EV Startup Scores $25m, Ford Still Banking With Uncle Sam

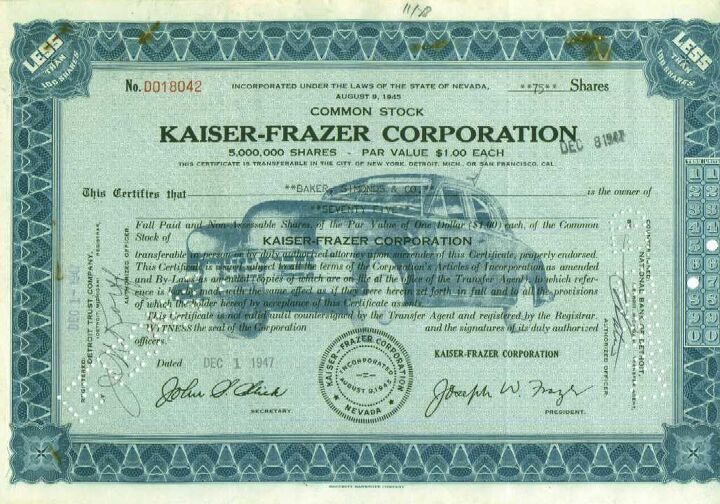

According to Detroit lore, Henry Kaiser once loudly threatened to throw one hundred million dollars in 1940s money towards the greater glory of Kaiser Motors, drawing a bemused chuckle from GM Chairman Alfred Sloan who quipped “give the man one chip.” Fast forward to 2009, and Coda Automotive, a firm hoping to sell Californians a $45k EV-ified Hafei Saibao Sedan, just scored $25m in funding reports Earth2Tech. That gives the firm a total of $74m raised so far, although the current round of funding won’t closed for another few months, say spokespeople. The latest money, from Aeris Capital, will be spent on “final safety certification testing,” as well as scaling up battery production. In short, Coda is almost-not-quite all the way to one chip in the car game… but that’s still only good for one roll of the dice. Even the weakest automakers have many multiples of that sum in their Treasury escrow accounts. And even the allegedly “bailout free” automakers get to raise debt with a little help from their government friend, TALF.

According to BusinessWeek, Ford Finance is planning on raising a cool half-billion in dealer floorplanning bonds through the government’s Term Asset-Backed Securities Loan Facility program known as TALF. Through TALF, buyers of Ford Finance’s floorplan bonds will qualify for low-cost loans from the Fed, essentially making the debt more valuable than it would otherwise be. Meanwhile, NADA is pushing for an extension of TALF past its planned March 31 expiration, as over $5b in automotive floorplanning could come due this year. Without TALF, NADA worries that dealers could have a tough time finding financing on the open market. Which, given the uncertainty surrounding the future of America’s car market, is not wildly surprising.

More by Edward Niedermeyer

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Analoggrotto I don't see a red car here, how blazing stupid are you people?

- Redapple2 Love the wheels

- Redapple2 Good luck to them. They used to make great cars. 510. 240Z, Sentra SE-R. Maxima. Frontier.

- Joe65688619 Under Ghosn they went through the same short-term bottom-line thinking that GM did in the 80s/90s, and they have not recovered say, to their heyday in the 50s and 60s in terms of market share and innovation. Poor design decisions (a CVT in their front-wheel drive "4-Door Sports Car", model overlap in a poorly performing segment (they never needed the Altima AND the Maxima...what they needed was one vehicle with different drivetrain, including hybrid, to compete with the Accord/Camry, and decontenting their vehicles: My 2012 QX56 (I know, not a Nissan, but the same holds for the Armada) had power rear windows in the cargo area that could vent, a glass hatch on the back door that could be opened separate from the whole liftgate (in such a tall vehicle, kinda essential if you have it in a garage and want to load the trunk without having to open the garage door to make room for the lift gate), a nice driver's side folding armrest, and a few other quality-of-life details absent from my 2018 QX80. In a competitive market this attention to detai is can be the differentiator that sell cars. Now they are caught in the middle of the market, competing more with Hyundai and Kia and selling discounted vehicles near the same price points, but losing money on them. They invested also invested a lot in niche platforms. The Leaf was one of the first full EVs, but never really evolved. They misjudged the market - luxury EVs are selling, small budget models not so much. Variable compression engines offering little in terms of real-world power or tech, let a lot of complexity that is leading to higher failure rates. Aside from the Z and GT-R (low volume models), not much forced induction (whether your a fan or not, look at what Honda did with the CR-V and Acura RDX - same chassis, slap a turbo on it, make it nicer inside, and now you can sell it as a semi-premium brand with higher markup). That said, I do believe they retain the technical and engineering capability to do far better. About time management realized they need to make smarter investments and understand their markets better.

- Kwik_Shift_Pro4X Off-road fluff on vehicles that should not be off road needs to die.

Comments

Join the conversation

Makes sense - no floor, no dealer. Until the credit market recovers this is probably one of the few ways to keep the system going.

Perhaps someone wanting to enter the car business should first open a bank... Ford Finance? Is this the same as Ford Credit, or is it a new name for it?