#Loans

Bark's Bites: Regulators, Mount Up!

It pains me greatly, dear readers, to say what I’m about to say. Those of you who regularly follow my writing know how I lean when it comes to politics. However, given the current state of the auto dealership world, I have no choice. I gotta admit it — I agree with Elizabeth Warren on something.

Good ol’ P…er, Senator Warren and I both agree that there needs to be more oversight of the automotive lending business. Part of my day job is to educate new automotive advertising sales representatives about the car sales industry, and when I get to the part of the day where I tell them about how the Finance and Insurance office works, I always give them the following warning:

“Guys, if you don’t know about how car loans work, you’re about to get very, very angry.”

So I’ll give you the same warning, friends. I’m going to share about the predatory lending practices that go on behind the scenes, and I’ll tell you what I think should be done to stop it.

Bark's Bites: Subprime Lending Is Even More Bizarre Than You Imagined

“We’re dirty, yeah, but so are the dealers. We’re all dirty in this business.”

The petite, honest-faced young lady sitting across from me at my lunch table doesn’t look like a predator. To be fair, she isn’t. She just works for a company that’s one of the biggest subprime lenders in the country, with offices in several states. By the time a dealer calls them for a loan, they’ve already tried every traditional bank and credit union in their Rolodex.

And in exchange for a delicious burrito, she agreed to meet with me and pull back the kimono on the subprime auto lending business in the United States, a business which many in the financial sector believe to be the next big bubble.

I have a lot of questions, and she’s more than willing to answer them. I ask what sorts of credit scores they’ll approve.

“We can pretty much approve any credit score. I just approved a 413 beacon score the other day. Of course, it was a 25 percent loan. Credit is really just one piece of the puzzle,” Elizabeth* (not her real name) explains to me. “Sure, we pull TransUnion and Equifax, but we’re also looking at their obligations versus their verifiable income. Medical bills don’t count. It’s just rent plus whatever else is on their credit report.”

“Sure,” I say. “That makes sense.”

“Of course,” she continues between small bites of burrito, “if they’ve just stopped paying a bill, something other than another car loan, we don’t count that bill as part of their monthly obligations. Nobody pays student loans. They’ll have like five or six loans and won’t have paid a damn dime in months. So we don’t worry about those.”

Hang on. It gets weirder. And better.

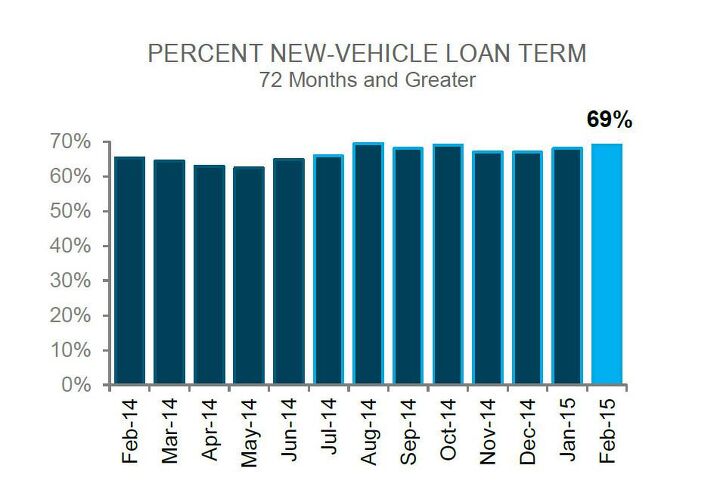

American Car Buyers Can't Get Enough of Long-Term Car Loans

The low, low monthly payments offered by spreading the cost of a new or used vehicle across a vast gulf of time is certainly an attractive one, even though the practice is fraught with hidden danger.

For U.S. car buyers, it has also become a very popular one, with data showing just how many people have decided to embrace a 73- to 84-month payment plan. Not only are their spending habits changing, they’re also changing their lender.

Government Never Forgets: GM to Pay Back Cash That Funded Celebrity, Cutlass Ciera Production

A bill for the assembly of two decades-old models — one from a defunct marque — will come due on April 1. And unlike much of the debts written off during General Motors’ bankruptcy, a major subsidiary now has to pay this chunk back.

The money, $220 million in all, was handed to GM Canada back in 1987 to save the Montreal-area Sainte-Thérèse Assembly plant. GM Canada used that bankroll to build the stunningly sexy Chevrolet Celebrity and Oldsmobile Cutlass Ciera. It later cranked out the last Pontiac Firebirds and fourth-generation Chevrolet Camaros.

The thing about 30-year interest-free loans is that someone eventually comes to collect.

Bark's Bites: Subprime Customers Don't Get To Negotiate

Dodge. Nissan. Kia. Mitsubishi. Ever wonder how any cars from these makes end up getting sold?

While there are certainly cars from these brands that attract the higher end of the automotive consumer marketplace (Hellcat, anyone?), the vast majority of the customers who end up in a car from one of these brands are in them for one reason, and one reason alone: they’ve got subprime credit. And they’re not alone.

