#June2016Sales

GM Is Losing All Kinds Of Market Share, And It's OK With That

“Has GM lost market share? Yes.”

Alan Batey, President, GM North America,

Wall Street Journal, July 6, 2016

From 17.7 percent in the first-half of 2015, General Motors’ U.S. market share tumbled by more than a point to 16.6 percent in the first-half of 2016.

But, GM’s North American president points out in a Wall Street Journal opinion piece, profitability is on the rise.

TrueCar estimates that, as a percentage of the average transaction price, GM’s incentive spend in June 2016 fell by half-a-percentage point to 10.9 percent, year-over-year. As for the average transaction price, TrueCar says GM’s rose 6.5 percent in June 2016 to $36,489. That is 9.4-percent higher than Fiat Chrysler Automobile’s June 2016 ATP, which also required greater incentives to achieve according to TrueCar. Meanwhile, Batey wrote in The Journal that GM has “reduced low-margin sales to daily rental companies in the U.S. by 88,500 units.”

This explains the marriage of two conflicting subjects: GM’s decreased volume in a growing market and GM’s corresponding increase in profitability.

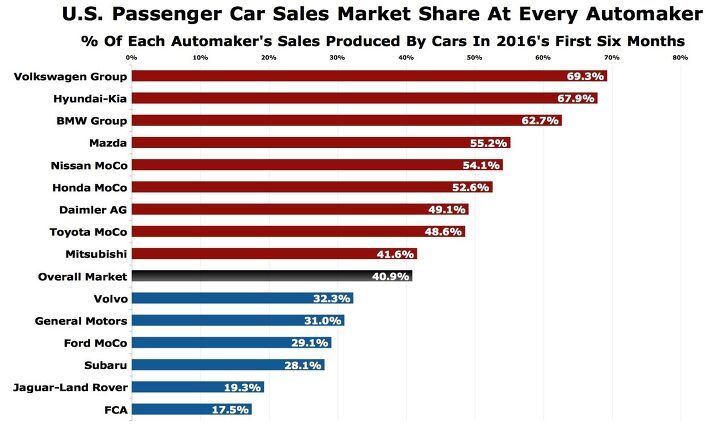

As SUVs And Pickup Trucks Surge, Which Automakers Sell An Inordinate Number Of Cars?

Barely four out of every ten new vehicles sold in the United States in the first-half of 2016 were traditional passenger cars. Toyota Camrys, Honda Civics, Ford Mustangs, Mercedes-Benz C-Classes, and dozens of alternatives remain numerous — more than 3.5 million were sold in 2016’s first six months.

But together, these cars make up a smaller chunk of the market now than they did a year ago, and a far smaller slice of the market than just five years ago. Cars were at parity with light trucks (pickups, SUVs, crossovers, vans) in 2011 and earned 52 percent of the market the year prior.

FCA's Cars Fall Harder And Farther In June, Jeep Doesn't Care

There’s nothing new here, nothing unusual at all to see.

U.S. sales at the increasingly popular Jeep brand jumped 17 percent in June 2016 as the overall market climbed just 2 percent; as SUVs and crossover sales grew 10 percent. Jeep sales have increased on a year-over-year basis in 33 consecutive months.

FCA’s need for Jeep to outperform was all the more clear in June, as Jeep attempted to follow-up an all-time record performance in May with sustained demand. Car sales across the automaker’s Alfa Romeo, Chrysler, Dodge, and Fiat brands plunged 40 percent, a loss of nearly 19,000 sales.

And so the trend continues. 17.4 percent of the new vehicles sold in the United States by Fiat Chrysler Automobiles in April were cars. That figure fell to 16.9 percent in May and dropped to just 14.2 percent in June.

These aren’t typos. For every 86 pickup trucks, minivans, commercial vans, SUVs, and crossovers sold at your friendly local FCA store in June 2016, there were only 14 cars sold along with them.

Winning! These Are America's Best-Selling Cars, Trucks, SUVs, Vans, and Luxury Autos In 2016's First Half

We’ve reached the halfway marker. After new vehicle sales soared to record levels in calendar year 2015, the volume produced by automakers competing for market share in the United States continued to expand through the first six months of 2016.

Between January and June, the 30 most popular new vehicle nameplates in the United States generated half of all auto sales, leaving more than 250 other vehicles to fight over half the market. Many of those popular vehicles own a far greater chunk of the market than entire manufacturers. The top-selling Ford F-Series line of pickup trucks, for instance, outsells every auto brand aside from Toyota, Chevrolet, Nissan, Honda, Jeep, and Ford itself. The 30th-ranked vehicle, Subaru’s Outback, outsells whole mid-tier premium brands such as Cadillac, Infiniti, Lincoln, and Jaguar-Land Rover.

In other words, popular vehicles are very popular indeed.

U.S. Auto Sales Brand-By-Brand Results: June 2016 YTD

A modest increase of 2 percent fell below expectations from forecasters that the U.S. auto industry would grow by more than 5 percent in June 2016. Indeed, given the extra day on June 2016’s auto sales calendar, the daily selling rate for the industry actually declined in June, albeit marginally.

Big gains were nevertheless not uncommon. The Ford Motor Company, Fiat Chrysler Automobiles, Nissan-Infiniti, and Hyundai-Kia all posted above-average gains. Ford’s best-selling F-Series, which accounted for three-in-ten sales at Ford’s namesake brand, posted a 29-percent year-over-year increase. Overall pickup truck sales, powered in large part by the Ford’s 15,766-unit increase, jumped 10 percent.

The Toyota Camry claimed the top spot among cars despite its own sharp decline, a 13-percent loss worth nearly 5,000 sales. For the first time since last October, the Honda CR-V was America’s top-selling SUV/crossover.

Recent Comments