Europe, Half Year Review: Bad News For French, Italians, Ford, And GM

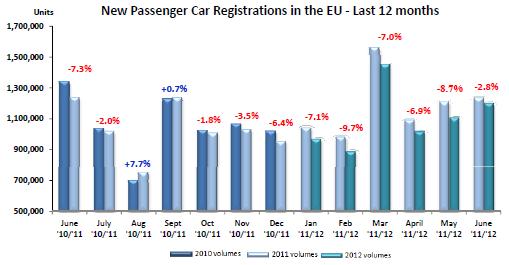

Europe’s new car market continues on its downward spiral with sales down 2.8 percent in June. Half year sales are down 6.8 percent across the EU, data released today by the European Automobiles Manufacturers’ Association ACEA show today. Some countries and automakers do much better, some much worse.

The fall would have been bigger, would Europe’s biggest car markets, Germany and the U.K., not have shown some resilience. Sales for the half year are up 2.7 percent in the U.K. and 0.7 percent in Germany. Matters look much worse in the remaining volume markets. France is down 14.4 percent in the first half year, Italy gave up 19.7 percent of its sales, Spain 8.2. Much talked about Greece, down a whopping 41.3 percent in the first six months, does not move the pan-European needle much. Greeks bought 5,527 cars in June and has dwindled to the market size of Luxembourg. The often ignored central European countries show strength.

JuneJanuary – June %Share %ShareUnitsUnits% Chg %Share %ShareUnitsUnits% Chg’12’11’12’1112/11’12’11’12’1112/11ALL BRANDS**1,201,5781,236,128-2.86,644,8297,130,655-6.8VW Group23.822.5286,109278,269+2.823.922.61,590,9331,614,423-1.5VOLKSWAGEN12.311.6148,074143,187+3.412.612.0838,132856,556-2.2AUDI5.65.066,69862,015+7.65.44.9362,038346,534+4.5SEAT2.02.324,21728,314-14.52.02.3133,971160,722-16.6SKODA3.93.646,88544,556+5.23.83.5255,437249,573+2.3Others (1)0.00.0235197+19.30.00.01,3551,038+30.5PSA Group12.313.1148,172162,166-8.612.213.2808,660938,817-13.9PEUGEOT6.57.278,47888,844-11.76.57.2432,426510,201-15.2CITROEN5.85.969,69473,322-4.95.76.0376,234428,616-12.2RENAULT Grp9.49.5112,627117,083-3.88.69.7570,959688,681-17.1RENAULT7.47.788,39894,601-6.66.87.9450,881561,093-19.6DACIA2.01.824,22922,482+7.81.81.8120,078127,588-5.9GM Group8.99.5107,160117,558-8.88.48.8560,934629,176-10.8OPEL/VAUXHALL7.38.188,252100,498-12.26.97.6457,630538,446-15.0CHEVROLET1.61.418,89317,019+11.01.61.3103,12690,475+14.0GM (US)0.00.01541-63.40.00.0178255-30.2FORD6.88.182,061100,708-18.57.88.1517,094576,879-10.4FIAT Group6.47.677,26194,173-18.06.77.5445,229536,931-17.1FIAT4.75.656,55369,580-18.74.85.5321,760391,923-17.9LANCIA/CHRYSLER0.80.89,4569,538-0.90.80.855,34755,093+0.5ALFA ROMEO0.71.08,59412,372-30.50.81.152,20375,901-31.2JEEP0.20.22,2982,123+8.20.20.113,65110,046+35.9Others (2)0.00.0360560-35.70.00.12,2683,968-42.8BMW Group6.66.579,44179,827-0.56.15.7404,771408,768-1.0BMW5.25.161,99762,537-0.94.94.6323,511326,150-0.8MINI1.51.417,44417,290+0.91.21.281,26082,618-1.6DAIMLER5.25.362,01065,767-5.75.14.7336,836337,489-0.2MERCEDES4.64.755,49258,186-4.64.54.1298,072294,795+1.1SMART0.50.66,5187,581-14.00.60.638,76442,694-9.2TOYOTA Group3.93.146,43538,766+19.84.24.0276,996282,106-1.8TOYOTA3.73.044,00637,158+18.43.93.8262,306269,556-2.7LEXUS0.20.12,4291,608+51.10.20.214,69012,550+17.1NISSAN3.63.242,93239,475+8.83.53.4230,992240,358-3.9HYUNDAI3.52.842,65334,839+22.43.32.8222,573199,419+11.6KIA2.72.132,36726,247+23.32.51.9168,938135,478+24.7VOLVO1.71.820,96122,689-7.61.81.8116,364128,100-9.2SUZUKI1.11.113,73413,870-1.01.21.380,96891,695-11.7HONDA1.10.913,38610,864+23.21.01.168,69677,252-11.1MAZDA1.01.011,60412,594-7.91.01.065,21674,617-12.6JLR0.90.610,4697,211+45.21.00.764,51847,922+34.6LAND ROVER0.70.48,3225,179+60.70.80.552,16136,632+42.4JAGUAR0.20.22,1472,032+5.70.20.212,35711,290+9.5MITSUBISHI0.40.75,1178,200-37.60.60.838,96557,662-32.4Not a healthy environmentl for manufacturers that are overweight in the parts of Europe where automotive pestilence is rampant. If you are a French or Italian maker, you have problems. Renault is down 17.1 percent for the half year, rival PSA lost 13.9 percent, Italian Fiat Group lost 17.1 percent.

