Tesla's Wild Second Quarter: Revenue Up, Losses Up, Cash Burn Down, and Some Head-scratching Statements

Tesla announced Wednesday that it lost $743 million in the second quarter of 2018, instantly pushing the automaker’s stock up by nearly double digit figures. No, this particular tidbit isn’t what investors hoped to hear, but CEO Elon Musk, who, unlike in past weeks, made it through the day without saying something overtly controversial, told them enough of what they wanted to hear.

The company’s revenue is up by over a billion dollars compared to the same quarter a year ago — $4 billion as a pre-tax total. Cash on hand was the lowest Tesla’s seen in two years ($2.2 billion), but the automaker’s reduced cash burn impressed some skeptics and reassured believers in Musk’s pledge to return to a positive cash flow in the third and fourth quarters. Having achieved its 5,000-Model-3s-per-week production goal, Tesla claims volume will crank up to 6,000 per week by late August. 10,000 per week comes in 2019.

There was even an apology from Musk for his bizarre behavior during a May earnings call, in which he snubbed analysts while acting like a bored teenager.

And did you know the Model 3 outsells all premium midsize sedans combined? Yeah, about that…

There’s other negatives buried in Tesla’s Q2 report — among them an anticipated impact on volume in China (due to a 40 percent tariff), the looming phase-out of the $7,500 federal EV tax credit (next year), and reduced customer deposits (new variants of the Model 3 will reverse it in Q3, Tesla insists) — but the midsize sedan segment statement needs to be dealt with.

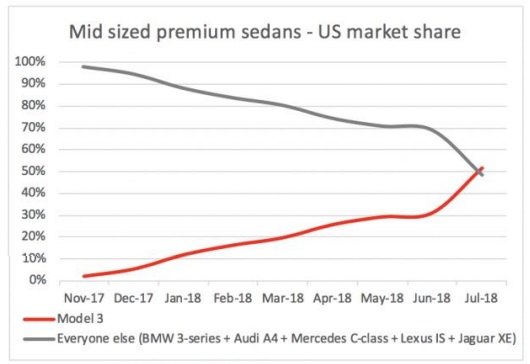

“In July 2018, Model 3 not only had the #1 market share position in its segment in the US, it outsold all other mid-sized premium sedans combined, accounting for 52% of the segment overall,” the company wrote. “The popularity of Model 3 is a true testament to the product.”

That last sentence is worthy of an online search for panel gaps, window malfunctions, and lengthy delays for service, all of which you’ll find on forums and subreddits. But what counts as the premium midsize sedan segment? What massive body of challengers did Tesla just wipe the floor with?

Turns out it’s just five vehicles. The BMW 3 Series, Mercedes-Benz C-Class, Audi A4, Jaguar XE, and Lexus IS. Just look at this graph:

As symmetrical as it is phallic, the graph is also glaring in its omissions. Where’s the Cadillac ATS? Infiniti Q50? Acura TLX? Volvo S60? Seems mighty selective.

But analysts weren’t pressing Musk on his company’s competition — it was production they wanted to hear about.

“A total vehicle output of 7,000 vehicles per week, or 350,000 per year, should enable Tesla to become sustainably profitable for the first time in our history – and we expect to grow our production rate further in Q3,” Tesla wrote in its letter to shareholders.

Model 3 production in the third quarter is pegged at 50,000-55,000, which actually works out to around 4,000 per week, implying some sort of downtime for the model’s two production lines. One of those lines (GA4) is housed in a tent — a makeshift structure Musk praised up and down. While he assured shareholders that Tesla’s Fremont assembly operation will not become a mainly outdoor affair, he sees no reason to change what’s happening in GA4.

A planned Gigafactory located in Shanghai will produce around 250,000 vehicles a year after it opens in three years’ time, the shareholder letter said, rising to 500,000 vehicles sometime after. The cost of the assembly plant would be funded through loans from local banks, Musk explained. The company’s also sourcing a location for a European facility.

Would the company hit its goal of 1 million vehicles in 2020? Musk responded by saying probably — though there’s a chance it might be as low as 750,000. He told analysts that Fremont can handle up to 600,000 vehicles, with Shanghai covering the rest.

Apparently the timeline for that Chinese plant differs depending on who Tesla, or Musk, is talking to.

[Image: Elon Musk/ Twitter]

More by Steph Willems

Latest Car Reviews

Read moreLatest Product Reviews

Read moreRecent Comments

- Probert They already have hybrids, but these won't ever be them as they are built on the modular E-GMP skateboard.

- Justin You guys still looking for that sportbak? I just saw one on the Facebook marketplace in Arizona

- 28-Cars-Later I cannot remember what happens now, but there are whiteblocks in this period which develop a "tick" like sound which indicates they are toast (maybe head gasket?). Ten or so years ago I looked at an '03 or '04 S60 (I forget why) and I brought my Volvo indy along to tell me if it was worth my time - it ticked and that's when I learned this. This XC90 is probably worth about $300 as it sits, not kidding, and it will cost you conservatively $2500 for an engine swap (all the ones I see on car-part.com have north of 130K miles starting at $1,100 and that's not including freight to a shop, shop labor, other internals to do such as timing belt while engine out etc).

- 28-Cars-Later Ford reported it lost $132,000 for each of its 10,000 electric vehicles sold in the first quarter of 2024, according to CNN. The sales were down 20 percent from the first quarter of 2023 and would “drag down earnings for the company overall.”The losses include “hundreds of millions being spent on research and development of the next generation of EVs for Ford. Those investments are years away from paying off.” [if they ever are recouped] Ford is the only major carmaker breaking out EV numbers by themselves. But other marques likely suffer similar losses. https://www.zerohedge.com/political/fords-120000-loss-vehicle-shows-california-ev-goals-are-impossible Given these facts, how did Tesla ever produce anything in volume let alone profit?

- AZFelix Let's forego all of this dilly-dallying with autonomous cars and cut right to the chase and the only real solution.

Comments

Join the conversation

We can debate the precise numbers, but it's interesting that a serious discussion can ensue about whether the Model 3 has outsold the BMW 3-Series only a year after TM3 production started. People can shout "Musk is a liar" all they want, but the arguments are now over thousands of cars, not a handful.

Another blatant lie by Musk and Tesla: Those Model 3 vs other sedans numbers are not comparable numbers for the numerous reasons I pointed out in another thread: -Pent-up long-term demand being served in one avalanche right now after over a year of delays vs. most people choosing BMW already having theirs in the garage -Only one model in that price range vs. BMW having about a dozen different bodystyles (2-series in several bodystyles, 3-series, 4-series, 5-series, X1, X2, X3, X4…) So not only do BMW sales in that price range get divided up between many different models and different body styles of 2-, 3-, 4-, and 5 series but people nowadays mostly choose BMW SUVs instead of 3-series sedans, and of those in the price range there are 4 different models that divide up the sales. Tesla has no SUV in that price range so all of their demand is funneled into that one single sedan model whereas with BMW you have to add up about 8 different models’ sales to compare. And all of those are profitable while they are continuously developing at least 8 new replacement models and countless variations and personalisation options to them too as opposed to Tesla bumbling around with approximately zero options and who knows if they’re able to develop future replacements for that one model… -Domestic brand vs. foreign (look at Fiat sales numbers in Italy, Citroen in France etc…) -Model 3 is a brand new model vs. BMW 3-series is exactly now at the end of its model cycle. Tesla doesn't even get up to even a third of just BMW's offerings in that price range. And BMW is profitable even though they are spending and investing in what real companies are supposed to unlike the shambles of Tesla.