ended July with an 1820-unit lead over the Mercedes-Benz C-Class. The 3-Series and C-Class account for 36% of all BMW and Mercedes-Benz sales in Canada, a slightly higher ratio than they pull in south of the border.

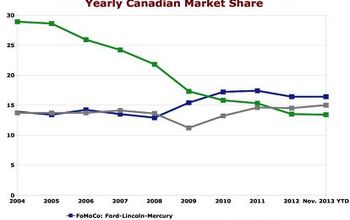

Overall, however, so-called premium brands don’t perform in Canada the way they do in the U.S. On that point, most notable are Detroit’s high-end automakers. Cadillac owns 0.5% of the Canadian market; Lincoln just 0.3%. Market share afforded to Cadillac and Lincoln in their homeland totals 1.6%.

The trend is pointing in Cadillac’s favour. Sales jumped 33% in the first seven months of 2013 and more than doubled in July. Lincoln, on the other hand, is down 18% this year and fell 19% in July. Still, Cadillac generates 18% of its U.S. volume with the XTS, but XTS sales are 39 times stronger in the U.S. than in Canada, where big cars simply are simply not deemed to be desirable. Lacking the XTS’s U.S.-style impact, Cadillac is left with a very small lineup in Canada.

It’s not just big luxury brand cars like the XTS and Lincoln MKS (down 56% to just 168 YTD) that fail to attract buyers. Sales of the Chrysler 300 are down 3%. Taurus volume is down 19%. The Chevrolet Impala should pick up soon, but through July, Impala volume has been cut in half. Hyundai doesn’t sell the Azera here, but Genesis sedan sales are down 15% and Kia’s Cadenza has only managed 62 sales in its first four months. Nissan Maxima? Down 43%. Buick LaCrosse? Down 52%. Toyota Avalon sales nearly tripled, but at 839 units through seven months, it’s a rare breed. Toyota Canada sells that many Corollas every week.

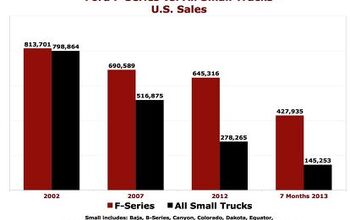

No, when Canadians think big, they don’t think car. Despite the 14% year-over-year decline reported by Canada’s best-selling vehicle, the Ford F-Series, and drops at Chevrolet and GMC, pickup truck sales increased 3% in July, forming 17% of the overall market.

If the first, third, and second-ranked trucks all posted declines, not to mention the declines reported by five other continuing trucks and a couple defunct pickups, how did the truck market continue its Canadian expansion? Ram sales rose by 1373 units, a 21% year-over-year increase. Through seven months, the Ram truck range has outsold the GM full-size twins by 90 units. It still trails the Ford F-Series by a wide margin, but the Ram remains Chrysler’s catalyst.

To what end? The Chrysler Group sold more automobiles in Canada than any other manufacturer in July 2013. Ford Motor Company’s own Ford division was the leading brand, but Chrysler Canada’s five divisions outsold FoMoCo by more than 1000 units, Hyundai-Kia by nearly 5000 units, and General Motors by more than 7000 units. The Ram truck accounted for three in ten Chrysler sales. Combined, the Ram, Dodge’s Grand Caravan and Journey, and Jeep’s Wrangler and Grand Cherokee outsold General Motors by 739 units.

Through seven months, from a pure volume standpoint, Hyundai has outsold Honda. Dodge and Ram would be the second-best-selling brand if they rejoined. Declining Mazda is more than 6000 sales ahead of rising Volkswagen. BMW is 71 sales ahead of Sprinter-less Mercedes-Benz. Lexus narrowly leads Buick. Fiat is 1566 units up on Mini. And Porsche is well on its way to another record year, having already sold more vehicles than in all of 2010, which was a record year at the time.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Kjhkjlhkjhkljh kljhjkhjklhkjh A prelude is a bad idea. There is already Acura with all the weird sport trims. This will not make back it's R&D money.

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

Comments

Join the conversation

We're a pragmatic people. We look for value and efficiency over fripperies. That's why we like hatchbacks, minivans and pickups. Both Chryco and Ford have sales on their offerings all of the time. GM has languished. Hyundai/Kia is eating their lunch by giving a ton of value over anything from GM with very few compromises in return. I don't forsee many changes from that. The biggest thing is the intros... having vehicles available in the States and not here hurts. Chryco is very bad for that.

@Dimwit - I'd have to agree. I have been reading about Ram 5.7 8 speed combo's in the USA for a long time and even up to this July, they were rare in Canada. I have yet to see or even find a 6.3 ft crew cab on a dealer's inventory. The same can be said for the new HO Cummins.