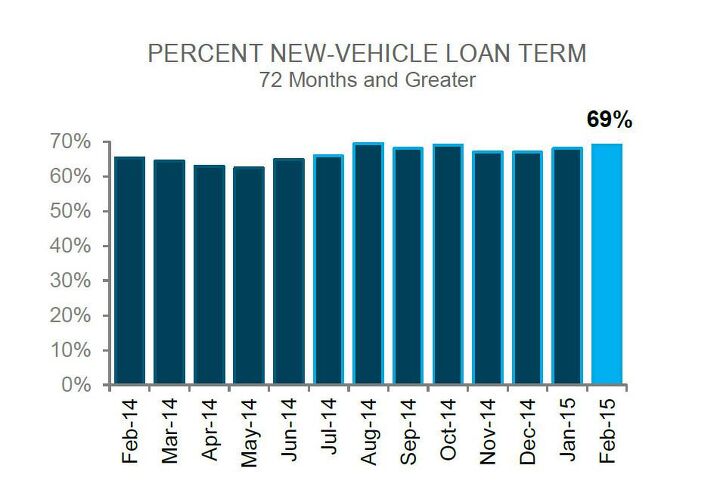

Chart Of The Day: 8 Years A Slave, Redux

Faced with less disposable income, higher taxes and more expensive vehicles (in most cases), loan terms in the Canadian market has gradually shifted to one where bi-weekly and even weekly payments have become the advertised norm, with 72, 84 and 96 month loans appearing as a fixture of the new and used vehicle marketplace. And with household debt levels reaching record heights in Canada, the chart above should be deeply concerning.

While the trend of long term loans has been brewing for some time in Canada, February marked a milestone. Nearly 70 percent of consumers opted for loan terms of 72 months or longer. Consumers will, in all likelihood be paying thousands of dollars on interest alone on what would normally be a modestly priced vehicle.

One scenario, outlined by a friend, saw him go into a new car dealer to purchase a truck for both his primary vehicle and a work vehicle. The truck was a modestly equipped domestic full-size truck, already deeply discounted to $35,000 CAD (plus 13 percent sales tax). The loan terms offered were 96 months for 3.99%. That would have added up to $6,000 in interest payments over the loan term.

While Canadians are apt to buy smaller, cheaper passenger cars, full-size trucks still reign at the top of the sales charts, and transaction prices of these vehicles are going nowhere but up.

Chart courtesy J.D. Power via The Globe and Mail

More by Derek Kreindler

Comments

Join the conversation

I really don't think the reduction of interest rates has the hugest bearing on vehicle ownership. I does and can have a short term influence. Canadians' don't have the same rate of vehicle ownership per capita as the US. The US is up around or over 750 vehicles per 1 000 and the Canadians' have around 640 vehicles per thousand. This is similar to many EU nations. I do think there is a slightly different vehicle culture between the two countries. Canadians' do drive many US vehicles, but they are more or less forced into that situation due to NAFTA. So, how do Canadians get to work? Is their better public or mass transit in Canada's urban environments compared to the US?

All good points, but let's throw in some more facts. IHS (Polk) reported that the average American (ok, not Canadian, sorry) ownership period for a new car was 4 years and 2 months in 2004, and 6 years and 1 month in 2014. (In large part due to improved vehicle long-term durability.) So, ceteris paribus (leaving aside debt:income ratios, merits of Canadian versus American political systems, whether Canada should apologize for Gordon Lightfoot or not) one would expect longer loan terms. As the lifespan (and ownership tenure) of cars lengthens, one would expect loan terms to lengthen with them. Just like people have come to see 30 years as a fine term for a house mortgage. In 2011 HUD reported the average age of the US owner-occupied housing stock was 35 years. Mortgages are generally 30. Average age of the US car fleet is about 11 years, average new-car loan term as of last quarter was 66 months (Experian)... about a quarter of US new-car loans were over 72 months. Just sayin. Now, as to why Canadians go for even longer terms than us supposedly-more-profligate 'murricans, I dunno. Maybe months are shorter in the metric system? (Yes, that was a joke. A weak one, yup.) PS Miles Davis was Kilometers Davis when he played in Montreal....

@ glen...... You mean kilometres ......eh ?

Canadian cities for the most part have way better public transport than most American cities, with the exception of NYC. We're pretty screwed financially now though. Canada never really had that bad of a time in 2008 outside of the manufacturing sector. We lived off of debt, but never corrected our ways. So we're probably going to be paying for that fairly soon. The correction can't come soon enough though. Vancouver is ridiculously expensive right now and people don't generally make much money here. Alberta and Saskatchewan are tanking, while you could describe everywhere else as fragile but benefitting from the low dollar and cheap oil.