#UnitedStates

Tesla CEO Accused of Kowtowing to China: A Tale of Two Musks?

Tesla CEO Elon Musk came under fire this week after Bloomberg wrote a piece accusing him of playing nice with totalitarian China following years of showing totalitarian California a complete lack of respect. With the semiconductor shortage leaving the industry in a holding pattern, tabloid journalism seems to be filling in the gaps to the dismay of yours truly. However, Musk’s relationship with both countries remains relevant since they represent the two largest automotive markets on the planet and will dictate the trajectory of the business.

He’s being accused of being extremely apologetic to Chinese regulators, despite having become infamous for acting in the exact opposite manner in the United States. As you might recall, American Musk is all about flagrantly ignoring the rules and telling the government regulators to take their concerns into the bathroom where they’ll have the privacy necessary to stick them where the sun doesn’t shine. When it comes to high-IQ billionaires, our Elon is the bad boy’s bad boy. But Chinese Musk is said to be deferential and happy to comply with the request of oversight groups before they become official mandates.

He sounds like a total traitor! At least, that’s how China’s state-run media framed it before Western outlets took the reporting and made Elon seem even worse on Tuesday. The story has since been spreading online, encouraging this website to take another look to see if Mr. Musk is actually the double-crossing villain that’s being claimed.

California Wins the Gas War, Fickle Automotive Coalition Realigns Position

The Coalition for Sustainable Automotive Regulation (CSAR) is officially withdrawing from a lawsuit between California and federal authorities over the coastal state’s ability to establish its own emissions standards. California leadership had vowed to ignore the Trump administration’s proposed rollback and began making binding side deals with automakers (specifically BMW, Ford, Volkswagen, Volvo, and Honda) committed to adhering to the aggressive limits established under President Obama. Unfortunately, this ran the risk of undermining the revised national standards penned shortly after the United States became energy independent. It also set up the CSAR to embrace any entity that had views conflicting with California Air Resources Board.

Federal concerns were that the Golden State setting its own targets would butt heads with the relaxed national benchmarks and ultimately divide the U.S. market and may even influence the types of vehicles that were manufactured for all of North America. But the issue became moot once President Biden broke the record for executive orders by signing 22 in his first week. Predictably, the brunt of these were designed to instantly undo any actions taken throughout the duration of the Trump administration and included one directing the Department of Transportation and EPA to reconsider the 2019 decision to remove California’s authority to limit tailpipe emissions by April and revise the fuel-efficiency standards for automobiles by summer.

Volkswagen's Dieselgate Concludes in the U.S.

Volkswagen Group appears to have completed the terms laid out by the U.S. Department of Justice after it decided the automaker required some oversight in the wake of the 2015 emissions fiasco (colloquially known as Dieselgate). VW was found guilty of equipping certain models with emissions-cheating software that would allow the car to run cleaner under testing conditions (passing regulations) and dirtier, with better performance, the rest of the time.

The con was brilliant and allowed VW to fool regulators for years until it all blew up in its face. Getting caught in the United States kicked off a chain reaction that cost the automaker a fortune globally. In May, VW estimated it had spent €31.3 billion ($34.40 billion USD) in fines and settlements and fines globally — adding that it expects to bleed another €4.1 billion through 2021. But the company was certainly happy to announce on Monday that it had adhered to settlement deal it reached with the Department of Justice and California’s Attorney General.

Seeing Red: U.S. Auto Sales, Q2 2020

In what might be the most blindingly obvious statement ever to be made in this august publication, the second quarter of 2020 was an absolute disaster for vehicle sales. Under the withering gaze of a global pandemic, the nation’s car dealers were awash in red ink — and the bitter tears of various dealer principals.

Demand and supply have cratered, producing a bewildering simultaneous mix of good deals in some segments as stores try to keep the lights on while shortages of a few key models hold the pricing line on others. Pile on the vanishing rental market you have an automotive industry the likes of which few have ever seen.

Don't Bet on Seeing Chinese Brands in the U.S. Anytime Soon

Over the past decade, regular reports that Chinese automakers were readying a major push into the North American market became commonplace. We started seeing them move out of trade show basements to take up some of the most desirable real estate on the main floor. While some of the product clearly wasn’t yet up to snuff, one could imagine budget-focused products flooding the U.S. and Canada after a few years of polish. However, the last time that seemed like a likely scenario was 2018.

Chinese brands are still trying to break into the untapped North American market; some even have physical office space set up within the United States. However, Sino-American relations have soured dramatically over the past few years, and new financial hurdles have made wrangling a new market extremely difficult.

