FCA's Cars Fall Harder And Farther In June, Jeep Doesn't Care

There’s nothing new here, nothing unusual at all to see.

U.S. sales at the increasingly popular Jeep brand jumped 17 percent in June 2016 as the overall market climbed just 2 percent; as SUVs and crossover sales grew 10 percent. Jeep sales have increased on a year-over-year basis in 33 consecutive months.

FCA’s need for Jeep to outperform was all the more clear in June, as Jeep attempted to follow-up an all-time record performance in May with sustained demand. Car sales across the automaker’s Alfa Romeo, Chrysler, Dodge, and Fiat brands plunged 40 percent, a loss of nearly 19,000 sales.

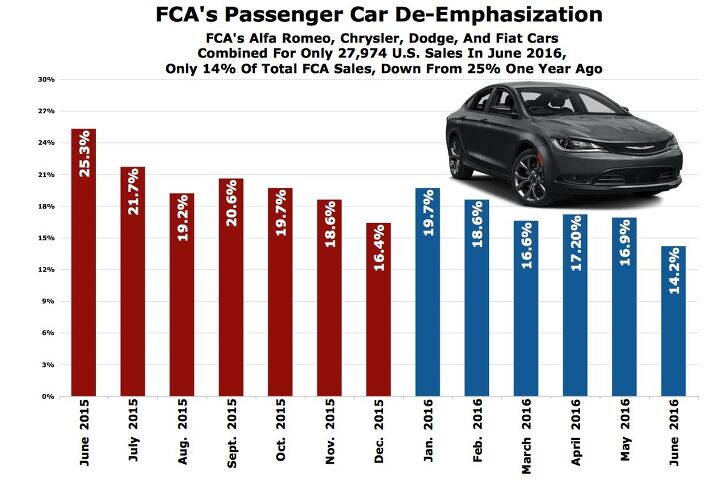

And so the trend continues. 17.4 percent of the new vehicles sold in the United States by Fiat Chrysler Automobiles in April were cars. That figure fell to 16.9 percent in May and dropped to just 14.2 percent in June.

These aren’t typos. For every 86 pickup trucks, minivans, commercial vans, SUVs, and crossovers sold at your friendly local FCA store in June 2016, there were only 14 cars sold along with them.

CARS IN GENERAL

Of course, the overall passenger car market is in a state of decline. This is not a trend unique to FCA. In June, U.S. sales of cars fell 9 percent as supremely popular nameplates such as the Toyota Camry and Corolla, top-selling premium cars such as the Mercedes-Benz C-Class and BMW 3-Series, and iconic Detroit muscle such as the Ford Mustang and Chevrolet Camaro all reported notable decreases.

Despite 1-percent year-to-date growth in the industry overall, a moderately successful answer to record sales in calendar year 2015, the car market was down 8 percent in the first-half of 2016, earning market share of just 41 percent. This isn’t new to 2016. Remember that one year ago, as the industry had grown 4 percent compared with the first six months of 2014, car volume was down more than 1 percent.

The losses in 2016, however, are more predictable and more significant.

DISCONTINUED

That seems like another lifetime now, however. The Chrysler 200 and Dodge Dart won’t be directly replaced by FCA-engineered efforts, and 200 production could stop by the end of 2016. FCA only 27,974 cars across its 10 car nameplates in June: the 200 and 300 at Chrysler; Dodge’s Challenger, Charger, Dart, and Viper; the Alfa Romeo 4C; and Fiat’s 500, 500L, and 124 Spider (which produced its first sale at the end of June).

NOT JUST JEEP

But Jeep, which produced 42 percent of all FCA sales in the United States in June, is the real answer. A 12-percent Cherokee decline was more than cancelled out by Renegade and Compass sales that were more than twice as strong this June as last. Additionally, a 24-percent Patriot increase, a 9-percent Grand Cherokee improvement, and the Wrangler’s 5-percent rise to 20,060 units, tops among Jeeps and second only to the Ram P/U on the FCA leaderboard, combined to push Jeep into the stratosphere.

Jeep is now on pace to sell more than 1,000,000 new vehicles in the U.S. in 2016. That’s a figure which might just erase all memories of the Chrysler 200.

[Images: FCA, Chart: Timothy Cain]

Timothy Cain is the founder of GoodCarBadCar.net, which obsesses over the free and frequent publication of U.S. and Canadian auto sales figures. Follow on Twitter @goodcarbadcar and on Facebook.

More by Timothy Cain

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Corey Lewis It's not competitive against others in the class, as my review discussed. https://www.thetruthaboutcars.com/cars/chevrolet/rental-review-the-2023-chevrolet-malibu-last-domestic-midsize-standing-44502760

- Turbo Is Black Magic My wife had one of these back in 06, did a ton of work to it… supercharger, full exhaust, full suspension.. it was a blast to drive even though it was still hilariously slow. Great for drive in nights, open the hatch fold the seats flat and just relax.Also this thing is a great example of how far we have come in crash safety even since just 2005… go look at these old crash tests now and I cringe at what a modern electric tank would do to this thing.

- MaintenanceCosts Whenever the topic of the xB comes up…Me: "The style is fun. The combination of the box shape and the aggressive detailing is very JDM."Wife: "Those are ghetto."Me: "They're smaller than a Corolla outside and have the space of a RAV4 inside."Wife: "Those are ghetto."Me: "They're kind of fun to drive with a stick."Wife: "Those are ghetto."It's one of a few cars (including its fellow box, the Ford Flex) on which we will just never see eye to eye.

- Oberkanone The alternative is a more expensive SUV. Yes, it will be missed.

- Ajla I did like this one.

Comments

Join the conversation

"200 production could stop by the end of 2016." Nope, it'll continue for quite a while longer than that. Also, there are a lot more forces at work here than merely "what the customers want" as is intuitive to the outsider. I should really write an article about this some day.

"De-emphasization"? There is no such word. Not in English, certainly. Try "de-emphasis".