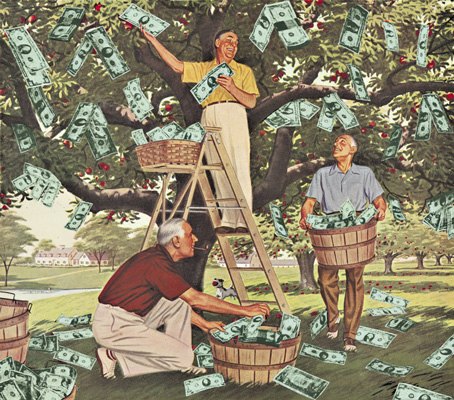

Can Lending Club = Free Car?

Back in the Clinton Era I worked as a financial analyst. My job was to make numbers dance on a computer while the masters of all things corporate made their decisions. It was brutally boring work. But when you’re only 23, you figure this rite of passage is just part of being a grunt before finally making it headlong into middle management.

I hit the middle management level a little over a year later, and then took a LOT of time off. Two hour lunches. Random walks in the middle of the day. I created Excel macros for most of my work and left the rest to other grunts in the corporate machine. I focused my spare time towards three things: cars, social life, and investing.

The first two were naturally interesting. The final one was about seizing opportunities and figuring out where, beyond Wall Street, I could develop a niche.

Since then I’ve made hundreds of loans and finance deals. Cars, new businesses, even real estate. It’s worked out well… but that’s only because I usually insist on collateral.

Lending Club has a different methodology. All of their loans are unsecured. Want to build on your home? If your credit is good enough, you can get the money… without the usual risk of a foreclosure.

Need a car loan? You may pay a few percentage points more than the 0% and 1.9% factory deals that are available for super-prime consumers. But there is no lien on your car. None. No lien means no immediate opportunity for the lenders to retrieve the car if you default on the loan.

What are the costs should you default on your loan? Well, I would consider it the same as when you have a douchebag ex-partner. Except in this case you are that douchebag. The cost comes with a nice big thunk on your credit history and, if you operate a business, you will have higher expenses for those things that are based on your credit rating. You will also be a de facto thief, a degenerate, a lowlife, a schmuck and a parasite of the modern world.

But for some folks, that’s a small price to pay for a free car. Come to think of it. That’s a small price to pay for some folks who still work in the corporate world.

More by Steven Lang

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- MaintenanceCosts I wish more vehicles in our market would be at or under 70" wide. Narrowness makes everything easier in the city.

- El scotto They should be supping with a very, very long spoon.

- El scotto [list=1][*]Please make an EV that's not butt-ugly. Not Jaguar gorgeous but Buick handsome will do.[/*][*] For all the golf cart dudes: A Tesla S in Plaid mode will be the fastest ride you'll ever take.[/*][*]We have actual EV owners posting on here. Just calmly stated facts and real world experience. This always seems to bring out those who would argue math.[/*][/list=1]For some people an EV will never do, too far out in the country, taking trips where an EV will need recharged, etc. If you own a home and can charge overnight an EV makes perfect sense. You're refueling while you're sleeping.My condo association is allowing owners to install chargers. You have to pay all of the owners of the parking spaces the new electric service will cross. Suggested fee is 100$ and the one getting a charger pays all the legal and filing fees. I held out for a bottle of 30 year old single malt.Perhaps high end apartments will feature reserved parking spaces with chargers in the future. Until then non home owners are relying on public charge and one of my neighbors is in IT and he charges at work. It's call a perk.I don't see company owned delivery vehicles that are EV's. The USPS and the smiley boxes should be the 1st to do this. Nor are any of our mega car dealerships doing this and but of course advertising this fact.I think a great many of the EV haters haven't came to the self-actualization that no one really cares what you drive. I can respect and appreciate what you drive but if I was pushed to answer, no I really don't care what you drive. Before everyone goes into umbrage over my last sentence, I still like cars. Especially yours.I have heated tiles in my bathroom and my kitchen. The two places you're most likely to be barefoot. An EV may fall into to the one less thing to mess with for many people.Macallan for those who were wondering.

- EBFlex The way things look in the next 5-10 years no. There are no breakthroughs in battery technology coming, the charging infrastructure is essentially nonexistent, and the price of entry is still way too high.As soon as an EV can meet the bar set by ICE in range, refueling times, and price it will take off.

- Jalop1991 Way to bury the lead. "Toyota to offer two EVs in the states"!

Comments

Join the conversation

The part I get confused about is how people think that getting one loan for 60 months for $25,000 at 22.45 percent is a better deal than a bunch of credit card debt at 15%. I admit to not being very good at math and not having much experience in this arena..... but I don't get it. For that matter, I don't understand why people it's a good idea to make a loan at 22.45% to somebody who is having trouble paying back 15%. "What is the total balance of your credit cards, interest rates and current monthly payments? A: (02/17/2012-06:43) - Citibank 8400 15% 163 Citibank 3400 15% 85 Chase 4000 15$ 97 USAA 12000 15% 259 GMC Bank 300 15% 25 total $28,100" *** Loan payments are currently $629. Under the new loan the amount due is $650.20 monthly, and note that this is on $25K, leaving another $3,100 at 15% still out there.

The other definition of this is gambling.