Mexico to the Rescue As Suppliers Resume Operations

Mexico is attempting to accelerate parts production to ensure North American automakers have enough components on hand to stay operational. The response to the pandemic saw manufacturing stalled worldwide as governments assessed whether or not we’d soon be living through a plague of biblical proportions. While fate decreed a repeat of the Black Death would not be necessary, untold damage resulted in numerous business sectors.

The automotive industry hardly went unscathed. Lockdowns stopped sales in many markets for months and plunged supply chains into turmoil as OEMs shut down to ensure staff were helping to “flatten the curve.” With the public’s interest shifting rapidly away from coronavirus mandates toward demonstrations about police brutality and racial justice, or simply devolving into riots because people are pretty angry about how poorly 2020 is playing out, suppliers and automakers are gradually moving back to more normal production schedules.

This has been easier said than done. But it is being done, and that’s the important thing.

Start Me Up: As Industry Slides Into Gear, U.S. Requests Industrial Assistance From Mexico

Mexico is considering reopening factories after May 18th, now that automakers and the U.S. government have requested it resume production at plants serving the American market. With supply chains needing time to catch up, vehicle assembly will be precarious until parts can be reliably sourced. And Mexico is an essential part of that industrial recovery plan, necessitating some light coordination with the United States.

Despite seeing a spike in new COVID infections, Mexico released a plan to ease restrictions on Wednesday. Making sure U.S. manufacturers have what they need has been incorporated into that strategy, with a few conditions. While industrial employees will soon head back to work, Mexico made no assurances that it will prioritize supplying the rest of North America with automobiles or their components.

Report: U.S. Dealerships Shrinking in Number, Throughput Down for 2019

The annual Automotive Franchise Activity Report asserts that the number of new-car dealerships in the United States has shrunk for the first time since 2013. The difference is marginal when viewed from a national perspective, but could support prior theories that larger dealer networks are consolidating while smaller, less competitive shops are being forced out of the market. The report claims the total number of storefronts fell from 18,294 in 2018 to 18,195 at the start of 2020. Dealership throughput was similarly down, decreasing by eight units from 2018 to 940.

While not particularly alarming, the figures do seem to mirror national population trends when placed under a microscope. The states that lost the highest number of showrooms tended to be regions that had the most trouble preventing people from moving.

Back to Normal: U.S. Auto Tariff Threats Return for EU

On Wednesday, President Donald Trump threatened to impose fresh tariffs on European automotive imports if the region can’t work out a trade deal with the United States. The good news is that the U.S. is already in the opening stages of negotiation with the United Kingdom, which is due to leave the EU at the end of January. British Prime Minister Boris Johnson has even said a key benefit of Brexit is the ability to negotiate with countries like the U.S. independently.

Unfortunately, the rest of Europe doesn’t seem as eager to do business — encouraging Trump to fall back to tariff threats. But there’s clearly a retaliatory angle here. In 2018, the EU threatened punitive tariffs on traditionally American items like whiskey and motorcycles as a response to Trump’s intent to impose tariffs on steel and aluminum. He’s targeting French goods this time, mentioning 100-percent fees on imported luxury goods from France (champagne, handbags, etc.), additional levies on digital services, and a 25 percent duty on European cars.

Survey: EV Interest Varies Wildly Between Nations, Ditto for Shared Ownership

If you follow the automotive industry at all, you’re undoubtedly aware that the United States is a region that hasn’t quite embraced automotive electrification on the same level as the rest of the developed world. Americans travel longer distances and have particular tastes, making EVs more popular in places like Europe and China. It also hasn’t passed the same sweeping regulations to ensure their advancement.

Whatever the cause, a new survey from London-based OC&C Strategy Consultants attempted to tabulate the disparity — asking 2,000 consumers (apiece) in the U.S., China, Germany, France and United Kingdom between March and April of 2019.

Their findings? Only about half of the surveyed Americans felt EVs were worth their consideration as a potential successor to their current ride. In China, 90 percent said they would seriously consider buying electric. Between 64 and 77 percent of respondents in Europe said the same (depending on country).

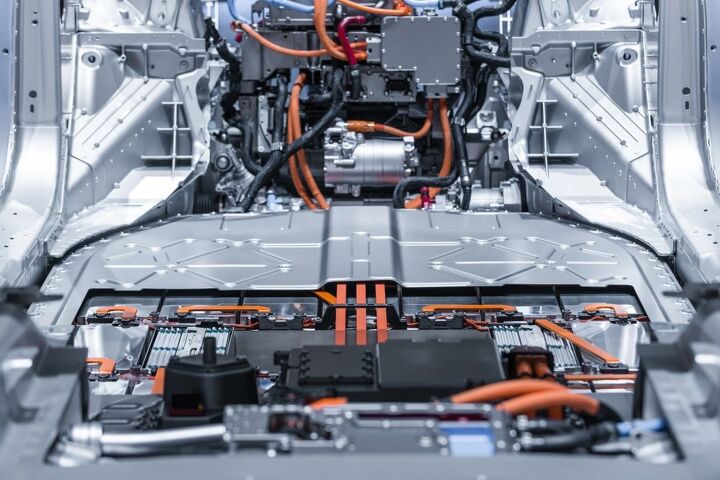

Disrupting the Industry: Korean Battery Suppliers at Each Other's Throats

While the automotive industry continues cleaning itself up via electrification and moral corporate messaging, most aspects of doing business have remained decently dirty. For all this striving for a utopian society, businesses still don’t like losing money and will go to great lengths to screw over the competition.

