#AutoFinancing

Canadian Borrowers Seeing More Loan Debt While U.S. Sees Subprime Loans Rise

Car buyers who borrowed money to finance their purchase are seeing higher loan debt per borrower rates, along with higher delinquency rates. And it’s happening on both sides of the border.

Let’s start with Canada. Automotive News picked up a report from TransUnion showing that average auto-loan debt per borrower has gone up in the second quarter, and so too have delinquency rates. This is happening as vehicle prices have also risen during the same time period. Consumers are also rolling in other debt and parts of the country are still in recovery mode from the recent economic crisis.

How Do Americans Manage to Pay Record High Prices for New Cars in 2017? By Paying Forever

Yet month after month, for six consecutive months to begin 2017, automakers are witnessing fewer and fewer buyers walking into dealers after sales shot to record levels in calendar year 2016.

Incentives, at $3,550 per car, are an effective lure. But that doesn’t change the fact that buyers are paying, on average, $33,000 and borrowing, according to Edmunds, $31,000 in order to finance a purchase.

How do car buyers afford the highest prices on record? By stretching the payment period to the longest terms ever: 69.3 months in June, Edmunds says.

Lenders Snatch Back the Piggy Bank After Taking a Hit on Auto Loans

April was the fourth consecutive month to see U.S. auto sales underperform compared to 2016, leading many to speculate that the long-awaited slump has finally arrived. New car sales aren’t the only thing slipping, as used vehicle values — diminished by a flood of off-lease stock and new car incentives — is on the same downward trajectory.

At the same time, the country’s biggest auto lenders have taken a look around and do not like what they see. No bank wants to be stuck with a low-value repossessed car, so purse strings are tightening across the United States. Securing that next loan just became harder.

Of course, this is the last thing any automaker wants to hear.

Bark's Bites: Subprime Customers Don't Get To Negotiate

Dodge. Nissan. Kia. Mitsubishi. Ever wonder how any cars from these makes end up getting sold?

While there are certainly cars from these brands that attract the higher end of the automotive consumer marketplace (Hellcat, anyone?), the vast majority of the customers who end up in a car from one of these brands are in them for one reason, and one reason alone: they’ve got subprime credit. And they’re not alone.

In fact, over half of the American public now has subprime credit, and there’s no sign that it’s getting better any time soon. As a result, most customers are just walking into a dealership hoping to be approved for a loan. Instead of being in a position of power when it comes to negotiation, they’re in a position of weakness.

For dealers, this is great news. For consumers, it’s awful.

Auto Leasing Insider Tips, Tricks, Myths and Misconceptions

A record 31 percent of all new vehicles sold this year in the U.S. are leased. I spent a good part of my career studying why some people refuse to lease. Much of their resistance stems from bad buzz. Some say it’s because of the stories they heard about ’80s-era open-end leases where owners were responsible for paying the car’s residual value at lease end. (These are the same customers who will not buy a Hyundai today because they produced crappy cars in the ’80s.) Others oppose leasing because they heard about a guy whose cousin’s neighbor had to pay $5,000 in wear and tear or excess mileage charges at lease end. And there are those of you who will brag comment below about how you always pay cash for your cars and don’t understand why other people won’t follow your lead.

This article is not designed to convert such non-believers to leasing. This advice, drawn from my years in the auto finance business, is for buyers who know the basics and benefits of leasing, want some timely tips on how to get the lowest possible payments, and want to pay less money on lease-end charges.

Why Spot Delivery Needs To Go Away, Now

Spending hours or days negotiating for a vehicle can be a taxing experience, so reaching an agreeable price feels like a big accomplishment for car shoppers. It seems reasonable to let your guard down and relax as you enter the F&I office to finish up the paperwork, but that can lead to a big mistake.

The finance manager or clerk will start going over the paperwork, representing the car as sold and financed while showing you a specific rate. You skim through the mountain of paperwork and quickly sign all of the forms so you can drive off in your new car.

At this point, most people are brimming with excitement — they show off the car to their friends and family and share pictures on social media — but that jubilation can quickly be deflated with a call from the dealer telling you that the financing has fallen through and you don’t own the car after all.

