Government Loan Guarantees Help Ford Beat The Debt

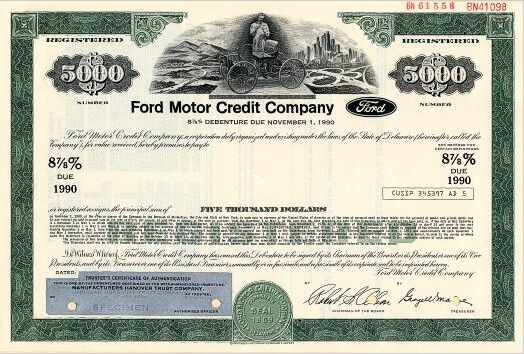

At the end of the second quarter of this year, Ford’s overall automotive debt totaled $25.8 billion. Just three months before, its debt level was at $32.6 billion. The debt reduction is all part of CEO Alan Mulally’s plant to earn an investment-grade debt rating by the end of 2011, a move that will lower Ford’s cost of borrowing as well as lowering interest payments. And though Ford’s been making a healthy profit, America’s bailout-free automaker has had more than its fair share of government help to beat the debt. According to the WSJ [sub], Ford’s extensive collection of government loan guarantees has been key to its ability to pay down more expensive debt accumulated during Ford’s 2006 restructuring.

Last week’s US Export-Import Bank loan of $250m was just the latest in a string of government loan guarantees that have helped Ford cut its debt. THe UK government also recently put a $572m guarantee for a $715m European Investment Bank loan to Ford. The EIB has also promised Ford $527.6m to produce cars in Romania. Ford has also taken on $1.8b in low-cost Department of Energy loans this year, on top of last year’s $5.9b DOE “Section 136” retooling loan. And the help is working

In April [Ford] made a $3 billion pre-payment on a $7.5 billion revolving loan.

In June, it paid $3.8 billion in cash to the United Auto Workers Retiree Medical Benefits Trust. A large chunk of the payment for retired worker health-care benefits was paid ahead of schedule.

Ford said its total debt payment in the second quarter should yield annual interest savings of more than $470 million.

Despite the EIB’s rejection of another $264m loan, Ford is clearing its bad debt with remarkable speed, a fact that was rewarded last week when Fitch raised Ford’s debt rating to within three steps of an investment-grade rating. Doubtless Ford would have been prioritizing debt reduction regardless of its government help, and it’s certainly made enough profit this year to make a start on the task. Thanks to generous government assistance, however, Ford is blowing through its debt faster than previously imagined.

In the second quarter of this year, Ford paid an estimated $318 per vehicle produced just to pay interest on its debt. Ford now estimates its total annual savings due to second-quarter debt reductions of more than $470m. And thus far consumers continue to see Ford as having avoided a bailout. Talk about having your cake and eating it too.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jeff Definitely a blast from the past. I would have picked a Cutlass or Monte Carlo over this at the time.

- Cae The front end reminds me of how far we've come with aerodynamic design. This is clearly a pre-Oil Embargo styling effort. Today, the front ends of cars and SUV's are not as Baroque like this, but you don't lose 2 mpg because of all that bent metal, either (YMMV).

- Bd2 418 views, 10 days ago on Youtube. Seriously ?

- Redapple2 That is one ugly car.

- Bd2 Drive Culture = Paid Advertising Shill.

Comments

Join the conversation

I sure wouldn't mind being able to pay off my mortgage with a low-interest, government-backed loan...

Ford has taken advantage of low interest loans that are available to any qualifying business. If you have to consider tax savings or gov’t subsidies for a deal to turn a profit then it isn’t a great deal to begin with. online car insurance quote