South Korean battery suppliers SK Innovation and LG Chem are currently clawing at each other like a couple of mad tigers. SK managed to secure a contract to supply Volkswagen Group with EV batteries, leading to the construction of a $1.7 billion factory in Georgia. LG did not, leading to a lawsuit. Both automakers and analysts are worried the litigation is spinning out of control, and could effectively obliterate their ability to do business in the United States.

Report: Trump Administration Seeks to Soften Fuel Economy Rollback

One of the issues underpinning the gas war has been an inability for either side to compromise. Initially, it was the current administration complaining about California wanting special treatment. But the coastal state was quick to return fire, claiming that the White House never offered a valid compromise.

Eventually California extended an olive branch by suggesting it would postpone existing fuel economy mandates by one year, while attempting to lock automakers in via written commitments. But federal regulators said a singular national standard was needed, suggesting California had overstepped its authority by trying to rope in manufacturers.

However, EPA Administrator Andrew Wheeler came back this fall with claims of a revised plan that could actually be more stringent than originally presumed. While still a rollback, the new draft was said to close several loopholes the industry could use to continue their polluting ways. “In some of the out years, we’re actually more restrictive on CO2 emissions than the Obama proposal was,” Wheeler said.

New reports now suggest the EPA’s words are more than just noise.

Fiat Chrysler and PSA Confirm Merger Deal

Fiat Chrysler Automobiles and Groupe PSA both confirmed their intention to merge on Thursday, verifying reports that the pair were in the final stages of approving the deal. The arrangement will be a 50-50 share swap, with the new company’s shares listed on the New York, Paris and Milan stock exchanges.

The duo hope to finalize a deal in the coming weeks to create a group with 8.7 million in annual vehicle sales. That would make it the fourth-largest automaker in the world — behind Volkswagen, Toyota and the Renault-Nissan-Mitsubishi alliance.

“There is still plenty of work to do before we reach a formal agreement, but what’s clear is that the opportunity that represents for both companies is very compelling,” FCA head Mike Manley told Reuters. It would appear the arrangement is getting plenty of support. French and Italian leadership have both endorsed the move, provided there are no significant job losses in either country.

Trade War Watch: Report Claims White House Wants to Dictate Where Cars Are Manufactured

The Trump administration has reportedly expressed an interest in deciding where and how automotive manufacturers do their business if they want to secure duty-free deals under the United States–Mexico–Canada Agreement (USMCA) that’s positioned to replace NAFTA. According to Bloomberg, there’s currently a discussion taking place between administration officials, congressional staff, and domestic and foreign automakers regarding the context of the legislation that lawmakers will ultimately have to vote on. The White House is said to want highly specific language that would allow it to select production rules unilaterally.

Considering how messy things have gotten with China, it could be useful to have extremely clear trade language and some direct oversight of businesses with global interests. But critics are worried the strategy could bring U.S. trade policy closer to the rigid policies already in place in the People’s Republic — a country America has attempted to distance itself from due to its ludicrous levels of government intervention.

The real fear is that the government could use this to give one manufacturer better treatment than another — cutting it a sweet deal for building in a politically advantageous area, for example. While plausible, we can’t confirm something that’s largely speculative.

Battle Lines Are Being Drawn in America's Gas War

Ford Motor Co, Honda Motor Co, BMW Group and Volkswagen AG announced a voluntary deal with California in July — drawing a line in the sand for who they’ll be supporting in the fueling fracas taking place between the Golden State and White House. Meanwhile, the Trump administration’s rollback proposal — which intends on freezing automotive emission standards at 2020 levels through 2026 — saw no such support. But the cavalry seems to have finally arrived after sitting on the sidelines during the battle’s opening maneuvers.

General Motors, Fiat Chrysler Automobiles, Toyota, Mazda, Nissan, Kia, and Subaru all sided against California in a filing with a U.S. appeals court from Monday night. While they’re not setting any economy targets, they are collectively firm on the issue of the state’s ability to self regulate. A large portion of the industry wants a single national standard, not individual states setting their own benchmarks while they attempt to catch up with product.

Recent Comments