In fact, over half of the American public now has subprime credit, and there’s no sign that it’s getting better any time soon. As a result, most customers are just walking into a dealership hoping to be approved for a loan. Instead of being in a position of power when it comes to negotiation, they’re in a position of weakness.

For dealers, this is great news. For consumers, it’s awful.

Sub-prime Borrowers May Get Bounced Out of the Club Next Year

Next year may not be as kind to new car buyers with bad credit.

If you’ve been paying attention to the market recently, it’s been an up-and-down ride for the past few days. Market volatility is just one of the indicators that the Federal Reserve may be considering a hike to the federal funds rate (probably not this year, though), which would impact borrowing rates in a record-setting year for the auto-loan business.

“It has the potential to impact auto loans, any rate increase certainly can,” said Melinda Zabritski, senior director for Automotive Finance for Experian. “The rate depends on so many other factors in the market … (A rate increase is) at some point, likely. But there’s not a strong chance that it will go up this year.”

Rates for loans have largely stayed the same since 2008, when interest rates were lowered to spur lending after the recession. Many of the low-rates today haven’t changed and automakers such as Subaru have offered interest-free loans on some of their cars.

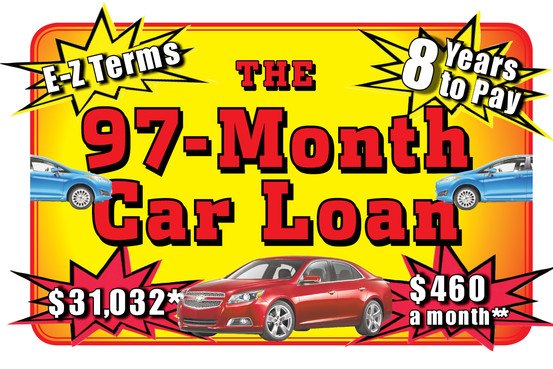

Chart Of The Day: 8 Years A Slave, Redux

Faced with less disposable income, higher taxes and more expensive vehicles (in most cases), loan terms in the Canadian market has gradually shifted to one where bi-weekly and even weekly payments have become the advertised norm, with 72, 84 and 96 month loans appearing as a fixture of the new and used vehicle marketplace. And with household debt levels reaching record heights in Canada, the chart above should be deeply concerning.

Equifax Now Reporting On How Rejected Loans Perform

Credit Unions will now be able to follow up with applicants who were unable to procure loans, and see if they pursued credit at other institutions, thanks to a new service from Equifax.

Captives To Face CFPB Oversight

New rules being announced by the Consumer Financial Protection Bureau would mean that the captive finance arms would be subject to oversight from the CFPB.

Honda's Sales Chief Warns Of "Stupid Things" As Accord, CR-V Top Retail Sales Charts

In this year’s red hot new car market, the Honda Accord and CR-V have apparently captured the top spot in both new car and SUV retail sales through the first half of 2014, according to Polk registration data. But John Mendel, Honda’s head of sales, had some pointed words for the industry as a whole, and the state of the American auto market.

OCC Warns Of Auto Lending Risk

The Office of the Comptroller of the Currency, a government entity that regulates and supervises banks, is sounding the alarm regarding risks related to auto loans.

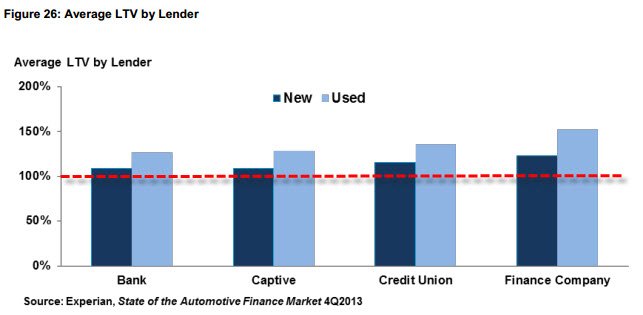

Captives Dominating Auto Financing As Banks Resort To Risky Loans

OEM captive financing arms are increasing their share of new car loans, with banks resorting to underwriting riskier loans in the used car market and to less credit-worthy buyers.

Loan Terms, Monthly Payments Hit Record Highs In 2014

The easy-credit train keeps on rolling in the auto world, with credit rating agency Experian reporting new records in key auto finance metrics.

Say Hello To 144 Month Financing

One year ago, we reported on the alarming trend of 97 month loans for new car sales. It turns out that these have now been supplanted by a substantially longer term. Say hello to the 144 month loan.

Mainstream Press Finally Worried About Cheap Car Loans

Months after TTAC started to relentlessly bleat about the glut of money flowing into the auto loan sector, the mainstream media is finally taking notice. Automotive News is finally expressing some worry over the factors that we’ve been discussing for some time: car loan terms are getting longer ( to help keep payments low), subprime lending is increasing and an expected rise in interest rates could put an end to the new car market’s exuberant performance.

Recent Comments