2 Views

E85 Boondoggle of the Day: VeraSun Goes Belly-Up

by

John Horner

(IC: employee)

Published: November 3rd, 2008

Share

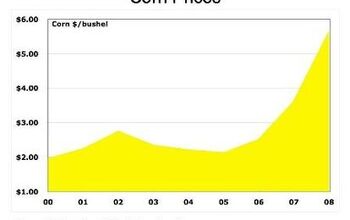

The Wall Street Journal reports the massive financial hangover of South Dakota’s VeraSun, 2006 IPO darling turned bushel basket case. VeraSun is trying to point the finger at the in vogue financial turmoil excuse, but the real problem is that they are buying high and selling low. Their Greenspan worthy doublespeak goes thus: “‘Worsening capital market conditions and a tightening of trade credit resulted in severe constraints on the Company’s liquidity position.’ It intends to work with lenders to secure ‘additional committed financing to provide adequate liquidity to fund operations in the normal course.'” But the real deal is that VeraSun “lost $63 million to $103 million due to bets on the price of corn that ended up working against it. VeraSun’s current liabilities totaled $312 million at the end of the second quarter, and it had $1.4 billion in long-term debt.” Ah, almost $2b in debt and losing commodities market bets. Now we’re getting closer to the truth. When it came time to get yet another credit card with which to pay the interest on the old credit cards, nobody would play ball. “As the global credit crunch intensified in September, VeraSun was unable to secure the funding it needed to pay interest on its debt, which is due in December.” And guess who has ridden to the rescue with debtor-in-possession financing to fund the Chapter 11 reorganization attempt? Cerberus, I kid you not. Lucky for them, plenty of moonshine is on hand for the deal signing party.

John Horner

More by John Horner

Published November 3rd, 2008 9:17 PM

Comments

Join the conversation

Never mind the abject criminality of turning food into fuel. When that burn-what-you-eat craze took hold, food prices in Asia went through the roof. What's next? Liquefy the carbon in my true love's diamond ring? And Cerberus is investing into those guys? Are they .... drunk?

Well said, Bertel. It couldn't have happened to a better "industry". Morons.

Folks, you are fast on a trigger. Just watch our congress finding ways to resurrect those corpses at our expense.