Americans Loving Their Leases, Not so Much Their Loans

Good times have clearly arrived, because Americans are flinging money at cars like it’s going out of style.

Leasing has never been more popular for American car buyers, reports the Detroit Free Press, and the size of their auto loans have also reached record territory.

The Continuing Saga of the Consumer Financial Protection Bureau and Dealer Interest Rate Markup on Car Loans, Part Two

That happy couple at the car dealership, back by popular demand.

Since we last reported on the Consumer Financial Protection Bureau (CFPB) and its controversial crusade to uncover racial discrimination by car dealers on interest rate markup on automobile loans, the agency has ordered over $100 million in fines and settlements against banks that some have deemed extortion. This has infuriated lenders and car dealers, and has frustrated lawmakers on both sides of the aisle.

The tale continued last week as the House Committee on Financial Services revealed that their work on this case now includes trying to get the CFPB and Department of Justice to agree on that age-old problem on how to get white car buyers to admit that they are actually white.

Let us review this investigation, which recently prompted the House committee to publish a report about the CFPB probe, titled “Unsafe at Any Bureaucracy: CFPB Junk Science and Indirect Auto Lending.”

A Different Perspective On The DaimlerChrysler Merger

My 25-plus years as a Big Time Auto Industry Executive afforded me many memorable moments. It would be difficult to single out one example, but I may be the only person on earth who has shaken hands with both Soichiro Honda and Derek Kreindler.

As for the low point of my career, there is no contest: the morning of May 7, 1998, four months after I joined Mercedes-Benz Credit Corporation. That was the day it was announced Daimler-Benz had merged with the Chrysler Corporation.

Ally Financial Offering 84-Month Loans Amid Industry Risk Concerns

Though most lenders aren’t comfortable with the idea of 84-month auto loans, Ally Financial is going full steam ahead with such loans.

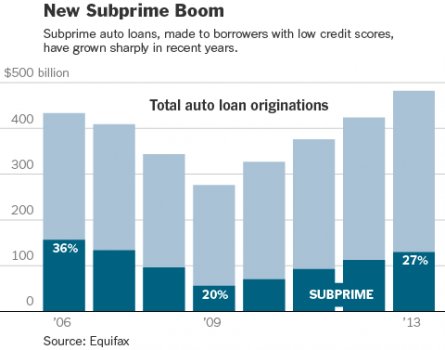

Subprime Auto Loans Climb to Highest Level Since Financial Crisis

Alan Zibel and Annamaria Andriotis of the Wall Street Journal (subscription required) report that consumer loans to borrowers with bad credit, including those for cars and light trucks, are now approaching 40% of loans issued, the highest percentage since the start of the financial crisis in 2007-08.

Almost four of every 10 loans for autos, credit cards and personal borrowing in the U.S. went to subprime customers during the first 11 months of 2014, according to data compiled for The Wall Street Journal by credit-reporting firm Equifax.

That amounted to more than 50 million consumer loans and cards totaling more than $189 billion, the highest levels since 2007, when subprime loans represented 41% of consumer lending outside of home mortgages. Equifax defines subprime borrowers as those with a credit score below 640 on a scale that tops out at 850.

Ally Leaves Government Ownership, US Treasury Exits Auto Industry

With its GMAC Financial leather jacket burning in the closet while a supermodel lip-syncs in the tub, Ally Financial is at last free from government ownership.

A Contrarian View Of Subprime Auto Loans

The topic of subprime auto loans has been a hotly contested one at TTAC, with numerous commenters defending both the practice and the stability of recent run-up in subprime lending.

Outstanding Subprime Loan Balances Hit 8-Year Highs

Buried in a feel good story about auto loans comes the news that subprime auto loans are at levels that we haven’t seen in nearly a decade.

Moody's: Underwriting Standards, Borrower Credit Declining

The global outlook for Auto Back Securities (ABS) is steady – except in North America, where underwriting standards and borrower credit are slipping.

Recent Comments