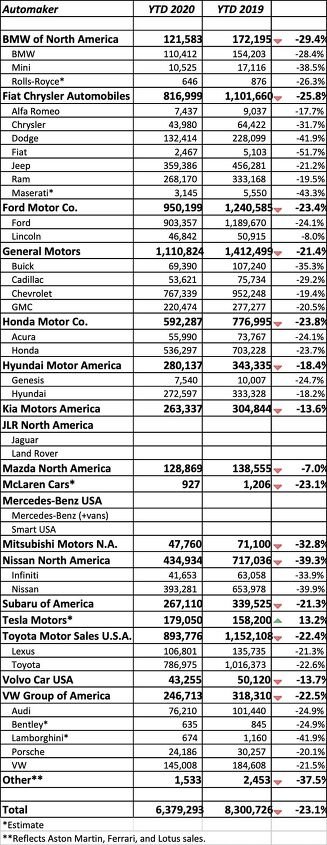

Seeing Red: U.S. Auto Sales, Q2 2020

In what might be the most blindingly obvious statement ever to be made in this august publication, the second quarter of 2020 was an absolute disaster for vehicle sales. Under the withering gaze of a global pandemic, the nation’s car dealers were awash in red ink — and the bitter tears of various dealer principals.

Demand and supply have cratered, producing a bewildering simultaneous mix of good deals in some segments as stores try to keep the lights on while shortages of a few key models hold the pricing line on others. Pile on the vanishing rental market you have an automotive industry the likes of which few have ever seen.

Fiat Chrysler reported Q2 sales in this country of 367,086 vehicles, a 39-percent decline over the same period one year ago. Without delving into specifics, the company said fleet sales were “impacted” but retail sales have been rebounding since the month of April. One interesting stat, surely spurred by pandemic stay-at-home activity, revealed that about 20 percent of new sales leads at FCA now come from online retailing (compared with about 1 percent a year earlier).

Fun fact: Jeep recorded the sale of a single Patriot, a vehicle that ceased production four calendar years ago.

The suits at Ren Cen also attempted to put a positive spin on their Q2 deliveries of 492,489 vehicles — a 34 percent decline — but did inject a note of caution and reality. “We expect continued sales recovery,” said Elaine Buckberg, GM Chief Economist, “but recognize that the path forward may not be linear, as rising infections in many states may lead to steps backward in the reopening process.”

Perhaps shockingly, sales of full-sized pickups are up through the end of June, though whether this is a damning indictment of how tepidly the new Silverado and Sierra were received when they first went on sale is up for some considerable debate.

Elsewhere, Hyundai sold 141,722 total units in Q2, a 24-percent decline compared to one year prior. This is not a surprise given world events. What is a surprise, however, is that 48,935 out of the 50,135 vehicles reported sold in June were retail units. Hyundai says while total volume was off by 22 percent, retail sales jumped 6 percent despite the ongoing economic challenges, with fleet sales down 93 percent (making for just 2 percent of total volume).

Also take note of Tesla, the only company on this chart whose reported deliveries YTD 2020 have outstripped last year’s numbers. This is largely thanks to robust Q1 growth this year. Q1 & Q2 2020 saw 88.4k and 90.65k deliveries respectively, while the company reported 63k and 95.2k for the same time periods this time last year.

Various talking heads are predicting the seasonally adjusted sales rate to tally somewhere in the neighborhood of 12.6 million to 13 million, down from just over 17 million last year. Those numbers assume, of course, that sales and consumer activity continue on the current upward trajectory compared to the months of April and early May. If the pandemic roars back with a vengeance in the coming months, all bets are off. For comparison, about 10 million units were sold in the bad old days of 2009 when the industry was awash with embarrassing senate hearings and bankruptcy proceedings.

You’ll notice our chart is incomplete. This is thanks to some manufacturers indicating they’ll be releasing their sales data sometime later this month. We’ll update if we feel like it when data becomes available.

[Images: Honda, Hyundai]

Matthew buys, sells, fixes, & races cars. As a human index of auto & auction knowledge, he is fond of making money and offering loud opinions.

More by Matthew Guy

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Jalop1991 This is easy. The CX-5 is gawdawful uncomfortable.

- Aaron This is literally my junkyard for my 2001 Chevy Tracker, 1998 Volvo S70, and 2002 Toyota Camry. Glad you could visit!

- Lou_BC Let me see. Humans are fallible. They can be very greedy. Politicians sell to the highest bidder. What could go wrong?

- SPPPP Vibrant color 9 times out of 10 for me. There may be a few shapes that look just right in metallic gray, for example. There are a few nices ones out there. And I like VW "White Silver". But I'd usually prefer a deep red or a vibrant metallic green. Or a bright blue.

- 28-Cars-Later Say it ain't so, so reboot #6* isn't going to change anything?[list=1][*]V4-6-8 and High "Tech" 4100.[/*][*]Front wheel drive sooooo modern.[/*][*]NOrthSTARt.[/*][*]Catera wooooo.[/*][*]ATS all the things.[/*][*]We're *are* your daddy's Tesla. [/*][/list=1]

Comments

Join the conversation

Nissan got clocked! They must be twitching on the canvas. Hyundai/Kia seem to have done ok relatively, as did Tesla, Mazda, and Volvo.

Nissan deserves to get clocked for their abysmal quality. Nissan's solution is to cut costs which for Nissan is to cut their quality.