The German carmakers survived the first half year relatively unscathed. Export-heavy as they are, we don’t have to worry about them.

If you hold stock in Ford or GM, then you have reason to be worried. Being at home in healthier regions of Europe did not help them much. Ford’s sales are down 10.4 percent in the first half year, GM lost 10.8 percent. Opel sales are down 15 percent, Chevrolet is up 14 percent. Matters shape up more and more for a possible tactical retreat from Opel and a consolidation of gains at Chevrolet.

A well-managed European automaker will survive this, a badly managed may not. Now is the time where cash is king. If you sit on debt, if you made losses during good times, you will have a hard time surviving the bad. If you sit on a pile of cash, and if you can translate the low Euro into export gains, you will come out of this stronger than ever.

Even among the badly mauled, some are hardier than others. In a research note, Morgan Stanley predicts that Renault’s 2012 profits will exceed last year’s even under the worst case scenario. One of the reasons is, says the note, that Renault “is silently transforming itself into a low-cost OEM.” Renault’s Dacia sales are growing, and the company found ways to make low cost cars very profitable, something other makers grapple with. Also, Renault owns nearly half of Nissan, and Nissan looks like pure gold at the moment.

Data are available for download here as PDF and here as Excel sheet.

Bertel Schmitt comes back to journalism after taking a 35 year break in advertising and marketing. He ran and owned advertising agencies in Duesseldorf, Germany, and New York City. Volkswagen A.G. was Bertel's most important corporate account. Schmitt's advertising and marketing career touched many corners of the industry with a special focus on automotive products and services. Since 2004, he lives in Japan and China with his wife <a href="http://www.tomokoandbertel.com"> Tomoko </a>. Bertel Schmitt is a founding board member of the <a href="http://www.offshoresuperseries.com"> Offshore Super Series </a>, an American offshore powerboat racing organization. He is co-owner of the racing team Typhoon.

More by Bertel Schmitt

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Statikboy I see only old Preludes in red. And a concept in white.Pretty sure this is going to end up being simply a Civic coupe. Maybe a slightly shorter wheelbase or wider track than the sedan, but mechanically identical to the Civic in Touring and/or Si trims.

- SCE to AUX With these items under the pros:[list][*]It's quick, though it seems to take the powertrain a second to get sorted when you go from cruising to tromping on it.[/*][*]The powertrain transitions are mostly smooth, though occasionally harsh.[/*][/list]I'd much rather go electric or pure ICE I hate herky-jerky hybrid drivetrains.The list of cons is pretty damning for a new vehicle. Who is buying these things?

- Jrhurren Nissan is in a sad state of affairs. Even the Z mentioned, nice though it is, will get passed over 3 times by better vehicles in the category. And that’s pretty much the story of Nissan right now. Zero of their vehicles are competitive in the segment. The only people I know who drive them are company cars that were “take it or leave it”.

- Jrhurren I rented a RAV for a 12 day vacation with lots of driving. I walked away from the experience pretty unimpressed. Count me in with Team Honda. Never had a bad one yet

- ToolGuy I don't deserve a vehicle like this.

Comments

Join the conversation

Alfa sales are at the 100K/year level once again. 400K units in 2014? I think that's yet another sales target completely missed ... Fiat would be out of business soon were it not for Chrysler.